When a catastrophic event strikes an offshore energy platform or grounds a fleet of international aircraft, the subsequent financial and logistical shockwaves radiate across continents in an instant, creating a ripple effect that tests the limits of the global insurance industry. These are not isolated incidents but rather emblematic of a new class of high-stakes, borderless losses that demand an equally sophisticated and globally integrated response. To address this escalating complexity, global claims management firm Sedgwick has unveiled its Global Specialty platform, a dedicated initiative designed to manage the world’s most intricate and challenging specialty claims. This launch represents a strategic pivot toward a more unified model, directly confronting the evolving realities of risk in an interconnected world where disasters rarely respect national boundaries.

When a Disaster Crosses Borders, Who Manages the Fallout?

In an increasingly globalized economy, the very nature of catastrophic events has transformed. Major losses, particularly in sectors like aviation, marine, and energy, inherently involve multiple jurisdictions, diverse regulatory frameworks, and a complex web of international stakeholders. An aviation accident, for instance, can involve the airline’s home country, the location of the crash, the nationalities of the passengers, and the manufacturing origins of the aircraft components. Each of these elements adds a layer of legal and logistical complexity that requires a seamlessly coordinated global response, something traditional, regionally focused claims models struggle to provide.

This borderless reality is further compounded by the convergence of climate-related events with critical infrastructure. As extreme weather patterns become more frequent and severe, their intersection with high-value assets like port facilities, energy grids, and transportation networks creates the potential for unprecedented losses. A single hurricane or flood can disrupt supply chains across the globe, leading to a cascade of contingent business interruption claims that are exceptionally difficult to quantify and manage. This perfect storm of interconnected risk necessitates a claims management approach that is not only global in scale but also deeply specialized in its understanding of these complex interactions.

The New Reality of Why Specialty Claims Are More Complex

The surge in high-stakes specialty claims is not a cyclical trend but a structural shift driven by powerful economic forces. The rapid economic expansion across Asia, for example, has fueled massive investments in new infrastructure and accelerated energy development. This growth has created a higher concentration of high-value, technologically advanced assets in regions that are also susceptible to natural catastrophes. As a result, the frequency and financial magnitude of losses in these areas have risen dramatically, demanding a more robust and expert-led claims handling presence on the ground.

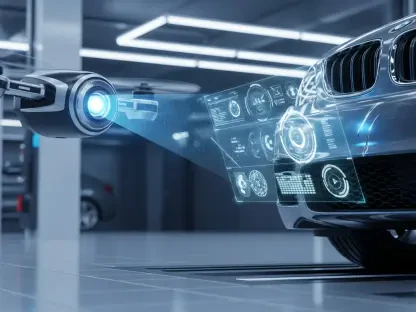

Simultaneously, the insured assets themselves have become more intricate. From next-generation aircraft and deepwater drilling rigs to sophisticated renewable energy installations, the engineering and technology involved are more complex than ever before. When a loss occurs, assessing the cause, extent of damage, and potential for recovery requires a level of subject-matter expertise that goes far beyond general claims adjusting. This increasing technicality means that a successful resolution often hinges on the specialized knowledge of engineers, maritime experts, or aviation specialists who can navigate the nuances of these highly specific industries.

Navigating the Market’s Core Tension Between Scale and Specialization

In this demanding environment, clients in the specialty insurance market face a fundamental tension. On one hand, they require the security and resources of a major global corporation. This includes state-of-the-art IT security to protect sensitive data, rigorous compliance protocols to navigate international regulations, and the financial stability to handle multimillion-dollar claims. Clients expect a partner with the scale to deploy a team anywhere in the world at a moment’s notice, a capability that only large, established organizations can reliably offer.

On the other hand, for high-stakes losses, these same clients demand the personal accountability and trusted relationship typically associated with a boutique, niche firm. They want to work with a senior adjuster they know by name, an expert whose judgment and experience they can rely on implicitly. The success of a complex claim often depends as much on the individual expert’s insight as it does on standardized processes. This dual expectation has created a significant challenge for the industry: how to deliver the power of a global enterprise with the focused, personal touch of a specialist.

Sedgwick’s strategic response to this market tension is the formal launch of its Global Specialty platform in January. Headquartered in London, the platform unifies the firm’s top-tier expertise in a single, cohesive unit. Its development was a deliberate, phased process, beginning in 2024 with the establishment of a 70-person global aviation claims team. Building on that model, the firm expanded into the marine and energy sectors, culminating in a new operational blueprint that blends a robust local presence in key hubs with globally deployable, world-class expertise from centers like London and Singapore. This structure is designed to offer clients the best of both worlds.

An Inside Look at Leadership Perspectives on Building a Global Solution

The strategic thinking behind the platform is rooted in a deep understanding of what it takes to manage a modern catastrophe. Damian Ely, the CEO of Sedgwick’s specialty division, emphasizes the irreplaceability of on-the-ground expertise, especially in the initial hours and days following a major loss. Ely notes that while technology and remote communication are valuable tools, they cannot replace the critical insights gained by having an expert physically present at a loss site. For claims valued in the hundreds of millions of dollars, the ability to see the situation firsthand, interact with local stakeholders, and make real-time assessments is indispensable.

This focus on expert-led service is echoed by Chief Commercial Officer Kevin Hagan, who points to the evolving demands of clients in a dynamic market. According to Hagan, insurers and brokers are no longer satisfied with a reactive, process-driven approach. They expect a claims partner who can provide proactive strategic advice, deliver deep data-driven insights, and help them navigate the complexities of a volatile risk landscape. The Global Specialty platform was engineered to meet this demand by creating a structure where deep technical expertise is the central pillar of the value proposition, ensuring that clients receive not just a service but a strategic partnership.

Building the Adjuster of the Future for a New Era

The increasing technicality of specialty claims is fundamentally reshaping the role of the loss adjuster. Deep, verifiable subject-matter expertise has become the industry’s most valuable currency. Professionals with backgrounds in fields like engineering, naval architecture, or aviation are in high demand, as their qualifications are essential for accurately assessing causality and quantum in complex loss scenarios. This shift requires a new approach to talent development, moving beyond traditional claims training to cultivate genuine specialists.

To address this need, Sedgwick has implemented a two-pronged strategy to build its next generation of experts. The firm is investing heavily in mentorship and graduate programs, pairing emerging talent with seasoned specialists to accelerate the transfer of knowledge in fields where it can take over a decade to develop true expertise. Simultaneously, Sedgwick is leveraging data analytics and artificial intelligence to supplement human insight. The goal is not to replace expert judgment but to arm adjusters with powerful tools that can help them identify trends, model loss scenarios, and extract deeper value from complex claims data for clients.

Looking forward, the expansion of the Global Specialty platform was a critical step in a broader strategic vision. Over the past several months, the focus has been on integrating teams and refining the operational model. The next phase of development will concentrate on bolstering marine technical services and expanding capabilities in technical and special risks. The successful launch of this platform demonstrated a clear commitment to addressing the market’s most pressing challenges. It established a new benchmark for managing complex global claims by creating a model that reconciled the need for global scale with the demand for deep, personal expertise, positioning the organization to meet the future of risk head-on.