The hotel investment landscape is facing a notable disruption centered around the escalating costs of insurance, a factor gaining prominence in underwriting models. Following the financial upheaval witnessed during the pandemic years, the United States hotel sector, particularly areas known for

The quest for optimal sleep has led people to explore various technologies, and one device garnering attention is the Oura Ring, which promises to revolutionize sleep patterns with its chronotype feature. Advanced wearable technology is the backbone of modern health tracking, and the Oura Ring

Simon Glairy, an esteemed figure in insurance and Insurtech, has carved a niche for himself as an innovator in risk management and AI-driven risk assessment. With the release of the Traveler’s 2025 Injury Impact Report, he sheds light on the intricate dynamics of workplace injuries and their

The integration of artificial intelligence into the realm of coding and software development is a captivating topic sparking debate among professionals. With AI tools becoming more capable of generating code, many in the industry are pondering whether this technological advancement will benefit

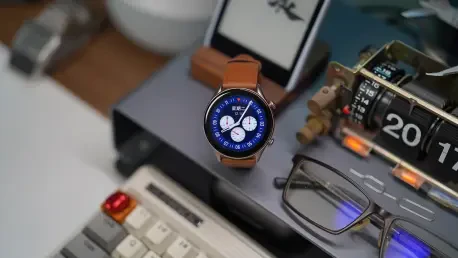

The intersection of wearable technology and health monitoring has reached a significant milestone. In a world where technology permeates every facet of our lives, the Samsung Galaxy Ring stands out as a beacon of innovation. Offering cutting-edge health tracking features, durable design elements,

In recent years, the prevalence of stress-tracking wearables has surged, transforming personal health management and sparking a debate about their role in modern wellness practices. These devices, replete with advanced sensors and algorithms, are changing how individuals monitor stress levels and

In the bustling world of consumer electronics, staying updated on the latest deals and innovations is crucial. Today, we're diving into the Samsung Galaxy Watch Ultra with Simon Glairy, an esteemed expert in Insurtech and AI-driven risk assessment, to explore what makes this smartwatch a standout

In a rapidly evolving landscape where artificial intelligence and insurance intersect, Simon Glairy stands out as an authority on Insurtech, risk management, and AI-driven methodologies. Today, we delve into a significant issue at the crossroads of technology and regulation—the National Association

The global shipping industry has recently grappled with the increasing costs of marine insurance, reflecting escalating regional tensions in the Strait of Hormuz. This waterway, a critical maritime passage, channels nearly a fifth of the world's petroleum supply, highlighting its importance. As a

In an era where artificial intelligence continually reshapes industries and everyday life, the TechCrunch Sessions: AI event stands out as a crucial gathering for the tech world. Taking place at UC Berkeley's Zellerbach Hall, this one-day summit serves as a beacon for innovation, bringing together

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy