The integration of artificial intelligence (AI) into WTW’s RiskAgility Financial Modeller (RiskAgility FM) marks a significant leap forward for life and health (L&H) insurers facing increasingly complex products and regulatory landscapes. As these companies strive to comply with rigorous standards like IFRS 17, the enhanced AI in RiskAgility FM offers a vital tool to streamline model development. This upgrade not only simplifies the writing, refining, and extending of model code but also deepens the understanding of actuarial concepts, thanks to the advanced capabilities of large language models (LLMs). Powered by cutting-edge Generative AI technology, the new features promise to drastically curtail errors and reduce the time required for model development, thus driving major efficiency gains.

Enhanced AI Capabilities for Insurers

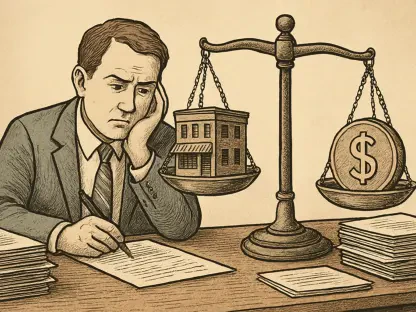

Mark Brown, the Global Proposition Lead at WTW, highlighted the increasing challenges faced by CFOs, CROs, and Chief Actuaries to reduce costs while improving the precision of financial models. He pointed out that integrating AI into actuarial modeling represents not just an upgrade but a revolutionary change that tackles the complex demands of the L&H insurance sector. With AI and LLMs, RiskAgility FM simplifies the actuarial process, enhancing its intuitiveness and reducing human errors. This innovation promises notable performance improvements, enabling insurers to better address regulatory changes and market demands.

The industry is clearly moving towards the greater adoption of advanced AI technologies to tackle these issues directly. As insurers continue to evolve, the necessity for accurate and robust financial modeling tools becomes increasingly significant. By incorporating AI into RiskAgility FM, these emerging needs are not only met but also set a new benchmark for the future of actuarial modeling. The resulting efficiency and accuracy improvements make a strong case for the widespread adoption of AI-enhanced tools in the insurance sector, paving the way for ongoing growth and innovation.