The insurance industry is grappling with surging claims costs and increased regulatory scrutiny, presenting significant challenges yet opening pathways for innovation and improvement. As insurers strive to manage these escalating costs, driven by external inflationary pressures and rising repair and replacement expenses, they are compelled to revisit their operational strategies. At the same time, evolving regulatory frameworks demand that insurers prioritize transparency and consumer satisfaction, reshaping the landscape for claims management.

Understanding the Current State of the Insurance Industry

The insurance sector today is marked by complexity and rapid change, influenced significantly by technological advancements and shifting consumer expectations. These developments have redefined the boundaries and scope of traditional insurance offerings. Market leaders include both long-established firms and emerging insurtech companies, who must navigate evolving regulations that strive to enhance consumer protection and industry accountability. This pivotal moment in the industry highlights a growing need for insurers to balance maintaining profitability with adhering to regulatory standards and delivering high-quality customer experiences.

Identifying Trends and Opportunities in Claims Management

Industry Trends and Technological Advancements

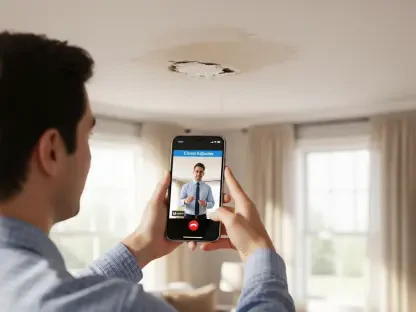

Recent years have witnessed transformative trends within the insurance sector, primarily driven by technological innovation. Digitalization, automation, and AI have revolutionized claims processing, offering opportunities for operational efficiency and improved customer interactions. Moreover, insurers are adapting to evolving consumer behaviors influenced by technology, seeking to meet demands for faster and more transparent services. These trends serve as impetus for insurers to explore fresh avenues, leveraging technology to effectively manage claims and address market drivers head-on.

Market Insights and Future Projections

In examining the market data and performance indicators, the insurance industry reveals promising growth projections, supported by technological adaptation and consumer-focused strategies. The trajectory of claims management is anticipated to benefit from further integration of innovative technologies, improving both efficiency and consumer satisfaction. Forecasts indicate that these shifts will not only support cost containment but also enhance competitive positioning for insurers who embrace change.

Navigating Industry Challenges and Solutions

The insurance industry faces multifaceted challenges that intertwine technological advancements with regulatory demands and fluctuating market forces. The mounting pressure of external inflation and increased claims costs requires insurers to rethink their cost management strategies. Automation and AI offer compelling solutions, streamlining operations and reducing costs. Additionally, strategic alliances and collaborations across industry stakeholders can bolster resilience. By addressing these challenges proactively, insurers can secure a more sustainable future and build trust with consumers.

The Impact of Regulatory Changes and Compliance

The regulatory landscape for insurers is evolving, placing emphasis on consumer protection and transparent operations. Compliance with emerging laws and standards is non-negotiable, necessitating robust security measures and practices that prioritize customer trust. The impact of regulatory changes is profound, compelling insurers to adopt practices that not only meet regulatory expectations but also enhance consumer confidence and industry credibility. These measures are crucial for maintaining competitive strength while fostering a relationship of mutual trust with policyholders.

The Future of Claims Handling and Industry Growth

Emerging technologies and market disruptors promise to shape the future landscape of claims handling. The integration of AI, machine learning, and digital platforms will likely lead to unprecedented industry growth, providing platforms for faster, more efficient claims processing. Factors such as technological innovation, regulatory evolution, and the economic environment will significantly influence the trajectory of industry advancements. Insurers poised to harness these changes stand to gain substantial competitive advantage.

Conclusion and Recommendations for Insurers

In light of the industry’s current challenges and opportunities, insurers must take decisive steps toward integrating innovative technologies and regulatory alignment to remain competitive. They should seek to enhance operational efficiencies, improve consumer experiences, and maintain strict compliance with evolving regulations. Future considerations include fostering industry collaborations and investing in emerging technologies to preempt market disruptions. By embracing these strategies, insurers can effectively navigate the complex landscape, positioning themselves for sustained growth and resilience in an ever-evolving market environment.