In today’s rapidly changing design and construction industry, the ability to manage risk effectively is crucial. Simon Glairy, a leading authority in insurance and Insurtech with a deep focus on risk management, offers his insights into how firms can navigate the complexities of the current landscape.

What are the current macroeconomic and environmental forces reshaping the design and construction sector?

The forces at play right now are quite diverse. Macroeconomically, we’re seeing inflation effect due to global economic shifts, which directly influence material costs and availability. From an environmental standpoint, there’s a rising urgency to address climate change impacts. Both these forces require the industry to rethink how they approach projects, from sourcing materials to ensuring long-term sustainability.

How do these forces influence risk profiles for design and construction firms?

These forces drastically alter risk profiles by introducing variables that can lead to project delays, increased costs, and even safety hazards. For instance, unpredictable weather patterns due to climate change can disrupt timelines, while macroeconomic factors can lead to financial instability if not managed properly. This heightened risk exposure necessitates a more robust approach to risk assessment and management.

In what ways have rising claims and costs transformed coverage needs for the industry?

The increase in claims severity has pushed design and construction firms to revisit their insurance coverage comprehensively. There’s a notable shift towards policies that can cover newer kinds of claims, such as those spawned by supply chain disruptions or environmental damages. This means a higher focus on tailored coverage that can adapt as quickly as the risks evolve.

What are some common gaps in insurance coverage that design and construction firms might face?

One significant gap is often in the area of cyber liability, which is increasingly crucial as firms adopt digital solutions. Another common gap is inadequate environmental liability coverage, overlooked until the point of a catastrophic event. Without closing these gaps, firms are vulnerable to financial fallout.

Can you share any real-world case studies that highlight the consequences of underinsuring in this sector?

Certainly. There was a case where a construction firm faced unexpected severe weather that halted operations for weeks. Their general liability coverage was insufficient to cover weather-related disruptions, leading to substantial financial loss. This situation underlines the importance of reviewing insurance policies regularly to ensure all potential risks are covered.

How can professionals in design and construction better advise their clients about navigating today’s insurance challenges?

Professionals should focus on educating clients about the dynamic nature of risks and the need for flexible insurance policies. Offering insights into emerging threats and ensuring clients understand the implications of underinsurance can build a more resilient strategy against unforeseen challenges.

What strategies should firms adopt to shift from reactive to proactive risk management?

Firms should begin with thorough risk assessments and scenario planning to anticipate potential issues. Implementing a proactive risk management strategy also involves investing in technology that can provide early warnings and equip teams with the data to make informed decisions ahead of time.

How can firms ensure their stability through times of uncertainty?

Stability stems from diversification and resilience planning. Firms should focus on building diverse supply chains and maintaining financial reserves. Engaging closely with insurance partners to routinely reassess policies is essential to adapt promptly to any new challenges.

What are the key challenges currently facing the design and construction sector?

Beyond economic pressures and climate risks, the industry grapples with labor shortages and rapidly advancing technology. Adapting to these changes requires a delicate balance between investing in human resources and embracing digital transformation.

Why is it important for firms to reassess their insurance and management strategies in this new era?

Reassessing strategies is critical due to the relentless pace of change in risk environments. What’s deemed adequate insurance today might be obsolete tomorrow. This constant evaluation ensures firms aren’t blindsided by emerging threats and can continue to operate smoothly even under pressure.

How can rising material costs and labor shortages impact design and construction businesses?

Material cost fluctuations and labor shortages can squeeze profit margins, cause project delays, and in severe cases, halt projects altogether. This underscores the necessity for strategic workforce management and material procurement processes to mitigate adverse effects.

What role do supply chain disruptions play in the industry’s risk landscape?

Supply chain disruptions can escalate project costs and delay completion, impacting the firm’s reputation and financial standing. Thus, enhancing supply chain resilience by diversifying suppliers and employing predictive analytics is becoming a foundational strategy.

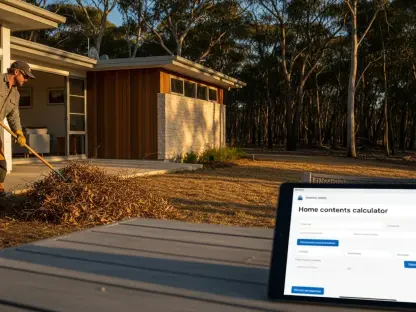

How can climate-related risks affect the insurance needs of design and construction companies?

Insurance needs are becoming more geared towards covering events like floods or hurricanes, influenced by climate change. Accurate climate risk assessments are now crucial for tailoring policies that protect against these potentially devastating events.

What insights will the webinar provide to help guide clients effectively during turbulent times?

The webinar offers a comprehensive look into current risks and practical strategies for adapting to them. Participants will gain valuable knowledge about optimizing insurance coverage and implementing forward-thinking risk management practices.

How can firms position themselves favorably with insurers amidst these risks?

Building a strong partnership with insurers through open communication and impressive risk management practices can position firms more favorably. Demonstrating robust efforts to minimize risks can also lead to better premium rates and customized coverage solutions.

What tools and strategies can be used to manage the new risk challenges in the design and construction sector?

Utilizing digital tools like AI-driven risk assessment platforms and project management software can significantly enhance a firm’s ability to navigate risks. These tools offer insights that help in making informed decisions, thereby managing risk more effectively.

Do you have any advice for our readers?

I recommend consistently investing in education and training around emerging risks and insurance solutions. The landscape is fluid, and staying informed is indispensable for safeguarding your firm’s future in this dynamic environment.