The evolution of artificial intelligence and cloud computing has fundamentally reshaped the small commercial insurance sector. These technologies, long anticipated for their potential to streamline and innovate, are now central to the industry’s rapid transformation. The insurance market is shifting from legacy systems toward more dynamic and efficient processes, driven by technology that enhances underwriting precision and speeds up distribution. Understanding this change is crucial for stakeholders eager to navigate today’s competitive landscape.

Key Trends and Insights in the Current Insurance Landscape

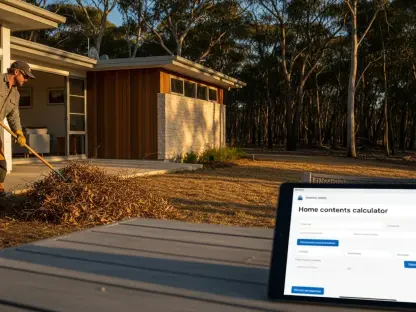

Recent shifts in small commercial insurance highlight a pivotal transformation. The industry, historically slow to adopt new technologies due to the dominant presence of large legacy insurers, is undergoing significant changes. These established companies, with their complex structures, have traditionally struggled to innovate. Managing General Agents (MGAs) and digital platforms have emerged as agile players leveraging technology to reshape the insurance market. The move toward digital infrastructure has become increasingly necessary to combat inefficiencies and outdated practices.

The integration of AI and advanced digital infrastructure is setting new standards in underwriting. Companies are using machine learning to enhance underwriter capabilities, resulting in faster decision-making and reduced operational costs. AI deployment has demonstrated significant improvements, drastically reducing the time required to generate bindable policy quotes. Digital infrastructures powered by cloud computing are leveling the playing field for new entrants, allowing them to operate unburdened by past technologies.

In navigating market volatility, such as fluctuations in liability claims, AI provides a strategic advantage in risk selection. Enhanced predictive capabilities mean insurers can select risks with confidence, despite the inconsistent data in some sectors. Maintaining stability amidst these challenges requires precise data management and a commitment to model evolution.

In-Depth Market Analysis and Future Projections

The insurance industry is poised for continued transformation as AI and cloud technology become more integrated. Innovations such as blockchain technology are emerging to ensure data transparency, thereby reinforcing trust between stakeholders. Furthermore, the trend toward subscription and on-demand insurance models indicates a shift toward more flexible, customer-centric solutions. As the regulatory framework evolves, the competitive dynamics will adjust, requiring insurers to stay agile and responsive to changes.

Economic factors also play a role as insurers explore profitability avenues in embedded or usage-based insurance products. These models have proven challenging due to unfavorable economics, prompting insurers to evaluate premium volumes and profit margins carefully. The strategic approach has shifted toward optimizing high-margin opportunities using data-driven insights.

Strategic Recommendations for Navigating Change

For industry professionals, embracing AI and cloud solutions is critical for maintaining a competitive edge. Building robust digital infrastructures and partnerships with technology firms will be crucial. Prioritizing technology literacy within organizations, focusing on data-driven decision-making, and staying responsive to regulatory changes can provide a significant advantage. Insurers should remain proactive in developing strategies to withstand economic shifts and maintain resilience in a changing marketplace.

Reflecting on these findings, the integration of AI and cloud computing has already demonstrated its capacity to transform small commercial insurance. Industry players have recognized technology as not just an opportunity but an imperative for progress. As the sector continues its trajectory of change, those leveraging these innovations effectively have positioned themselves well for future success. The adoption of these technologies was crucial in overcoming historical challenges and inefficiencies, ensuring the industry could adapt to meet evolving demands effectively.