In the fast-evolving world of insurance, Managing General Agents (MGAs) are emerging as unexpected powerhouses, reshaping how risk is underwritten and distributed in 2025. Picture a landscape where traditional insurers struggle to keep pace with niche markets and complex risks like cyber threats or climate impacts, while MGAs, with their agility and specialized expertise, are stepping into this gap, forging alliances with capacity providers and brokers that promise to redefine the industry by 2026. This surge in momentum isn’t just a trend—it’s a seismic shift, fueled by trust and innovation, that’s capturing the attention of stakeholders across the board. What’s driving this change, and how are these partnerships setting the stage for a transformative future?

Why MGAs Are Leading Insurance Innovation

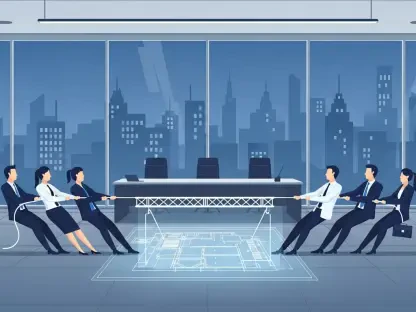

At the heart of today’s insurance revolution, MGAs stand out as catalysts for change, bridging the divide between traditional models and modern demands. Their rise isn’t accidental; it stems from an ability to craft tailored products for underserved markets, often faster than larger carriers can pivot. Capacity providers are taking notice, pouring resources into these nimble partners to tap into segments that were once out of reach, from specialized liability to emerging tech risks.

This momentum is underpinned by a growing recognition of MGAs as more than just intermediaries. They’re seen as innovators who can navigate regulatory mazes and market shifts with precision, delivering results where others falter. Industry gatherings in 2025 are buzzing with discussions about how these agents are not just adapting to change but actively shaping it, setting a bold trajectory for the year ahead.

The Changing Insurance Ecosystem and MGAs’ Critical Role

Market dynamics in 2025 reveal why MGAs have become indispensable to the insurance ecosystem. With inflation pressuring margins and new risks like digital breaches or environmental disasters mounting, traditional insurers often lack the flexibility to respond swiftly. MGAs, however, excel in this environment, leveraging deep underwriting knowledge to address gaps that broader carriers can’t easily cover.

Regulatory changes add another layer of complexity, pushing the industry toward stricter compliance and transparency. Here, MGAs act as vital allies, offering localized expertise and streamlined processes that help capacity providers meet evolving standards. Their role as problem-solvers in a fragmented market underscores why partnerships with these agents are now a strategic necessity for staying competitive.

Core Factors Fueling MGA Growth into 2026

Several key drivers are propelling MGAs toward unprecedented growth as 2026 approaches. Data from recent industry reports, such as a 2025 survey by Clyde & Co, reveals that 57% of capacity providers plan to increase their allocations to MGAs between 2025 and 2026, signaling robust confidence in their potential. This financial backing is a cornerstone of their ability to scale and innovate.

Beyond funding, MGAs bring unique strengths to the table, including rapid product development and access to niche markets that traditional models overlook. Their close ties with brokers further amplify this impact, creating distribution networks that are both efficient and trusted. Observations from events like the Capacity Exchange in 2025 highlight how these elements—capital, expertise, and relationships—form a powerful trifecta for sustained success.

A final factor lies in their adaptability to emerging challenges. Whether it’s designing coverage for cutting-edge technologies or addressing climate-related exposures, MGAs are proving they can pivot quickly, meeting client needs with precision. This versatility ensures they remain at the forefront of industry evolution, ready to capitalize on opportunities in the near future.

Industry Leaders Weigh In on MGA Potential

Confidence in MGAs resonates strongly among industry leaders in 2025, with voices at the Capacity Exchange echoing a shared optimism about their long-term value. A prominent capacity provider noted during a panel discussion, “MGAs aren’t just filling gaps—they’re building new pathways for growth that benefit everyone in the chain.” Such sentiments reflect a shift from viewing these agents as temporary fixes to recognizing them as enduring partners.

Insights from the Managing General Agents’ Association (MGAA) further reinforce this perspective, emphasizing how trust is the bedrock of MGA-insurer collaborations. Case studies shared at recent forums showcase partnerships that have yielded impressive returns, particularly in specialty lines where expertise drives profitability. These real-world successes paint a vivid picture of an industry united in its belief that MGAs are poised to lead.

Statistics also bolster this narrative, with industry analyses projecting a steady rise in MGA-driven premium volumes over the next year. This data, combined with firsthand accounts of seamless teamwork between stakeholders, underscores a collective vision: MGAs are not just part of the future—they are essential to crafting it.

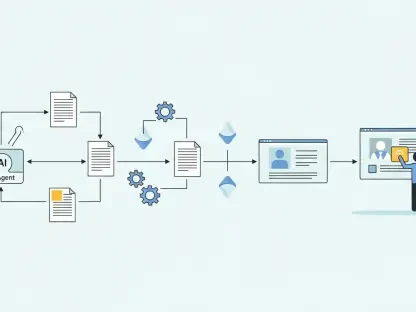

Strategies to Strengthen MGA Partnerships Ahead

For MGAs, insurers, and brokers aiming to solidify their alliances by 2026, actionable strategies are critical in a competitive landscape. Investing in data analytics and compliance infrastructure stands out as a priority, ensuring that MGAs meet the rigorous standards capacity providers demand. This focus on operational excellence builds credibility and fosters deeper trust across partnerships.

Open communication, supported by frameworks from organizations like the MGAA, also plays a pivotal role. Regular dialogue about shared goals—especially around complex risks such as cyber threats or sustainability challenges—helps align strategies and mitigate friction. Industry experts in 2025 stress that transparency in these discussions can turn potential obstacles into opportunities for collaboration.

Lastly, a commitment to sustainable growth over quick gains is essential. Leveraging technology to streamline processes and enhance resilience prepares partnerships for long-term challenges. By focusing on these areas, stakeholders can create a robust ecosystem where innovation thrives, positioning MGAs as indispensable players in the market’s next chapter.

Reflecting on a Pivotal Moment for MGAs

Looking back, the journey of MGAs in 2025 revealed a turning point for the insurance industry, where agility and collaboration became defining strengths. Their ability to navigate uncharted risks and forge unbreakable bonds with capacity providers and brokers marked a departure from traditional constraints. The optimism expressed at industry events and the data backing their rise painted a clear picture of transformation.

As the path unfolded, it became evident that the next steps rested on deliberate action. Stakeholders needed to prioritize investments in technology and compliance, ensuring partnerships could withstand future pressures. A focus on dialogue and shared innovation offered a blueprint for tackling emerging challenges together.

Ultimately, the legacy of this era hinged on a collective resolve to build beyond short-term wins. By fostering trust and aligning on visionary goals, MGAs and their allies laid the groundwork for a resilient future, proving that true momentum came from unity and foresight.