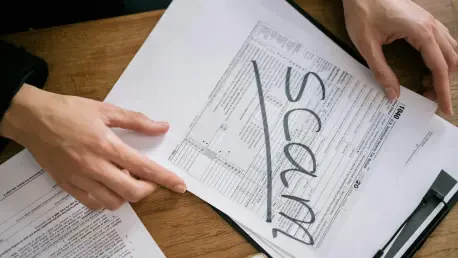

In a striking example of the insurance industry’s resolve to combat deceit, a recent legal victory has spotlighted the ongoing battle against fraudulent claims, with Admiral Insurance emerging triumphant against a family duo. The case, involving a mother and son, unraveled a calculated attempt to exploit a minor car accident for substantial financial gain, only to be thwarted by meticulous investigation and legal action. This significant win, resulting in damages exceeding £200,000, underscores the critical importance of vigilance within the sector. It serves as a stark reminder that fraudulent behavior carries severe consequences, not just for the perpetrators but also for the integrity of the insurance system as a whole. The determination to root out such schemes reflects a broader commitment to fairness, protecting honest policyholders from the ripple effects of fraud, such as increased premiums. This story of detection and justice highlights the sophisticated measures insurers must employ to safeguard trust and accountability.

Uncovering the Deceptive Claim

The saga began with what appeared to be a routine minor collision involving Inderjit Singh and a vehicle insured by Admiral. Initially, it was acknowledged that Singh sustained a slight injury, a detail that seemed unremarkable at first glance. However, the claim she subsequently filed painted a vastly different picture, alleging extensive damages and severe injuries far beyond what the incident warranted. This glaring inconsistency triggered suspicion among Admiral’s team, prompting a deeper dive into the validity of the submission. The exaggerated nature of the reported losses suggested a deliberate attempt to defraud, setting the stage for a rigorous investigation. Such discrepancies are often the first red flags in identifying fraudulent intent, and in this instance, they proved to be the catalyst for uncovering a broader scheme. The insurer’s swift response to these warning signs exemplifies the proactive stance necessary to address deceit in an industry frequently targeted by opportunistic claims.

Further scrutiny revealed the involvement of Singh’s son in orchestrating the fraudulent claim, turning what might have been seen as an individual act into a coordinated family effort. Admiral, in collaboration with a specialized firm known as HF, embarked on a comprehensive probe to dissect the details of the case. Their combined expertise in legal and investigative matters exposed the fabricated elements of the claim, from inflated injury reports to fictitious financial losses. This partnership proved instrumental in building a robust case against the duo, demonstrating the value of collaborative efforts in tackling complex fraud. The uncovering of this deception not only highlighted the sophistication of such schemes but also the determination required to counter them. As insurers face increasingly cunning tactics, the need for specialized support and thorough analysis becomes ever more apparent, ensuring that no fraudulent stone is left unturned in the pursuit of justice.

Legal Victory and Financial Repercussions

The culmination of Admiral’s efforts came in a courtroom showdown, where the evidence painstakingly gathered proved irrefutable against Inderjit Singh and her son. The court’s ruling was decisive, awarding damages surpassing £200,000 to Admiral, a sum that reflected both the scale of the attempted fraud and the costs incurred in exposing it. This financial penalty served a dual purpose: it compensated the insurer for the resources expended in the investigation and acted as a powerful deterrent to others considering similar deceitful actions. The judgment sent a clear message that the consequences of fraud extend far beyond mere reprimand, hitting perpetrators where it hurts most—their finances. Such outcomes are vital in an industry where fraudulent claims can lead to significant losses, ultimately burdening honest customers with higher costs. This legal triumph stands as a testament to the effectiveness of a zero-tolerance approach to insurance fraud.

Beyond the immediate financial impact, the case shed light on the broader implications of fraud within the insurance sector. The substantial award underscored the judiciary’s recognition of the seriousness of such offenses, reinforcing the notion that fraudulent behavior undermines the trust essential to the industry’s functioning. It also highlighted the growing trend of insurers leveraging legal avenues to protect their interests, a strategy that has become increasingly necessary as fraud tactics evolve. The involvement of family members in this scheme further illustrated the complex dynamics at play, requiring insurers to remain vigilant against coordinated efforts. This victory, while a win for Admiral, also serves as a reminder of the persistent challenges faced by the sector in maintaining equity. The financial repercussions faced by the fraudsters are a step toward accountability, ensuring that the burden of deceit does not fall on the shoulders of those who play by the rules.

Safeguarding the Industry’s Integrity

The successful prosecution of this case emphasizes the critical role of robust investigative mechanisms in preserving the integrity of the insurance industry. Admiral’s collaboration with HF exemplifies how strategic partnerships can enhance the ability to detect and address fraudulent claims, providing a model for others in the sector to emulate. The diligence displayed in uncovering the exaggerated claim reflects a broader commitment to safeguarding the system from financial abuse, which often results in higher premiums for all policyholders. By prioritizing thorough scrutiny, insurers can mitigate the impact of deceitful practices, ensuring that resources are directed toward genuine claims rather than fabricated ones. This case serves as a benchmark for the importance of proactive measures, encouraging continuous improvement in fraud detection methods to stay ahead of evolving schemes.

Reflecting on the aftermath, the industry must continue to invest in advanced tools and training to combat the sophisticated nature of modern fraud. The legal outcome against Singh and her son demonstrated that no attempt at deceit is too small or too intricate to escape notice when met with determined opposition. The £200,000 penalty imposed by the court acted as a resounding warning to potential fraudsters, reinforcing the principle that dishonest actions will be met with severe consequences. Moving forward, insurers should build on this precedent by fostering greater collaboration and sharing best practices to fortify their defenses. Emphasizing prevention alongside prosecution can further deter fraudulent behavior, protecting the trust that underpins the relationship between insurers and their clients. This case closed a chapter of deceit, but it opened a dialogue on the enduring need for innovation and resolve in upholding fairness across the board.