As the familiar rhythm of the seasons gives way to longer, more intense periods of extreme heat, the risk of catastrophic fire is no longer a distant threat for a few but an encroaching reality for millions. Major insurers across the nation are now sounding a clear and urgent alarm, compelling homeowners to confront a difficult question: is the financial protection you bought years ago sufficient for the fundamentally different risks you face today? The convergence of shifting climate patterns and the steady expansion of communities into natural landscapes has created a new era of vulnerability. This evolving danger demands a critical reevaluation of personal preparedness and a deeper understanding of the insurance policies that are supposed to serve as a final line of defense against financial ruin. It is a challenge that requires moving beyond old assumptions and acknowledging that what was once considered adequate may now be dangerously insufficient.

The Complacency Crisis: A Dangerous Gap in Preparedness

A profound disconnect between the escalating fire danger and public readiness has become a critical point of concern, with recent research exposing a startling lack of preparation. A December 2025 consumer survey revealed that a staggering 41.3% of residents had taken no steps to prepare their properties for potential fire threats. This inaction is often rooted in a misplaced confidence, a common assumption that a fire is something that happens elsewhere, to other people. This widespread complacency creates a significant vulnerability, as a failure to take physical precautions is often a direct reflection of a more perilous financial unpreparedness. The belief that one’s home is not at risk or that there would be no time to act anyway fosters a passive approach that leaves households dangerously exposed. This mindset transforms a manageable risk into a potential catastrophe, not just for one family, but for entire communities where preparedness is a shared responsibility.

This prevailing sense of security dangerously extends to financial planning, particularly when it comes to insurance coverage. Many homeowners operate under the mistaken belief that simply having a policy guarantees complete protection in a worst-case scenario. However, the reality is that a standard insurance plan is not a universal shield against all potential losses. Treating an insurance policy as a one-time purchase without conducting periodic reviews is a significant financial gamble that could have devastating consequences. In the aftermath of a fire, families can discover that their coverage is woefully inadequate, leaving them with a massive financial gap between what the policy pays and the actual cost of rebuilding their lives. This assumption of complete coverage, without a thorough understanding of the policy’s terms, represents a critical failure in risk management that can compound the emotional trauma of a disaster with a long-term financial crisis.

Understanding Your Policy’s Fine Print Before It’s Too Late

A standard home insurance policy is a complex document, often containing specific limitations and exclusions that are easy to overlook until it is too late. For example, a significant portion of fire-related destruction is caused not by the main fire front, but by wind-borne embers that can travel for miles and ignite properties far from the initial blaze. Some insurance policies may contain clauses that limit or entirely exclude coverage for damage caused by these embers, a detail buried in the fine print that could invalidate a claim. To safeguard against such devastating surprises, homeowners are strongly urged to conduct a detailed review of their policy documents. It is crucial to identify these potential gaps and consider upgrading to a more comprehensive plan, such as one that includes “total replacement coverage,” which is designed to cover the full cost of rebuilding a home to its previous standard, even if that cost exceeds the policy’s face value.

Timing is another critical and often misunderstood factor in securing adequate protection against natural disasters. Insurance companies commonly implement “embargoes” when a major event, such as a large-scale bushfire, is imminent or already in progress. This standard industry practice prevents individuals from purchasing last-minute coverage once the risk has become a certainty. The harsh reality is that if you wait until a fire is threatening your region, you will almost certainly be too late to secure a new policy or increase your existing coverage. This underscores the importance of proactive, rather than reactive, financial planning. While household budgets are under constant pressure, the potential cost of being uninsured or underinsured in the face of a total loss is orders of magnitude greater than the annual premium. Viewing insurance not as a mere expense but as a vital investment in financial resilience is a fundamental shift in perspective that is now essential.

A New Reality: How Climate Change Is Redrawing the Risk Map

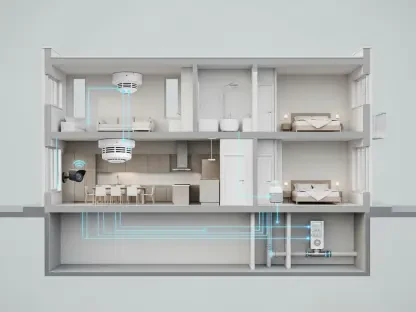

The warnings from insurers are not based on seasonal fluctuations alone but on a clear, data-driven trend of increasing and intensifying risk. Detailed meteorological and climatological analysis provides a stark context for the heightened threat levels. Forecasters point to an immediate danger in many southern states, where intense heatwaves combined with dry, gusty winds create “optimal bushfire conditions.” These conditions enable fires to spread with astonishing speed and unpredictability, making them incredibly difficult to contain. Modern fires can easily jump over natural and man-made firebreaks, such as rivers and multi-lane highways, propelled by powerful winds. This volatility means that communities once considered safe due to their distance from a fire’s direct path are now highly vulnerable to rapidly spreading flames and the ever-present danger of wind-borne embers, fundamentally changing the calculus of risk for millions.

Beyond the immediate forecasts, a larger, systemic shift is underway, permanently altering the landscape of fire risk. Comprehensive reports on severe weather patterns establish a long-term trend toward more frequent and intense bushfires, directly linking this change to hotter, drier conditions and altered rainfall patterns. This changing climate is creating environments that are more conducive to fire ignition and spread. Crucially, this evolving threat is also expanding geographically. The risk is no longer confined to remote or rural areas. The continued growth of the “bushland-urban interface,” where residential developments are built adjacent to or within natural bushland, has placed millions of people in metropolitan areas at significant risk. This demographic and developmental shift makes urban and suburban preparedness just as critical as preparation in traditionally high-risk rural zones, erasing the old boundaries of fire danger.

Building Your Financial Defense: A Two-Part Strategy

In response to this elevated and expanding risk profile, experts across the insurance industry advocate for a comprehensive, two-pronged strategy to build genuine resilience. The first part of this strategy involves tangible, physical actions to prepare homes and properties for a potential fire event. This is about creating a defensible space that can increase a structure’s chances of survival. Homeowners are advised to develop and regularly rehearse a detailed bushfire survival plan with all family members and to assemble a fully stocked emergency kit. Essential property maintenance includes routinely clearing leaf litter and debris from roofs and gutters, mowing and removing long, dry grass, and relocating flammable materials like woodpiles and propane tanks well away from any structures. Furthermore, ensuring that the property has clear, unobstructed access for emergency vehicles can be a critical factor for firefighters attempting to save a home.

The second, equally vital, component of this strategy is to ensure financial resilience through adequate and up-to-date insurance coverage. A common and costly mistake is for homeowners to have a “sum insured” amount that is based on the property’s original purchase price or an outdated valuation from many years ago. This amount is often tragically insufficient to cover the cost of rebuilding and replacing contents at today’s prices for labor and materials. This oversight is a primary cause of underinsurance. To combat this, homeowners are strongly urged to review their insurance settings against current replacement costs. Insurers recommend using online building and contents calculators, which are sophisticated tools designed to provide a more accurate and realistic assessment of the required coverage level for homes, personal belongings, and vehicles, ensuring that a recovery is financially possible.

A Unified Call for Societal Resilience

The combined messaging from across the insurance industry established a powerful and cohesive narrative about the urgent need for public action. The analysis identified three core areas of concern: the deep-seated problem of underinsurance fueled by public complacency; the scientifically observed increase in fire risk driven by climate change; and the critical need to align physical risk reduction with robust financial planning. Major events, such as the January 2025 Los Angeles wildfires, served as a stark case study, demonstrating how such disasters could dramatically increase public awareness and highlight the absolute necessity of collaborative mitigation measures. Ultimately, addressing this complex and evolving landscape required a coordinated and ongoing effort between governments, insurers, and communities to build a more resilient society capable of withstanding the challenges of a new environmental reality.