The intricate world of insurance, long defined by complex policies and lengthy customer service calls, is undergoing a seismic shift driven by the strategic deployment of conversational artificial intelligence. This technological evolution represents far more than a simple upgrade to automated phone systems; it is a fundamental reimagining of the customer journey. Insurers are now leveraging AI not just as a tool for reducing operational costs but as the central pillar in a new service model designed to enhance customer satisfaction, dramatically improve efficiency, and unlock unprecedented opportunities for future growth. The industry is rapidly moving from a heavily human-dependent framework to a sophisticated, blended ecosystem where intelligent automation and human expertise work in seamless synergy, addressing long-standing inefficiencies and finally meeting the modern consumer’s demand for simplicity and speed.

The Catalyst for Change

Bridging the Expectation Gap

The acceleration toward a digitally-driven service model was significantly propelled by the global pandemic. This period created a “perfect storm” of conditions that exposed the vulnerabilities of the traditional insurance contact center. On one hand, customer call volumes surged as individuals, prompted by a renewed awareness of mortality, sought to review and understand their policies. On the other hand, the industry’s workforce was under immense strain due to high rates of absenteeism and the widespread talent migration known as the “Great Resignation.” This confluence of events forced insurers to confront a critical reality: their existing infrastructure was ill-equipped to handle modern pressures. Consequently, the industry experienced what experts estimate to be a decade’s worth of digital adoption in a remarkably short span, as companies scrambled to find more resilient, scalable, and efficient ways to serve their clients in a rapidly changing world. This forced evolution highlighted the urgent need for smarter, automated solutions that could manage volume without sacrificing service quality.

This rapid digitization was also a direct response to a widening chasm between consumer expectations and the traditional insurance experience. In an age where digital-native companies have set the standard for frictionless transactions, customers have grown intolerant of cumbersome processes. The fact that an estimated 80% of insurance customer service contacts historically required human intervention stands in stark contrast to the self-service efficiency of e-commerce leaders, where direct human contact is a rarity. Consumers now expect the process of buying a policy or filing a claim to be as intuitive as ordering a product online. The industry’s legacy systems and human-centric workflows were simply not designed for this new paradigm, leading to frustration, long wait times, and operational bottlenecks. The push toward AI-driven conversational platforms is therefore not just a technological upgrade but a strategic imperative to close this expectation gap and align the insurance industry with the standards of the modern digital economy.

Unlocking the 90/10 Automation Strategy

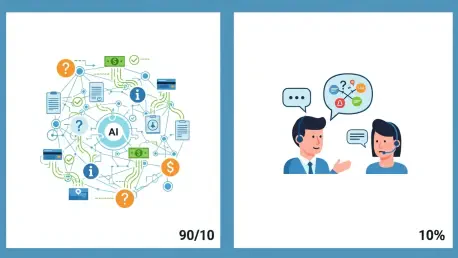

A deeper analysis of the interactions flowing into insurance call centers reveals a clear and compelling case for automation. The data shows that the vast majority of customer inquiries are routine and follow predictable patterns. Approximately 55% of all calls are for obtaining basic information, such as policy details, payment due dates, or the status of a claim. Another 35% of interactions are for executing simple transactions, like making a payment or updating contact information. This means that a staggering 90% of the total call volume consists of low-complexity tasks that are perfectly suited for automation. Only a small fraction, about 10%, involves genuinely complex issues that require the nuanced problem-solving skills, empathy, and deep expertise of a human agent. This 90/10 split provides a powerful strategic roadmap, allowing insurers to target conversational AI precisely where it can deliver the most impact: on the high-volume, repetitive queries that consume the bulk of an agent’s time.

The ultimate goal of this strategy is not the wholesale replacement of human agents but a fundamental transformation of the contact center’s role and function. By deploying conversational AI to handle the 90% of informational and transactional queries, insurers can create a more intelligent and efficient service ecosystem. The vision is to drastically reduce the reliance on human-only interactions, shifting from the current 80% down to just 10%. In this new model, AI serves as the first point of contact, capable of authenticating customers, understanding their intent, and resolving a majority of issues instantly. This automation frees human agents from monotonous, repetitive tasks, allowing them to evolve into high-value specialists. Their time and expertise can then be dedicated to managing the 10% of complex, sensitive, or emotionally charged cases where human intervention is not just preferred but essential, leading to better outcomes for customers and more engaging work for employees.

Implementation and Future Outlook

Navigating the Demographic Divide

Successfully implementing a blended AI-human service model requires a nuanced understanding of different customer demographics, as a one-size-fits-all digital approach is destined to fail. Older customers, for instance, generally possess a better understanding of the complexities of insurance products but often exhibit a strong preference for speaking with a person. They may be hesitant to engage with digital channels unless the interface is exceptionally straightforward and intuitive. For this segment, the technology must be designed with simplicity at its core, ensuring that processes like authentication and information retrieval are effortless. Furthermore, the system must provide a seamless and immediate escape hatch to a human agent whenever the customer expresses a desire or the AI detects frustration. This flexibility ensures that technology enhances, rather than replaces, the trusted human connection that this demographic values, building confidence in the digital system while preserving access to personal support.

In stark contrast, younger, digital-native customers are not only comfortable with but actively prefer interacting through digital channels. However, their fluency with technology is often coupled with a limited understanding of the intricacies of insurance products. This creates a unique paradox: while they are willing to use self-service tools, they may ask complex, foundational questions that go beyond the scope of a simple transactional bot. Their inquiries can require detailed, educational responses that explain concepts like deductibles, coverage limits, or liability. This necessitates a sophisticated AI that can not only process transactions but also provide clear, contextual information. More importantly, it highlights the enduring need for a blended model where the AI can intelligently identify when a query demands the deeper expertise of a human agent who can provide thorough explanations and guidance, ensuring these less-experienced customers make informed decisions about their coverage.

A Case Study in Transformation

The theoretical benefits of conversational AI are validated by compelling real-world results. One major multi-line insurance company, facing a daunting 20% year-over-year increase in call volumes and a crippling 18% absenteeism rate in its call centers, partnered with DXC Technology to overhaul its customer service operations. The insurer’s existing Interactive Voice Response (IVR) system was a significant source of customer frustration. Its convoluted, multi-layered menu structure made it difficult for callers to navigate, leading to extremely low rates of successful customer authentication and high rates of self-service abandonment. Customers were frequently misdirected or forced to repeat information, causing satisfaction scores to plummet and operational costs to spiral. The failing IVR was not just an inconvenience; it was a critical business liability that was damaging customer relationships and straining an already over-extended workforce, making a technological intervention essential for survival.

Over a focused four-month project, a new conversational AI solution was integrated into the insurer’s existing systems. The impact was both immediate and dramatic. The company witnessed a sevenfold improvement in call conversion, meaning that seven times as many issues were successfully identified and resolved within the first interaction, without needing a human handoff. The system also delivered a sixfold improvement in successful IVR authentications, streamlining the front end of every call. Perhaps most impressively, there was a twentyfold improvement in the number of misdirected calls that were automatically rerouted to the correct department without any human intervention. This trifecta of improvements represented what was described as a “triple crown”: a simultaneous victory in enhancing both customer and agent satisfaction, substantially reducing operational costs, and driving a massive improvement in overall efficiency, proving the transformative power of a well-executed AI strategy.

The Next Wave of AI Integration

The role of conversational AI in the insurance industry became increasingly integral to shaping its future landscape. A primary area of expansion materialized in the form of “embedded insurance,” where coverage was seamlessly integrated into larger consumer transactions. For instance, offering car insurance at the point of a vehicle purchase or travel insurance during a flight booking process required a frictionless, user-friendly interface, a role that AI-powered chatbots and voice assistants were perfectly positioned to fill. Another significant development was the use of AI as a conversational front-end for virtual assistants like Alexa and Google Assistant. This allowed policyholders to access information about their coverage, make inquiries, or even initiate a claim by simply speaking a command in their own homes, making insurance a more accessible and integrated part of their daily lives. These applications demonstrated a shift from reactive customer service to proactive and convenient engagement.

Ultimately, the strategic investment in these transformative technologies was no longer viewed as an optional upgrade but as a fundamental imperative for achieving sustainable growth and maintaining a competitive edge. For insurance companies with global aspirations, the ability of AI to operate fluently in multiple languages and dialects became a critical enabler for expansion, particularly in the fast-growing Asian market where linguistic diversity is a key challenge. The successful implementations of conversational AI provided a clear blueprint for the future. The industry had decisively moved beyond its traditional, often inefficient, service models. It embraced a new paradigm where technology and human expertise were combined to create a customer care ecosystem that was more responsive, efficient, and aligned with the expectations of the modern consumer, solidifying AI’s role as a cornerstone of the industry’s continued evolution.