The traditional, often lengthy process of filing a car insurance claim, characterized by extensive paperwork and prolonged waits for adjusters, is rapidly becoming a relic of the past as technology reshapes the industry from the ground up. At the forefront of this revolution is artificial intelligence (AI), specifically the integration of machine learning, computer vision, and large language models (LLMs) into claims processing. By 2026, the entire experience of handling an auto insurance claim is projected to be almost unrecognizable from today’s standards. For the average driver, this technological evolution holds the promise of unprecedented speed and efficiency. However, it also introduces a new set of critical concerns surrounding the privacy of personal data and the inherent fairness of the algorithms that will soon make crucial financial decisions. This shift necessitates a closer look at the benefits, the potential drawbacks, and the proactive measures drivers can adopt to successfully navigate this new landscape of intelligent auto insurance.

1. The New Era of Touchless Claims

One of the most profound and immediate changes drivers will experience is the widespread adoption of “touchless” claims processing, a system where the entire claims journey, from the initial report to the final payment, is managed with minimal human intervention. This automated approach is fundamentally transforming the nature of service provided by auto insurers. In the past, filing a claim initiated a cumbersome cycle that could extend for weeks, involving scheduling an inspection with a human adjuster and enduring significant delays. AI dismantles this timeline. Using advanced computer vision, image recognition software can analyze photos and videos of vehicle damage uploaded by a driver through a mobile application, providing a near-instantaneous assessment of repair costs and the potential for a total loss. This capability dramatically curtails the need for on-site inspections, allowing insurers to make swift and informed initial decisions, thereby accelerating the entire process from the very first step and setting a new standard for service delivery.

The advantages of this streamlined system translate directly into a better customer experience by drastically reducing claim cycle times and enhancing accessibility. For minor and unambiguous incidents, such as a cracked windshield or a small dent, the entire claim can be triaged, approved, and paid out within a matter of minutes or hours, rather than days or weeks. This rapid resolution is arguably the single greatest benefit for policyholders, significantly alleviating the stress and uncertainty that typically accompany an accident. Furthermore, AI-powered chatbots and virtual assistants, often leveraging sophisticated LLMs, offer immediate, 24/7 customer support. These automated systems can expertly guide drivers through the First Notice of Loss (FNOL) process, answer complex policy questions, and provide real-time status updates on a claim. This constant availability means help is accessible anytime and anywhere, effectively eliminating the frustration of long hold times and limited business hours.

2. Fairer Pricing Through Better Risk Assessment

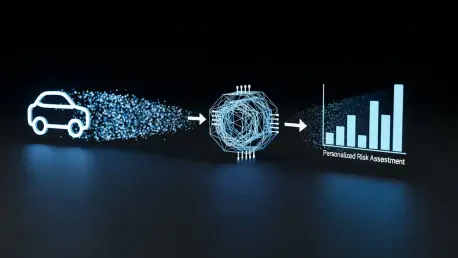

The transformative impact of artificial intelligence extends well beyond the claims department, fundamentally altering how auto insurance policies are priced. Insurers are now leveraging AI to analyze immense and complex datasets, with a particular focus on telematics data collected from in-car devices or smartphone applications, a practice commonly known as usage-based insurance (UBI). This technology allows for the creation of a highly accurate and individualized risk profile for each driver. AI models can meticulously evaluate actual driving behaviors, including factors like average speed, instances of hard braking, the time of day a vehicle is typically used, and total mileage. This granular analysis leads to personalized premiums that are often fairer for individuals who practice safe driving habits. The data-driven methodology represents a significant departure from the traditional, one-size-fits-all pricing models that have long relied heavily on broad demographic categories, enabling a system that instantly rewards good behavior on the road.

Beyond personalizing premiums, AI is also proving to be a powerful tool in the fight against insurance fraud, an issue that costs the industry billions of dollars annually and ultimately inflates premiums for all policyholders. Human analysts, while skilled, can struggle to identify sophisticated fraudulent schemes hidden within vast quantities of data. AI algorithms, in contrast, can analyze millions of claims simultaneously to detect subtle and suspicious patterns that would otherwise go unnoticed. These systems can identify unusual connections between seemingly unrelated parties, flag inconsistent or inflated repair estimates, and spot other red flags indicative of fraudulent activity. By detecting and preventing fraud with far greater efficiency and accuracy, AI helps to reduce the financial losses incurred by insurers. This, in turn, helps to keep the overall cost of auto insurance down, creating a more stable and affordable market for every driver.

3. Navigating the Algorithmic Challenges

While the benefits of AI in terms of speed and efficiency are compelling, the increasing reliance on automated claims processing introduces new and significant challenges for drivers. A primary concern revolves around the “black box” problem, where the complex algorithms making decisions are often so intricate that their reasoning is not easily understandable, even to their creators. In instances where a claim is undervalued or denied, receiving an automated decision without a clear, human-intelligible rationale can be a source of intense frustration and can deeply erode trust between the policyholder and the insurer. For a driver to effectively dispute an unfavorable outcome, it is essential to understand the specific factors and logic that led to the algorithm’s conclusion. Without this transparency, policyholders are left at a disadvantage, unable to challenge decisions that may be flawed or unfair, thereby creating a power imbalance in the claims process.

Compounding the transparency issue are significant concerns regarding algorithmic bias and data privacy. An AI system is only as impartial as the data it is trained on. If the historical claims data used to develop these algorithms reflects past societal biases or is incomplete for certain demographic groups, the AI may unintentionally perpetuate or even amplify these inequities in its future decisions. This could lead to systematically unfair pricing or claim outcomes for some drivers based on factors unrelated to their actual risk profile. Simultaneously, the foundation of AI-powered insurance is the collection and analysis of vast amounts of personal data, including sensitive telematics information, claim photos, and personal details. As UBI and AI become standard, the data footprint of each driver will expand significantly. This raises critical questions about data security and usage, making it imperative for drivers to understand their policy’s data-sharing agreements and the security measures their insurer has in place to prevent breaches.

4. Preparation for the Future Driver

The transition toward AI-driven insurance is not a passive event for consumers; it demands a new level of engagement and digital literacy from every driver. To effectively navigate this evolving landscape, it is crucial to proactively understand the terms of one’s policy, particularly the sections pertaining to data collection and claims processing. Before 2026, policyholders should take the time to thoroughly review their insurance documents to comprehend exactly what data, such as driving scores or location information, is being gathered by their insurer. Understanding how this information is used to evaluate risk and handle claims is the first step toward maintaining control in an automated system. Furthermore, since AI systems thrive on clear, structured, and visual data, maintaining robust digital evidence has become paramount for a successful claim. After an accident, drivers must prioritize documenting the event meticulously by capturing high-quality, multiple-angle images and videos of both the vehicle damage and the surrounding scene, as this documentation is the primary input for the AI’s computer vision assessment.

In addition to diligent documentation, drivers should be prepared to utilize the digital tools provided by their insurer while also knowing when to seek human intervention. Using the insurer’s dedicated mobile application to file the FNOL immediately after an accident is highly recommended. This ensures that all relevant data is captured and transmitted in the insurer’s preferred, structured format, which allows for rapid AI triage and processing. However, it is equally important to recognize that an initial AI decision is not necessarily the final word, especially for claims that are complex, unusual, or disputed. Drivers should not hesitate to escalate their case to a human adjuster if they feel the automated assessment is inaccurate or unfair. The most effective insurance systems of 2026 will likely be hybrid models that leverage AI for its unparalleled speed and efficiency in straightforward cases, while relying on the empathy, nuanced judgment, and advocacy of human adjusters for more complex situations, ensuring the integrity of the coverage.

5. An Intelligent Path Forward

The integration of AI and LLM-driven processes had fundamentally reshaped the auto insurance industry, marking a definitive shift away from legacy systems. Drivers came to expect a claims experience that was not only faster but also more affordable and tailored to their individual circumstances. This newfound convenience, however, was accompanied by a new set of responsibilities. Policyholders learned the importance of monitoring their digital footprint and understanding the complex algorithmic factors that influenced both their insurance premiums and the outcomes of their claims. By remaining vigilant about their data rights, meticulously documenting every incident with digital evidence, and knowing precisely when to request human intervention, drivers successfully navigated this new technological frontier. This proactive engagement ensured that their driving experience remained both secure and fair in an increasingly intelligent age of auto insurance.