In the rapidly evolving world of fintech for maritime services, Simon Glairy stands out as a beacon of expertise, particularly in the realm of insurtech and AI-driven risk management. Today, we delve into the world of digital solutions for seafarers, catalyzed by NYK's recent acquisition of Kadmos.

As major retailers reel from cybercrimes costing them hundreds of millions, the insurance sector scrambles to adapt. Just how vulnerable is the business world to these threats, and what steps are being taken to shield against potential future catastrophes? The Unseen Threat Looming Over Retail

In a world increasingly impacted by climate change, flooding has emerged as a critical challenge facing many homeowners and insurance providers. As people seek reliable means of safeguarding their homes from potential flood damage, the advent of digital flood insurance solutions has offered

In recent years, micro-captive insurance has garnered significant attention due to its intricate balance between legitimate tax advantages and increased regulatory scrutiny. Central to this discussion is the 831(b) tax election, part of the 1986 Tax Reform Act, originally designed to support small,

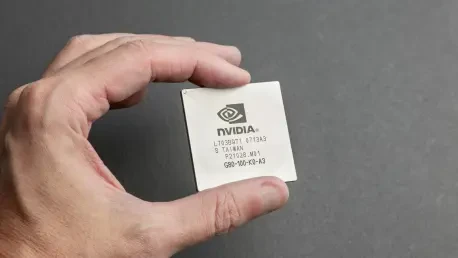

Nvidia has emerged as a dominant force within the AI startup ecosystem, where its influence is increasingly evident due to a strategic blend of investment prowess and technological innovation. Known globally for its high-performance graphics processing units (GPUs), Nvidia has leveraged its

Legal system abuses are often hidden drivers of escalating insurance costs, impacting both consumers and insurers alike. Frivolous lawsuits and the practice of third-party litigation funding contribute significantly to this issue, making it an economic burden for the general public. Trusted Choice,

In recent months, there has been a noticeable surge in insurtech funding, drawing attention from various industry stakeholders. As climate risks loom larger and technological advancement becomes critical, insurtech companies are receiving substantial investments to address these challenges. This

What factors make modern construction projects increasingly complex in terms of insurance needs, and how is the industry adapting to these challenges? In recent years, natural disasters have significantly impacted construction globally, with events in 2024 alone causing over $368 billion in

It is increasingly evident that construction firms are encountering significant challenges in properly assessing their insurance needs, leading to a troubling disconnect between expected coverage and real-world risks. This scenario often results from a simplistic, transactional approach prioritized

In recent years, the UK has witnessed a stark rise in flood-related events, placing the spotlight on the urgent need for comprehensive flood insurance reform. Low-income homeowners face an existential threat as policy shortcomings and poor urban planning expose them to significant financial risk.

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy