The dental insurance market is poised for significant transformation as it advances through a period of impressive growth and technological integration. A substantial increase in market value is in the pipeline, fueled by rising awareness about oral health and an escalating demand for preventive dental care on a global scale. This evolution is particularly pronounced with the integration of innovative technologies and strategic insurance products designed to enhance healthcare accessibility and improve patient outcomes. As the landscape of dental insurance shifts, its influence extends beyond economic growth to societal health and well-being.

Dental Insurance Frameworks

Diverse Plan Offerings

The dental insurance market is primarily structured around a variety of plan types, each offering unique benefits tailored to meet different consumer needs. Dental Health Maintenance Organizations (DHMO), Dental Preferred Provider Organizations (DPPO), and indemnity plans form the core framework of this industry. Among these, DPPOs have emerged as a favored choice for consumers due to their blend of cost-effectiveness and the autonomy they provide in dentist selection. This preference for DPPOs reflects a broader consumer trend toward flexible, economical healthcare solutions that do not compromise on quality.

The appeal of DPPOs extends to their ability to balance affordability with access, making dental care more approachable for diverse demographic segments. As consumers become savvier about their health insurance options, the demand for plans that offer a wider network of providers at competitive rates is increasing. This trend not only signifies a shift in consumer behavior but also challenges insurance providers to adapt their offerings accordingly, ensuring their services remain relevant and attractive in an increasingly competitive market.

Influence of Employment-Sponsored Programs

Employment-sponsored programs and public health initiatives are instrumental in driving the uptake of dental insurance. Such programs serve as a catalyst for growth, enabling broader access to dental care through employer-provided benefits and government subsidies. These initiatives are becoming increasingly sophisticated, leveraging digital health services to enhance the value proposition of dental insurance. As an extension of their health and wellness offerings, these programs contribute to a growing awareness of the significance of oral health, further supporting market expansion.

The integration of dental insurance within broader health benefit packages underscores the strategic importance of oral health in employee well-being programs. As businesses recognize the long-term benefits of maintaining employees’ dental health, including reduced absenteeism and enhanced productivity, the incorporation of such insurance options in benefit strategies is becoming more prevalent. This trend is complemented by public health campaigns emphasizing preventive care, which not only addresses immediate health concerns but also fosters a culture of proactive health management.

Regional Growth Dynamics

Emerging Markets: India and Brazil

In the global expansion of dental insurance, emerging markets like India and Brazil are at the forefront, offering vast opportunities for growth. As these countries witness burgeoning middle-class populations and increased urbanization, the demand for advanced dental services and insurance coverage intensifies. Healthcare services in these regions are evolving rapidly, responding to an informed population that is becoming increasingly aware of the critical role oral health plays in overall well-being. The growth in these markets is bolstered by strategic initiatives aimed at developing robust insurance infrastructures.

Insurance providers entering or expanding within these regions must focus on collaboration with local dental service providers to enhance service accessibility and quality. This partnership approach is essential for building comprehensive coverage networks that can cater to the diverse and growing needs of these populations. Furthermore, educational campaigns and targeted marketing strategies play a crucial role in raising awareness about the availability and benefits of dental insurance, ensuring these regions continue to see steady growth in adoption.

Focus on Infrastructure and Access

The development of efficient insurance infrastructures and improved access to quality dental services are pivotal in solidifying dental insurance’s presence in emerging markets. By effectively harnessing technology and aligning with local healthcare providers, insurers can create a more inclusive and accessible dental care system. This strategy not only supports market penetration but also elevates the standard of care available to consumers. Ensuring affordability and accessibility are key drivers in these markets, especially amid growing demand.

By building on public-private partnerships, insurers can extend their reach and offer a broader range of services tailored to local needs. As these collaborations develop, there is a consequent improvement in consumer trust and perception, which is critical for sustained growth. Moreover, these efforts contribute significantly to the broader goal of achieving comprehensive healthcare coverage across varied socioeconomic segments, ultimately improving public health outcomes and fostering economic stability.

Technological Influences

Artificial Intelligence Integration

Artificial Intelligence (AI) is revolutionizing the dental insurance landscape by introducing unprecedented efficiencies and accuracy in insurance processing. Its integration into the sector aids in automating routine tasks such as claim management and fraud detection, which significantly reduces operational costs and enhances overall service delivery. AI’s analytical capabilities enable insurers to identify patterns and trends that streamline processes and improve decision-making. This transformation positions AI not merely as a technological advancement but as a strategic enabler of growth in the dental insurance market.

AI’s impact extends into clinical settings, where it aids in diagnostics, enhancing the accuracy of procedures such as dental X-ray analysis for cavity detection and gum disease assessment. This technological proficiency not only optimizes the insurance process but also elevates patient care by facilitating early diagnosis and treatment. AI’s growing role in dentistry underscores an industry-wide shift towards integrating innovative technologies to enhance both consumer and provider experiences.

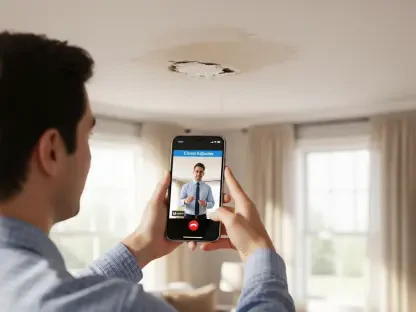

Teledentistry Adoption

Teledentistry is gaining ground as a transformative force within the dental industry, offering a cost-effective and convenient alternative to traditional in-office consultations. Through virtual consultations and digital health services, teledentistry minimizes the barriers associated with physical visits, particularly in underserved areas. Its adoption into insurance policies reflects a broader acceptance and recognition of its benefits, providing patients with greater flexibility in accessing dental care while reducing overhead healthcare costs.

The integration of teledentistry into dental insurance plans significantly extends the reach of dental services, enabling proactive patient engagement and facilitating preventive care. By offering a viable platform for follow-up appointments and consultations, teledentistry enhances patient satisfaction and adherence to treatment regimens. As technology continues to evolve, its role in reshaping the way dental care is delivered and perceived is expected to grow, leading to more comprehensive and interconnected healthcare solutions.

Preventive Care Focus

Prevention as a Coverage Strategy

The dental insurance industry is increasingly emphasizing preventive care as a fundamental component of coverage strategies. This shift reflects a broader recognition of the economic and health benefits associated with routine dental check-ups and screenings, which help mitigate the risk of more severe health issues in the future. Insurers are strategically incorporating preventive care services into their plans, encouraging early intervention and promoting overall health and wellness.

By educating consumers on the importance of preventive measures, insurers are fostering a proactive approach to dental health. This strategy not only reduces long-term costs for both providers and consumers but also aligns with broader trends toward holistic health management. As awareness of the systemic connections between oral and physical health grows, preventive care within dental insurance frameworks is poised to play an increasingly vital role in enhancing patient outcomes and reducing healthcare expenditures.

Preventive Care and Overall Health

Dental insurance policies are evolving to align with an increasing understanding of how oral health impacts overall systemic health. Conditions such as gum disease have been linked to more serious health issues like heart disease and diabetes, highlighting the importance of maintaining oral health as part of comprehensive health care. Consequently, preventive strategies are being prioritized within insurance frameworks, not only to improve individual health outcomes but also to contribute to broader public health objectives.

The focus on preventive care represents a shift towards more responsible and informed healthcare consumption, with individuals encouraged to manage their health proactively. This aligns with modern health paradigms that emphasize prevention over treatment. Insurers that effectively communicate and implement these strategies will likely see enhanced customer loyalty and engagement, as consumers become more aware of the benefits preventive care offers for long-term health and financial savings.

Market Consolidation and Dynamics

Consolidation Trends

The dental insurance industry is experiencing significant consolidation as major firms acquire smaller entities and Dental Service Organizations (DSOs) to strengthen their market positions. These mergers and acquisitions are strategic moves that enable companies to capitalize on economies of scale, diversify service offerings, and drive innovation by pooling resources and technological capabilities. Market consolidation is reshaping the competitive landscape, fostering a more robust and interconnected insurance industry.

These consolidation trends reflect a broader industry movement toward creating more comprehensive and adaptable service networks. As companies harness synergies from acquisitions, they can enhance their service delivery and customer satisfaction while gaining competitive advantages. This trend also encourages operational efficiencies that improve profitability and support continued investment in innovation and expansion, ensuring sustained industry growth.

Strategy Behind Mergers

Strategic mergers in the dental insurance sector, such as Sun Life Financial’s acquisition of DentaQuest, exemplify how companies are enhancing their specialization and expanding their service reach. These moves are typically aimed at augmenting capabilities, accessing new markets, and offering more tailored insurance products. The focus is on leveraging the strengths of each entity to deliver superior value to customers, thereby fostering loyalty and promoting market growth.

Through mergers, companies can access advanced technologies, expertise, and networks that would otherwise take years to develop independently. This strategic expansion allows insurers to respond more effectively to market demands, delivering innovative solutions that meet evolving consumer expectations. As the industry continues to develop, mergers and acquisitions will remain vital components of corporate strategy, enabling firms to maintain competitiveness and adapt to the rapidly changing healthcare landscape.

Dominant Market Segments

DPPOs Leading the Charge

In the realm of dental insurance, Dental Preferred Provider Organizations (DPPOs) have established themselves as dominant market players due to their cost-effective nature and consumer-centric approach. DPPOs offer a wider range of dentist choices and competitive pricing, catering to the evolving demands of modern consumers who value both affordability and flexibility. This segment’s prominence reflects a distinct consumer preference for insurance plans that combine economic viability with the ability to choose healthcare providers freely.

The rise of DPPOs is indicative of broader consumer trends towards personalized and accessible healthcare options. By offering networks with a more extensive range of provider choices, DPPOs appeal to a diverse clientele seeking comprehensive coverage without the restrictions typically associated with other plan types. Insurers focusing on this segment are well-positioned to capture a significant share of the market, driving further growth and innovation within the industry.

Procedural Segmentation

Preventive services command a substantial market share within the dental insurance industry, as the sector shifts towards early detection and intervention strategies. This procedural segmentation emphasizes the role of regular dental check-ups, cleanings, and screenings in maintaining oral health, aligning with the broader trend toward preventive medicine. The commitment to preventive care not only reduces the long-term costs associated with dental treatments but also fosters a culture of health consciousness among consumers.

By prioritizing preventive services, dental insurance providers are adapting their products to meet the increasing demand for proactive health management. This strategic focus not only benefits individual health outcomes but also contributes to broader healthcare cost containment efforts. As awareness of preventive dentistry expands, insurance providers offering comprehensive preventive coverage are likely to experience increased consumer loyalty and engagement, solidifying their market positions.

APAC as a Growth Epicenter

Factors Driving APAC Forward

The Asia-Pacific (APAC) region is emerging as a growth epicenter for dental insurance, driven by factors such as increased oral care awareness and rising healthcare investments. The region’s maturing middle class, coupled with changes in dietary habits, contributes to an escalating demand for dental services and insurance coverage. These dynamics present significant opportunities for insurers to capture new markets and expand their influence across diverse populations.

In the APAC region, investment in healthcare infrastructure and education plays a crucial role in promoting dental insurance adoption. As consumers become more health-conscious and financially empowered, they seek insurance products that offer comprehensive and reliable coverage. Insurers tapping into this burgeoning market must tailor their offerings to align with local needs and preferences, fostering growth through innovation and adaptability.

China’s Market Influence

China, as a pivotal player in the APAC dental insurance market, commands a significant portion of the region’s growth. Favorable demographic shifts, urbanization, and government-backed healthcare initiatives contribute to strengthening China’s insurance market position. These factors, combined with efforts to enhance service accessibility and affordability, drive the expansion of dental insurance in the country, creating a robust and dynamic market environment.

China’s insurance market is characterized by a strong focus on improving healthcare delivery and increasing public access to dental services. Through strategic policy initiatives and investments, the Chinese government is supporting the development of a comprehensive health insurance framework that addresses the needs of its vast population. This commitment to improving healthcare outcomes positions China as a leader in the APAC region, influencing market trends and setting new standards for dental insurance services.

Competitive Edge and Key Players

Key Industry Players

The competitive landscape of the dental insurance market is shaped by leading companies like Aflac Inc., Allianz SE, and Ameritas Life Insurance Corp., known for their strategic positioning and innovative approaches. These key players leverage partnerships, new product launches, and geographical expansions to strengthen their market presence, ensuring they remain at the forefront of industry developments. Their efforts exemplify the dynamic nature of the market and the need for continuous adaptation to consumer demands and technological advancements.

These companies’ strategies are focused on enhancing customer engagement and service delivery through technological integration and product customization. By offering tailored solutions and embracing digital platforms, they cater to diverse consumer segments, thereby boosting their competitive edge. As the dental insurance industry continues to evolve, these key players are well-positioned to drive innovation, expand their influence, and sustain growth through strategic initiatives and market insights.

Innovation and Technology

Innovation and technology are critical drivers in maintaining a competitive advantage within the dental insurance industry. Companies are increasingly focusing on digital solutions, such as online enrollment processes and efficient claim handling systems, to enhance customer experiences and streamline operations. This technological integration not only improves service delivery but also aligns with consumer expectations for convenience and accessibility in managing their insurance needs.

By embracing modern technological advancements, dental insurers can offer more personalized and responsive services, meeting the ever-changing demands of the market. This commitment to innovation positions them as leaders in the industry, capable of adapting to trends and anticipating future challenges. As digital technology continues to reshape healthcare delivery, companies that prioritize technological integration will likely remain at the forefront of the dental insurance market, setting benchmarks for quality and service.

Future Considerations and Market Outlook

The dental insurance market stands on the brink of a major transformation, characterized by robust growth and technological integration. The sector is set to experience a notable rise in market value, spurred by increasing awareness of the importance of oral health and a growing global demand for preventive dental care. This ongoing evolution is further amplified by the integration of cutting-edge technologies and the introduction of strategic insurance products that aim to enhance healthcare accessibility and improve patient outcomes.

As the dental insurance landscape transforms, its impact is not limited to economic aspects alone but also extends to societal health and overall well-being. The role of dental insurance in promoting regular check-ups and preventive care cannot be understated, as it plays a crucial part in the early detection and treatment of dental issues, which can, in turn, prevent more serious health problems.

Technological advances, such as digital tools and platforms, are revolutionizing the way dental services are delivered and managed, making it easier for individuals to access and afford quality dental care. These innovations also assist in streamlining administrative processes, reducing costs, and improving the patient experience. As dental insurance continues to evolve, it is positioned to make a significant impact on public health, enhancing not just individual smiles but also the well-being of entire communities.