A string of recent, seemingly disconnected leadership announcements across the insurance landscape actually reveals a meticulously orchestrated symphony of strategic intent when viewed as a collective whole. These personnel movements are far more than simple updates to a corporate masthead; they are powerful signals broadcasting a fundamental evolution in how the industry is gearing up for its future.

Beyond the Headlines: Decoding a Strategic Shift in Insurance Talent

The recent flurry of high-profile appointments at firms like Pen Underwriting, HIVE Underwriters, Skuld, MNK Group, and Insurance United Against Dementia (IUAD) represents a critical moment for industry observers. While on the surface these are routine corporate changes, a deeper look uncovers them as clear indicators of the sector’s shifting priorities. Each hire, from a niche underwriter to a chief strategy officer, tells a story about where a company is placing its bets for future growth and stability.

This analysis will move beyond the press releases to dissect the underlying strategic currents driving this talent acquisition wave. By examining these moves in context, it becomes clear that the insurance industry is undergoing a deliberate realignment. The focus is shifting toward deep market specialization, aggressive M&A-fueled expansion, the integration of cross-industry expertise, and a renewed emphasis on purpose-driven leadership, all of which are shaping the competitive landscape for years to come.

The Anatomy of Ambition: What New Leadership Reveals About Industry Direction

Doubling Down on Deep Expertise: The Underwriting Arms Race in Niche Markets

A clear trend emerging is the aggressive pursuit of deep, specialized underwriting talent, signaling a strategic pivot toward high-margin niche markets. Pen Underwriting’s reinforcement of its professional indemnity team in Birmingham with seasoned experts Raman Nahal and Jazz Parkash is a prime example. Their extensive backgrounds, focusing specifically on PI and regional markets, demonstrate a calculated move to capture a greater share of a complex and profitable sector, moving away from a generalist approach.

Similarly, HIVE Underwriters’ forward-planning to launch a marine specialty division, effective in July 2026, underscores this long-term commitment to specialization. The recruitment of an entire leadership team—Nick Lewis, Alistair Marriott, and Jared Short—well in advance shows a deliberate strategy to build a formidable market presence from the ground up. This methodical assembly of proven leaders with deep expertise in distinct areas of marine, transportation, and logistics signals that the firm is not just entering a market, but intending to dominate it, creating significant competitive pressure on incumbents.

Securing the Helm: Fortifying Leadership for Stability and Strategic Expansion

Recent leadership appointments also highlight two distinct yet complementary corporate strategies: ensuring stability in core operations and driving aggressive expansion. Skuld’s appointment of Charlotte Valentin as the permanent Head of its Piraeus office exemplifies the first approach. By promoting a long-tenured internal leader with deep regional and company-specific knowledge, Skuld fortifies its position in the critical Greek market, prioritizing continuity and operational excellence during a period of transition.

In contrast, MNK Group’s creation of a Chief Strategy and Development Officer role for Matthew De Jesus represents a clear commitment to transformative growth. This external hire is specifically tasked with spearheading the company’s M&A ambitions on a global scale. This move illustrates an appetite for inorganic growth and a belief that new, outside perspectives are essential to catalyze significant corporate change. These parallel strategies show an industry balancing the need to protect its foundational strengths while simultaneously pursuing bold, new avenues for expansion.

The Cross-Pollination of Talent: Why Tech and Finance Acumen is Now an Insurance Asset

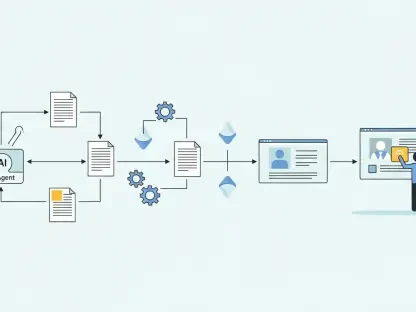

The profile of new leadership is evolving, with a growing premium on experience from outside the traditional insurance ecosystem. The appointment of Matthew De Jesus at MNK Group is particularly telling; his background spans not just commercial strategy but also venture capital and technology at firms like Talis Capital and Voxelmaps. This signals a crucial industry convergence, where an understanding of tech integration and sophisticated M&A is becoming as valuable as a career spent in underwriting or broking.

This trend challenges the long-held assumption that the best leaders must rise from within insurance ranks. The modern challenges facing the sector—from digital transformation and insurtech disruption to complex global M&A—demand a hybrid skill set. Companies are increasingly seeking leaders who can bridge the gap between legacy operations and future-facing technologies, recognizing that the ability to implement advanced systems and execute complex financial transactions is now a core competitive differentiator.

Purpose as a Pillar: The Strategic Importance of Industry-Wide Collaboration

Leadership appointments are also reflecting a growing understanding that corporate purpose and collective action are powerful strategic assets. The selection of Tracy-Lee Kus, CEO of Aon’s Global Broking Centre, to the board of Insurance United Against Dementia (IUAD) is more than a nod to corporate social responsibility. It demonstrates a strategic alignment with a cause that resonates deeply across the industry and society, enhancing brand reputation and stakeholder trust.

In today’s competitive talent market, a strong commitment to a shared purpose can be a significant differentiator. Aligning with impactful philanthropic initiatives like IUAD helps firms attract and retain top-tier professionals who seek meaning in their work beyond the bottom line. Furthermore, such industry-wide collaboration strengthens the sector’s collective influence and fosters a culture of engagement, proving that doing good is also good for business.

From Observation to Action: Applying the Lessons from a Shifting Landscape

The collective message from these strategic hires is unambiguous: the insurance industry is actively prioritizing deep specialization, M&A-driven growth, the integration of technological and financial acumen, and purpose-led leadership. This is not a passive evolution but a conscious reshaping of the talent pool to meet future demands. These trends provide a clear roadmap for what capabilities will define success in the coming years.

For industry players, this moment calls for proactive measures. It is an opportune time to conduct a talent audit to identify gaps in niche expertise and to consider creating new, hybrid roles that fuse strategic planning with technological implementation. For insurance professionals, the path forward involves cultivating specialized skills in high-demand areas or broadening their expertise to include strategic finance, technology, and data analytics to align with these emerging leadership profiles.

The Human Capital Forecast: Charting the Future of Insurance Leadership

This series of appointments signaled a forward-looking industry actively preparing for a more complex, competitive, and technologically integrated future. These were not isolated decisions but interconnected moves in a larger strategic game where talent is the ultimate asset. The long-term implications pointed toward an intensified war for specialized talent and the ascendance of a new type of leader—one with diverse, cross-industry experience capable of navigating multifaceted challenges.

Ultimately, the analysis of these hires suggested a profound shift in what the industry values. The most critical asset that insurance firms were acquiring was not a new technology or a rival company, but the strategic human capital that would define the next generation of market winners. It was this investment in people—in their specialized knowledge, their strategic vision, and their diverse perspectives—that held the key to future resilience and growth.