The global commercial insurance landscape is undergoing a monumental transformation as a massive surge in policyholder surplus and a stabilized reinsurance market finally break the back of a six-year pricing climb. For the first time in nearly a decade, property owners are entering negotiations

The pursuit of the perfect mile often hinges on the split-second accuracy of the glass and silicon strapped to a runner's wrist, a reality Huawei aims to dominate with its latest precision instrument. The Huawei Watch GT Runner 2 represents a significant advancement in the dedicated fitness

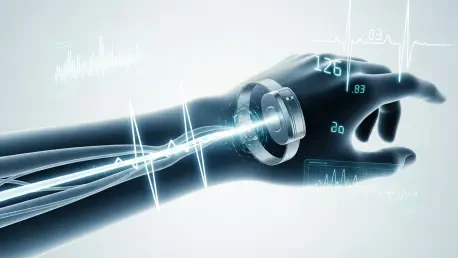

The landscape of cardiovascular health is shifting from episodic clinical visits to continuous, background monitoring. At the forefront of this evolution is Simon Glairy, a distinguished expert in health technology and medical device validation who has spent years analyzing the intersection of

The modern automotive landscape has reached a pivotal juncture where the safety of a vehicle is determined more by its lines of code than by the strength of its steel frame. This reality became starkly apparent with the recent announcement that Ford is recalling 4.3 million vehicles, a figure that

Modern enterprises are discovering that even the most sophisticated large language models often behave like brilliant but uninformed interns who lack basic institutional knowledge. This fundamental disconnect, frequently referred to as the context gap, prevents artificial intelligence from

The escalating volatility of global weather patterns has forced a radical recalculation of risk, transforming once-stable residential zones into precarious financial voids known as insurance deserts. These regions are defined by an environment where extreme weather events have rendered traditional

The strategic partnership between Ohio Mutual Insurance Group and Convr represents a major step in the digital evolution of the commercial insurance industry, signaling a fundamental shift in how specialty insurers manage complex risks. By integrating an advanced underwriting workbench, Ohio Mutual

The modern landscape of venture capital has moved far beyond the simple exchange of equity for cash, evolving into a sophisticated game of strategic alignment where a single introduction at the right venue can determine a decade of market dominance. The intersection of venture capital, visionary

The era of the weary actuary buried under stacks of thousand-page technical manuals is rapidly giving way to a more efficient landscape where data speaks directly to the professionals who manage it. For decades, the insurance industry relied on manual navigation of dense documentation to build and

The insurance sector stands at a definitive crossroads where the novelty of algorithmic processing has finally matured into a foundational pillar of global risk management strategies. No longer confined to the back-office laboratories of high-tech startups, artificial intelligence is now actively

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy