In today's complex geopolitical landscape, gaining insights from industry leaders is invaluable. Simon Glairy, a well-regarded expert in the fields of insurance and Insurtech, joins us for an in-depth discussion on the evolving economic climate and its impact on the insurance sector. Simon is

The European insurance sector is experiencing a transformative phase, necessitated by unified cyber reporting regulatory challenges that intensify the need for streamlined operations. With cyber threats increasingly endangering the industry and the rapid advancement of digital technologies,

As artificial intelligence continues to permeate various industries, the phenomenon of "AI hallucinations" has come under scrutiny for its potential to mislead. These occurrences raise alarm when AI systems produce content that appears believable yet contains inaccuracies. Towergate Insurance has

Simon Glairy’s journey in InsurTech has positioned him at the cutting edge of AI-driven risk assessment, where he navigates the complex intersection of technology, ethics, and profitability within insurance. With a keen focus on pricing optimization, Simon is committed to pioneering strategies that

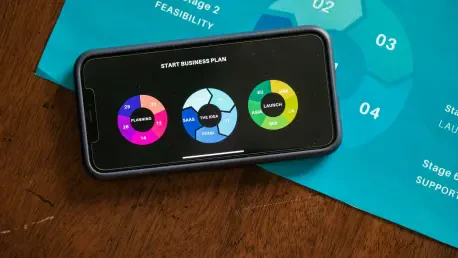

In the rapidly evolving tech industry, delivering groundbreaking technology innovations or securing significant enterprise contracts often becomes the main focus for startups. Yet, these ambitious companies frequently neglect a critical operational component: strategic insurance planning.

In an era where economic challenges routinely batter industries, one UK-based personal lines insurer has made headlines with a remarkable financial feat. Policy Expert has not only defied the odds but also set a new benchmark in business growth with an impressive 36% surge in annual revenue. This

As the healthcare landscape evolves, addressing medication management and safety becomes increasingly critical, especially for aging populations. In this context, Humana, a leading player in the insurance and healthcare sectors, confronts the complex challenge of ensuring patient safety amidst the

The UK insurance market is currently experiencing a notably soft phase, providing a favorable environment for buyers. With rates decreasing across various insurance classes, purchasers are reaping the benefits of enhanced coverage options and advantageous terms. However, the motor insurance sector

Embedded insurance is seamlessly revolutionizing how consumers buy and interact with insurance by integrating it into their purchasing journey, making it a core, often invisible element of their transactions. This emerging concept is reshaping the insurance industry, moving away from traditional

In a surprising turn of events, cyber insurance premiums experienced a 2.3% decline last year, marking the first reduction in over a decade. Total industry premiums fell to roughly $7.1 billion, signaling a significant shift in the cyber insurance landscape. Nonetheless, the market remains notably

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy