As climate change accelerates the frequency and severity of natural disasters, the insurance industry faces an unprecedented challenge in safeguarding property and financial stability against escalating risks. Wildfires are creeping closer to urban centers, hailstorms are inflicting damages worth billions annually, and water-related destruction is becoming more common and intense. Despite these alarming trends, a significant portion of industry leaders acknowledge that the sector is falling behind in its response to such climate-driven perils. Recent insights from a comprehensive survey of over 220 property and casualty executives reveal a troubling consensus: adaptation efforts are not keeping pace with the growing threats. This gap between the increasing impact of climate volatility and the industry’s preparedness raises critical questions about how insurers can protect policyholders and maintain financial resilience in an era of compounding losses. The urgency to modernize approaches and embrace innovative solutions has never been more apparent.

Growing Climate Threats and Industry Shortfalls

The intensifying effects of climate change are reshaping the risk landscape for insurers, with natural disasters becoming more frequent and costly in ways that traditional models struggle to predict. Urban wildfires now threaten densely populated areas, while severe hailstorms have emerged as consistent billion-dollar events, alongside rising incidents of water damage from storms and flooding. These evolving perils demand a proactive stance, yet a striking 61% of surveyed executives admit that the insurance sector as a whole is not adapting quickly enough. This acknowledgment points to systemic challenges in addressing the scale of climate volatility. While many leaders express confidence in their individual companies’ progress—64% believe their firms are ahead of the curve—this optimism does not translate to industry-wide readiness. The disconnect highlights a broader issue: fragmented efforts are insufficient against threats that require collective innovation and urgency to mitigate escalating financial and societal impacts.

Beyond the recognition of lagging adaptation, the sheer scale of climate-driven losses underscores the need for a fundamental shift in how risks are assessed and managed within the insurance sector. The increasing unpredictability of events like severe convective storms and non-weather-related water damage exposes vulnerabilities in current frameworks, leaving insurers exposed to significant financial strain. Many companies still operate under the assumption that historical patterns can guide future outcomes, a mindset ill-suited to today’s dynamic environment. The survey findings emphasize that without a unified push toward modernized strategies, the industry risks falling further behind as climate impacts compound over time. This is not merely a matter of adjusting policies but of rethinking foundational approaches to ensure that coverage remains viable for policyholders facing heightened threats. The gap between isolated company advancements and sector-wide stagnation remains a critical barrier to achieving resilience.

Technology’s Potential and Adoption Gaps

Artificial intelligence (AI) holds transformative promise for the insurance industry in tackling climate-related risks, yet its integration remains uneven despite widespread recognition of its benefits. A substantial 68% of executives surveyed agree that advanced AI models are effective in managing losses tied to climate events, with nearly three-quarters viewing it as a tool for unlocking new revenue streams and refining underwriting practices. The potential for AI to provide property-specific insights and improve risk prediction is undeniable, offering a path to more accurate pricing and better protection for policyholders. However, only 40% of carriers have embedded AI into their core operations, and a mere 25% rely on it as a primary method for addressing specific hazards. This slow uptake reveals a hesitation to fully leverage technology, even as threats like wildfires and severe storms grow in complexity, leaving many insurers unprepared for the scale of modern challenges.

Compounding the issue of limited AI adoption is the persistent reliance on outdated tools that fail to capture the nuances of today’s risk environment. Legacy actuarial and stochastic models, designed for a more predictable past, are still favored by many, with 41% of leaders considering them the most accurate for risk prediction compared to just 20% who prioritize AI. This attachment to traditional methods overlooks the reality of compounded loss patterns and property-specific vulnerabilities that characterize current climate threats. Alarmingly, significant portions of insurers lack risk models entirely for certain perils—15% for non-weather water damage and 12% for wildfires. Such gaps in capability hinder the industry’s ability to respond effectively to emerging dangers. Bridging this technological divide requires not just investment in AI but a cultural shift toward embracing innovation as a cornerstone of risk management, ensuring that tools align with the unpredictable nature of climate-driven disasters.

Modernization as a Path Forward

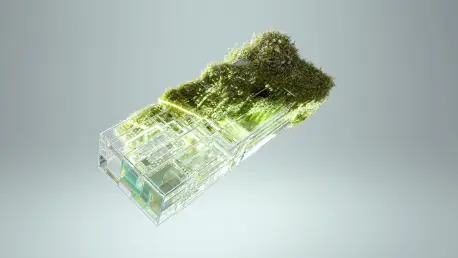

The urgent need for modernization in the insurance sector is clear, as clinging to outdated risk modeling leaves companies vulnerable to the escalating financial toll of climate events. Experts argue that legacy systems are no longer equipped to handle the intricate, property-level risks posed by urban wildfires or catastrophic hailstorms, which demand precise and adaptive solutions. AI-driven models offer a way forward by not only predicting risks with greater accuracy but also illustrating how mitigation strategies can alter outcomes, fostering transparency for insurers, regulators, and policyholders alike. The call for change is framed as a critical choice: continue with approaches rooted in past stability or adopt innovative tools that enable detailed understanding and protection of individual properties. Without this shift, the industry risks further destabilization as billion-dollar events become the norm, straining both financial reserves and public trust in coverage reliability.

Looking back, the insurance industry’s response to climate risks was marked by a growing awareness of the need for transformation, even as adoption of modern tools lagged behind the pace of environmental change. The reliance on legacy systems and the slow integration of AI reflected a cautious approach that often prioritized familiarity over innovation. Yet, the insights from industry leaders pointed to a clear direction for the future. Moving forward, insurers were urged to prioritize the integration of AI into core functions like underwriting, pricing, and claims processing to build stability against climate-driven losses. Emphasizing property-level precision in peril modeling emerged as a vital step, alongside broader collaboration to align individual company efforts with collective progress. By investing in technology and rethinking risk frameworks, the sector could better shield policyholders from the financial impacts of natural disasters, ensuring a more resilient path in an increasingly volatile world.