In the highly competitive and rapidly evolving European insurance landscape, strategic leadership appointments are becoming a critical tool for companies aiming to secure a competitive edge and respond to emerging market demands. As industries grapple with new risks, from climate-related catastrophes to dynamic shifts in global trade, insurers are proactively reinforcing their teams with specialized talent to navigate these complexities. Recently, two prominent firms have made significant moves, appointing seasoned professionals to spearhead expansion and innovation, signaling a clear intent to deepen their market penetration and enhance their product offerings across key European territories. These strategic placements are not merely personnel changes but are indicative of a broader industry trend toward investing in deep regional expertise and forward-thinking product development to meet the sophisticated needs of clients in an uncertain world. The focus is squarely on leveraging expert knowledge to build stronger relationships and deliver more tailored, resilient solutions.

Descartes Underwriting Fortifies Central European Presence

Expanding Leadership to Capitalize on Market Demand

Descartes Underwriting, a specialist in parametric reinsurance solutions, is strategically intensifying its focus on Central Europe by restructuring its regional leadership to foster accelerated growth. The company has announced an expansion of responsibilities for Juan Maria Marqués Domenech, who will now oversee Central Europe in addition to his current role as commercial director for Iberia. This decision is designed to create a more unified and potent commercial strategy across these vital markets, leveraging Domenech’s proven track record to build momentum. The move reflects a deliberate effort to strengthen the company’s engagement with both clients and brokers throughout the region. By consolidating leadership, Descartes aims to streamline its operations and enhance its service delivery, ensuring a consistent and high-quality approach to developing and deploying its innovative parametric insurance products. This expansion is a direct response to the increasing demand for sophisticated risk management solutions that can effectively address the growing frequency and severity of climate-related events impacting businesses across the continent.

Bolstering Local Expertise for Targeted Growth

To support this ambitious regional expansion, Descartes has appointed Felix Dalheimer as the new business developer dedicated to the German and Austrian markets, a move that injects deep local expertise into the team. Dalheimer brings a wealth of relevant experience, having previously served as an underwriter for German risks at Chubb and held a technical position in catastrophe analysis at R+V Re. His profound understanding of natural catastrophe risks and their financial implications is a significant asset that aligns perfectly with Descartes’ core business of providing data-driven, parametric solutions for climate-related perils. His appointment is expected to be instrumental in cultivating stronger relationships with local partners and clients, providing them with the nuanced support and technical insight required to navigate complex risk landscapes. This hiring underscores the company’s commitment to not only expanding its geographical footprint but also embedding specialized, market-specific knowledge within its teams to drive meaningful and sustainable growth in Central Europe’s sophisticated insurance sector.

West of England P&I Navigates Industry Shifts with New Product Head

A Strategic Appointment for Product Innovation

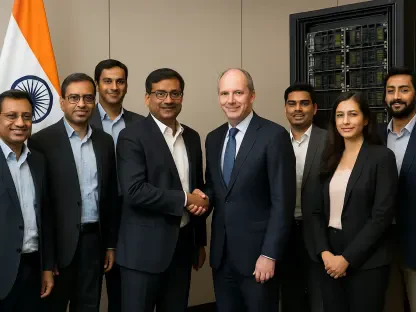

In a parallel move focused on adapting to the evolving needs of the global shipping sector, West of England P&I has appointed Alexis Wildman as its new head of products. This key leadership change is a central component of the club’s overarching strategy to innovate and refine its product offerings, ensuring they remain relevant and effective in a maritime industry undergoing significant transformation. Reporting directly to the recently appointed Chief Underwriting Officer Bart Mertens, Wildman’s role is pivotal in shaping the future of the club’s diverse product portfolio. She succeeds Richard Turner, who is retiring, and is tasked with managing existing products while spearheading the development of new solutions. A significant part of her mandate will involve close collaboration with the club’s managing general agent partners, including the recently acquired Nordic Marine Insurance, to create synergistic and comprehensive coverage options for a global client base. This appointment signals a proactive approach to product management, positioning the firm to better anticipate and meet the changing risk profiles of shipowners.

Leveraging Decades of Marine Insurance Acumen

Alexis Wildman brings over two decades of extensive experience in the marine insurance industry to her new position, equipping her with the deep expertise necessary to lead West of England P&I’s product strategy. Her distinguished career includes senior roles at major firms such as Ki Insurance, RSA, and Codan, where she honed a strong background in underwriting, sophisticated portfolio management, and dedicated product leadership. This comprehensive skill set makes her uniquely qualified to oversee the club’s portfolio and drive innovation that aligns with the dynamic demands of the maritime sector. Her appointment is another crucial step in the firm’s ongoing leadership refresh, which aims to infuse the organization with fresh perspectives and specialized knowledge. By leveraging Wildman’s considerable acumen, the club is better positioned to enhance its value proposition, strengthen its market position, and continue delivering the high-caliber service and tailored insurance solutions that its members have come to expect in a complex and ever-changing operational environment.

A Forward-Looking Strategy for a Dynamic Market

The strategic leadership appointments at both Descartes Underwriting and West of England P&I underscored a definitive industry trend toward fortifying specialized expertise to navigate an increasingly complex risk environment. By placing seasoned professionals in critical roles, these firms demonstrated a clear commitment to proactive adaptation and targeted growth. Descartes Underwriting’s move to strengthen its Central European team with individuals deeply versed in regional catastrophe risk was a direct response to the escalating demand for advanced climate-related insurance solutions. Similarly, West of England P&I’s decision to bring in a new head of products with extensive marine insurance experience highlighted the necessity of continuous innovation within the maritime sector. These calculated decisions were not isolated personnel changes but were integral parts of broader corporate strategies aimed at enhancing client relationships, refining product portfolios, and securing a stronger competitive footing in their respective markets. Ultimately, these actions have positioned both organizations to better anticipate future challenges and capitalize on emerging opportunities.