The promise of enterprise-wide artificial intelligence has finally begun to materialize for the insurance industry, moving beyond the isolated pilot programs that, for years, failed to deliver on their transformative potential. While insurers have long recognized the value of AI in specific applications like fraud detection and intelligent document processing, a significant hurdle remained: the inability to scale these capabilities across the organization. Research previously highlighted that over 90% of carriers struggled to move beyond these siloed successes. Now, a strategic evolution is underway, shifting the industry’s focus from the constant pursuit of novel AI tools toward the sophisticated orchestration of existing AI assets. This mature approach embeds intelligent systems directly into core operational workflows, grounding them in a deep, contextual understanding of the insurance business and ensuring they function as integral components of a unified enterprise architecture, rather than as disparate, add-on solutions.

The Dawn of Integrated Intelligence

The initial wave of AI adoption was largely defined by the deployment of narrow, single-purpose models, often referred to as “single agents,” designed to solve discrete problems in isolation. The current landscape, however, is characterized by the emergence of “coordinated agent ecosystems.” In this advanced model, multiple specialized AI agents collaborate dynamically, sharing critical context and sequencing decisions across complex, multi-step processes like underwriting, claims management, and policy servicing. These ecosystems are inherently context-aware, built with an explicit understanding of insurance-specific constructs such as product types, policy states, business rules, and historical outcomes. This transition elevates AI orchestration from a technical capability to a central strategic imperative, empowering intelligent systems to participate in holistic, enterprise-level decisions that transcend traditional functional and system silos, creating a truly connected and responsive organization.

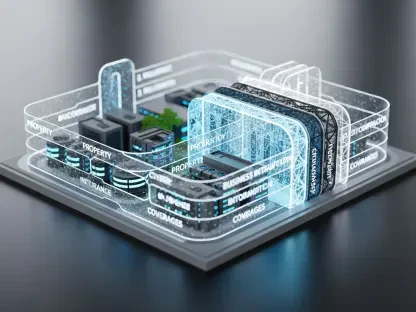

A critical distinction between experimental AI and the robust, production-grade systems now in operation is the ability to consistently comprehend and maintain insurance context at scale. Early attempts to hard-code business logic and definitions directly into AI models or data pipelines proved to be fragile and unsustainable. This approach led to brittle systems that were difficult to govern and required extensive retraining whenever business rules or product definitions changed. The solution to this foundational challenge has been the widespread adoption of domain ontologies. An ontology functions as a shared “semantic backbone” for the enterprise, externalizing the complex web of insurance relationships between products, coverages, and rules into a governed, centralized domain layer. This allows AI models to focus on their core tasks of prediction and inference, while the ontology provides the necessary context, ensuring consistency, continuity, control, and interpretability across all enterprise systems.

Powering New Frontiers in Trust and Commerce

As intelligent systems assume greater responsibility in core decision-making processes, the demand for transparency and explainability has intensified significantly. The concept of explainability has evolved far beyond simply interpreting the outputs of a single algorithm or reviewing a static set of business rules. Insurers now require comprehensive, workflow-level visibility, which provides the ability to trace how a decision is formulated and progresses through a series of steps involving multiple AI agents, automated rules engines, and human reviewers. This holistic view of the decision-making journey has become crucial for governance, satisfying regulatory compliance, and building enduring trust in automated systems, particularly within high-stakes functions such as complex claims adjudication and dynamic underwriting, where clarity and accountability are paramount.

This enhanced AI capability is also the primary engine driving growth in new markets, most notably in the realm of embedded insurance. The business model for embedded products, typically characterized by low premiums and extremely high volume, is economically incompatible with traditional, human-intensive operational structures. To capitalize on this burgeoning market, which is now valued at over $87.4 billion, leading insurers are pivoting to predominantly AI-serviced models. AI agents are now managing the vast majority of the embedded insurance lifecycle, including eligibility verification, claims intake, document validation, and routine adjudication. Rather than attempting to retrofit legacy processes, forward-thinking insurers are designing AI-native service flows from the ground up, fostering the development of new, highly automated operating models and, in some cases, entirely new insurance entities architected around automated decisioning and seamless service delivery.

An Architectural Blueprint Realized

The competitive landscape of the insurance industry was ultimately reshaped not by those who possessed the most novel AI tools, but by those who built the most robust and integrated foundational architecture. Strategic investments in two key areas proved decisive: sophisticated AI orchestration layers capable of coordinating a diverse set of agents and data sources, and resilient domain ontologies that provided a consistent, governable source of business context. The organizations that gained a significant advantage were those that successfully wove AI into the very fabric of their core workflows. Critical elements such as governance, operational guardrails, and data discipline were treated as integral components of the design from the outset, not as afterthoughts. This architectural foresight was the key that unlocked the sustainable, long-term value of artificial intelligence and defined the industry leaders.