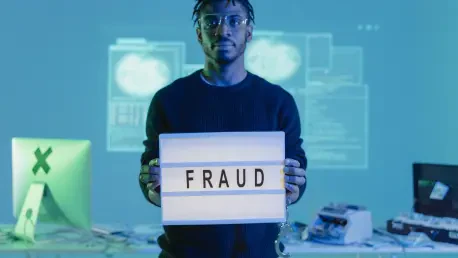

The insurance industry stands at a critical juncture as fraud schemes have evolved from simplistic scams to intricate operations fueled by cutting-edge technology, posing unprecedented challenges to insurers worldwide. Once limited to staged accidents or exaggerated claims, today's fraudsters

Short introduction Meet Simon Glairy, a renowned expert in insurance and Insurtech, with a sharp focus on risk management and AI-driven risk assessment. Today, we dive into a fascinating conversation about Global Indemnity Group’s latest venture—a new reinsurance managing general agency (MGA)

In an era where digital innovation is reshaping every corner of the financial services sector, the insurance industry stands at a critical juncture, grappling with inefficiencies that have long plagued its operations. Artificial intelligence (AI) has emerged as a powerful force to address these

In an era where healthcare and insurance industries grapple with mounting inefficiencies, a staggering statistic reveals the depth of the challenge: manual medical claims processing can take hours or even days for a single record review, often resulting in costly delays and errors. This bottleneck

In the rapidly shifting landscape of insurance fraud, staying one step ahead of tech-savvy criminals poses an immense challenge for the industry, as gone are the days of simple scams like staged car accidents. Today’s fraudsters harness artificial intelligence to forge documents, create synthetic

In a world where digital innovation shapes nearly every sector, the insurance industry stands as a prime example of transformation driven by cutting-edge advancements, with technology redefining how policies are crafted, claims are processed, and customers are engaged in ways that were previously