In the world of agriculture, where success is measured by seasons and harvests, a hidden financial threat is growing. Underinsurance is leaving many farmers dangerously exposed, turning manageable losses into potential catastrophes. We sat down with Simon Glairy, a leading expert in agricultural insurance and risk management, to explore the depth of this issue. Our conversation uncovered the real-world impact of claim shortfalls, the relentless pressure of construction inflation, the unique challenges posed by historic farm buildings, and the often-overlooked risks that come with modern farm diversification.

With one in 10 farm claims being significantly underinsured and payments cut by nearly 45%, can you share an anecdote of how this plays out? Please walk us through the financial and operational impact on a typical farm when a claim payout falls short by over £11,000.

Absolutely. It’s a scenario we see far too often, and it’s heartbreaking. Imagine a family farm that loses a critical livestock shed to a severe storm. They’ve paid their premiums for years, assuming they’re fully covered. The initial relief of having insurance is shattered when the assessor discovers the rebuild cost is much higher than their policy’s sum insured. Because they were underinsured by nearly 40%, the “average clause” kicks in, and their payout is slashed by around 45%. Suddenly, that check is over £11,000 short of what’s needed. This isn’t just an inconvenience; it’s a crisis. It means diverting funds meant for new machinery or next season’s seed, taking on unexpected debt, or leaving a structure partially rebuilt, exposed to the elements. The stress is immense, and it’s a devastating financial blow at the worst possible time.

Construction costs are forecast to rise another 15% in five years, compounding the underinsurance problem. How does this ongoing inflation affect a farm’s valuation year-to-year, and what practical, step-by-step measures can farmers take annually to ensure their coverage keeps pace with rising rebuild costs?

This is the silent creep that catches so many off guard. A valuation that was accurate just two years ago, when construction inflation was peaking at over 10%, is now dangerously obsolete. That 15% forecast over the next five years means that if you simply renew your policy without adjusting the numbers, your coverage gap widens every single day. The most critical step for any farmer is to treat their insurance review as an essential annual business task, not just an administrative one. First, don’t just accept the auto-renewal. Sit down with your broker and actively discuss your sums insured. Second, get an updated valuation, especially if you’ve made any improvements or if it’s been more than three years since your last one. Finally, ask your insurer about index-linking, which automatically adjusts your coverage to account for inflation, providing a crucial buffer against these rising costs.

Rural properties with non-standard materials, like stone barns or heritage farmhouses, face higher risks. What specific challenges do these unique structures present for accurate cost assessments, and can you provide some metrics on how much more expensive they are to rebuild compared to standard commercial buildings?

This is where standard commercial risk assessments completely fall apart. You can’t value a 200-year-old stone barn the same way you value a modern steel-framed shed. The challenges are immense. First, sourcing traditional materials like reclaimed stone or slate is incredibly expensive and time-consuming. Second, you need specialist labor—stonemasons or craftspeople who understand heritage construction methods—and their skills come at a premium, with labor costs projected to climb 18% by 2030. These factors dramatically increase the rebuild period, adding further to the overall cost. While every property is unique, it’s not uncommon for these heritage-style buildings to cost significantly more to rebuild than a standard commercial structure of the same size, a fact that is often missed in basic assessments, leading to massive underinsurance.

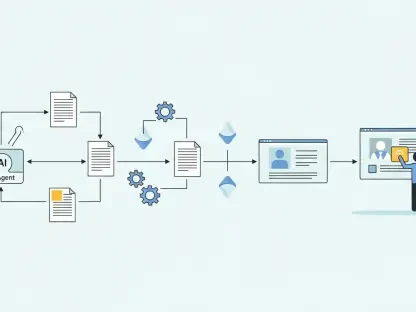

As farmers diversify into areas like renewable energy or hospitality, they often introduce new coverage gaps. What are the most common insurance blind spots you encounter with these ventures, and what is the process for ensuring a new enterprise is correctly added to a policy from day one?

Diversification is fantastic for business, but it’s a minefield for insurance if not handled correctly. The most common blind spot is simply forgetting to tell the insurer. A standard farm policy will not cover a wedding venue, a café, or a solar panel array unless they are specifically added. We see farmers install renewable energy systems without realizing they need separate coverage for equipment breakdown and liability. Or they might start hosting events without adequate public liability insurance, exposing their entire operation to a single mishap. The process must start the moment you decide to launch a new venture. Call your broker immediately. You’ll need to conduct a new risk assessment for that specific enterprise, considering things like public access, new equipment, and potential business interruption. It requires specialist underwriting to ensure the new venture is properly integrated into your main policy, not just tacked on as an afterthought.

Do you have any advice for our readers?

My single most important piece of advice is to view your insurance policy not as a static document but as a living part of your business strategy. Your farm is constantly evolving—buildings age, costs rise, and new ventures begin. Your insurance must evolve with it. Don’t wait for a claim to find out you’re undervalued. Be proactive. Schedule a thorough review with an agricultural insurance specialist every year, ask the tough questions about inflation and rebuild costs, and never, ever assume you’re covered. A little time spent on due diligence now can save you from financial ruin later. It’s happening now, on real farms, and it’s costing farmers serious money. Don’t let yours be one of them.