In the current business environment, companies confront numerous risks that could adversely affect their financial health and operational stability. As a vital safeguard against these uncertainties, property and casualty insurance (P&C insurance) offers crucial defense mechanisms against potential damages and liabilities. This form of insurance becomes an indispensable element in ensuring business continuity and resilience in the face of unforeseen circumstances. As businesses constantly navigate through dynamic markets and regulatory landscapes, having effective risk management strategies is pivotal. This guide delves into the essential aspects of P&C insurance, explaining its significance, functionality, and the various benefits it offers. It also explores the pivotal role legal advisors play in efficiently managing claims and disputes, thereby enabling businesses to maintain their competitive edge and ensure sustainable success in challenging times.

Understanding Property and Casualty Insurance

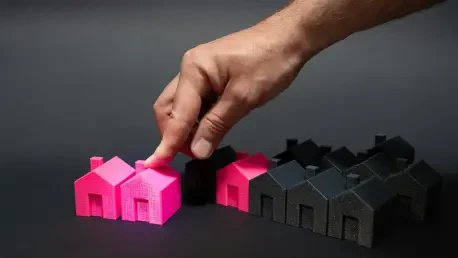

Property and casualty insurance, commonly referred to as P&C insurance, comprises an array of policies intended to protect businesses and individuals from losses related to property damage or liability claims resulting from injuries or damages inflicted on others. This broad category of insurance incorporates significant subtypes such as property insurance, liability insurance, vehicle insurance, and theft insurance. Each of these components plays a key role in forming a comprehensive risk management structure crucial for businesses of all sizes and industries. By covering these various elements, P&C insurance ensures that firms can effectively navigate both predictable and unpredictable challenges without jeopardizing their financial stability. In a world where business risks can emerge from countless directions, P&C insurance is not merely an optional safeguard but a necessary instrument for sustained business operations.

The significance of financial protection provided by property and casualty insurance cannot be overstated, as businesses encounter diverse risks that might disrupt their operations significantly. Whether it is theft, property damage, or liability claims, these risks potentially pose a substantial threat to a company’s financial condition and operational continuity. P&C insurance functions as a financial shield, allowing enterprises to focus on their core activities even in the presence of adversities. It facilitates seamless operational flow by mitigating potential losses and ensuring that firms are not left financially vulnerable in the event of unexpected incidents. This financial protection is fundamental for companies to adapt to an evolving business landscape, where agility and resilience determine long-term success and viability.

Enhancing Risk Management

A strategic advantage of property and casualty insurance is its role in improving risk management by transferring potential financial liabilities to insurance providers. This transfer empowers businesses to focus on growth and innovation, as they are unburdened by the constant threat of unforeseen liabilities, allowing management to concentrate on expanding core functionalities rather than being stalled by the fear of potential setbacks. In this context, P&C insurance serves as a strategic tool that enhances business operations, providing confidence to innovate and expand into new markets without the looming specter of financial unpredictability. The ability to focus on long-term strategic goals without distractions from sudden financial pitfalls underscores the insurance’s vital place in effective risk management strategies.

Reputation and efficient claim management are also pivotal elements supported by property and casualty insurance. A business’s reputation can make or break its success in the market, and managing claims professionally helps maintain that crucial reputation. P&C insurance affords businesses professional mechanisms for handling claims to minimize adverse publicity and facilitate smooth resolutions. This involves structured processes that ensure businesses can address and resolve claims without causing harm to their standing in the market. By integrating effective claim management into their operations, firms can preserve their competitive position and continue to meet obligations promptly and adeptly, reinforcing the trust and reliability they offer their clients and stakeholders.

Role of Legal Advisors

Legal advisors play an indispensable role in guiding businesses through the complexities of property and casualty insurance claims and disputes. Their expertise ensures organizations can navigate intricate legal landscapes and form strategies tailored for precise risk mitigation. Advisors assist with risk assessments, claim management, and legal representation, equipping companies to handle challenges effectively. By aiding in the development of customized insurance policies and offering astute legal strategies, legal advisors ensure that businesses are safeguarded against liability risks and can maintain operational integrity. This support allows firms to focus on their core activities with the reassurance that potential legal and financial complications will be handled proficiently, thereby enhancing operational coherence and strategic planning.

Strategic business protection is significantly bolstered through property and casualty insurance, aiding companies in managing financial and reputational risks while ensuring adherence to legal standards. The involvement of skilled legal advisors further enriches this protective scheme, offering vital guidance and expertise essential for comprehending and resolving claims and disputes. Through their in-depth understanding of legal and insurable elements, advisors provide firms with a broader perspective, empowering them to undertake informed, strategically sound decisions. This collaboration between businesses and legal consultants fosters an enriched risk management framework, one that is both resilient to current challenges and adaptive to future uncertainties.

Key Takeaways

Property and casualty insurance, often called P&C insurance, consists of various policies designed to protect businesses and individuals from property damage or liability claims due to injury or damages caused to others. This extensive insurance category includes important subtypes like property insurance, liability insurance, vehicle insurance, and theft insurance. Each subtype is vital for creating a robust risk management framework essential for businesses across various sectors. By covering these areas, P&C insurance allows companies to manage both foreseeable and unforeseen challenges without risking financial security. In a world where risks can arise from numerous sources, P&C insurance is not just an optional safeguard—it’s a vital tool for ensuring ongoing business operations.

The financial protection offered by P&C insurance is crucial, shielding businesses from diverse risks that could severely affect operations. Whether facing theft, property damage, or liability claims, these threats can compromise a company’s financial health and operational continuity. P&C insurance acts as a financial barrier, enabling businesses to concentrate on their primary tasks despite adversities.