In the dynamic world of digital banking, the lines between traditional financial services are blurring faster than ever. At the forefront of this evolution is Simon Glairy, a leading expert in Insurtech and AI-driven risk assessment. We sat down with Simon to dissect Chase’s latest strategic move in the UK: the launch of ‘Chase Protect,’ its first bundled insurance product. Our conversation explores the competitive advantage of all-in-one digital models, the intricate dance of partnering with specialist providers, the technical feats of creating a seamless in-app experience, and how this new offering is a crucial piece in the larger puzzle of building a comprehensive digital financial ecosystem.

Chase is offering a bundled insurance product for £12.50 a month to compete with traditional packaged bank accounts. How does this all-in-one digital model create a competitive advantage, and what specific customer pain points does it aim to solve compared to separate policies?

The real competitive genius here lies in its direct assault on administrative friction, which is a massive pain point for consumers. People are tired of juggling multiple policies, different renewal dates, and various clunky web portals for their insurance. Chase is offering a single, elegant solution for a flat £12.50 a month, which feels incredibly transparent and manageable. This model isn’t just about bundling services; it’s about consolidating a customer’s mental load into one familiar place—their banking app. It solves that nagging feeling of disorganization and the fear of missing a payment or a renewal notice for one of many disparate policies.

The service uses specialist providers like Collinson for travel and the AA for breakdown cover. Could you walk me through the decision to partner with third parties instead of building these services in-house, and how do you ensure a seamless customer experience through the Chase app?

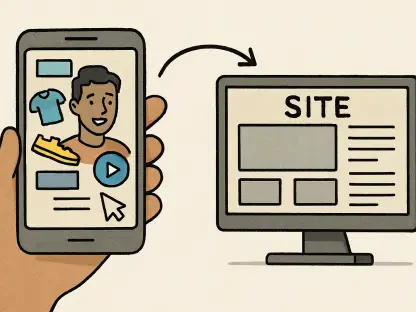

The decision to partner is a classic “buy versus build” dilemma, and in this case, “buy” is the clear winner. Building an insurance underwriting and claims operation from scratch is a monumental undertaking, requiring deep regulatory expertise and infrastructure. By partnering with established giants like Collinson, Assurant, and the AA, Chase is essentially leasing decades of trust and specialized capability. The challenge, and the secret to success, is making that partnership invisible to the end-user. The entire experience, from purchase to claim, is managed through the Chase app. This means the underlying technical integrations have to be flawless, so the customer feels they are dealing with Chase and only Chase, even when the service is delivered by a partner.

A key feature is managing the entire policy lifecycle, from purchase to claims, entirely within the app. What were the key technical or design challenges in this integration, and could you provide an example of how a customer files a claim without ever leaving the digital environment?

The primary challenge is creating a unified and intuitive user journey that masks the complexity of handoffs between different systems. You’re connecting Chase’s modern banking platform with the legacy systems of multiple, well-established insurers. Imagine a customer needing to file a claim on a lost phone while on vacation. Within the Chase app, they would navigate to Chase Protect, select “mobile phone,” and be guided through a simple, in-app form to report the loss, theft, or damage. They can upload documentation, track the claim’s status, and receive updates—all within the same digital environment where they check their balance. The backend technology does the heavy lifting of securely transmitting that information to Assurant, but for the customer, it feels as simple and integrated as making a bank transfer.

The product combines worldwide travel insurance, mobile phone protection, and breakdown cover. What was the rationale for selecting this specific combination of services, and what metrics will you use to measure the success of this new offering among your current account holders?

This combination is incredibly strategic because it covers the three most common “life-on-the-go” risks for a modern, mobile consumer. You have protection for when you travel, for the device that is central to your life, and for your primary mode of local transport. It’s a bundle designed for modern living. Success won’t just be measured by the raw number of sign-ups. The key metric will be the “attach rate”—the percentage of their existing current account holders who opt into the service. They’ll also closely monitor user engagement within the app and, crucially, the impact on customer stickiness and their willingness to centralize more of their financial life with Chase.

Since its UK launch in 2021, Chase has focused on ecosystem growth, recently partnering with Transport for London. How does the launch of Chase Protect fit into your broader strategy for encouraging customers to centralize their financial lives within a single digital bank?

Chase Protect is a cornerstone of their ecosystem strategy. A current account, a savings account, and cashback are table stakes in today’s market. By adding a layer of protection and insurance, they are moving from a transactional relationship to a more holistic one. It’s another powerful reason for a customer not to look elsewhere. When your daily commute via Transport for London earns you cashback and your summer holiday is covered by the same app, you begin to see Chase as your central financial hub. This isn’t just about cross-selling; it’s about deeply embedding the bank into the fabric of a customer’s daily activities and life events, creating a much stickier, long-term relationship.

What is your forecast for the future of bundled financial products and digital insurance in the UK banking sector?

I believe we’re at the very beginning of a major shift. The success of offerings like Chase Protect will force traditional high-street banks to radically rethink their clunky, often poor-value packaged accounts. The future is hyper-personalization and modularity, delivered seamlessly through a single digital interface. We’ll see more banks using AI to suggest tailored bundles based on a customer’s life stage and spending habits. The silos between banking, insurance, and even investments will continue to crumble, and the winners will be the platforms that can deliver the most comprehensive and frictionless value proposition to their customers.