The global insurance industry is at a critical juncture, driven by an unprecedented surge in demand for unit-linked products that has pushed aging technology infrastructures to their breaking point. As these investment-oriented policies gain popularity, insurers are grappling with a fundamental challenge: their aging, fragmented technology infrastructure is ill-equipped to handle the complexity and scale of this new market reality. The recent multi-year partnership between U.S. WealthTech leader Clearwater Analytics and Generali Deutschland AG to overhaul the management of its €40 billion unit-linked business is a landmark event, signaling an industry-wide shift away from legacy systems. This article explores the growing chasm between market demands and outdated technology, analyzing how strategic modernization is becoming less of a choice and more of a prerequisite for survival and growth.

The Rising Tide of Unit-Linked Products and the Systems Left Behind

For decades, the insurance industry has relied on robust, albeit rigid, legacy systems built for traditional products. These platforms were designed for stability, not agility. However, the market has evolved dramatically. Unit-linked insurance, which combines life coverage with investment funds, offers customers greater transparency and potential for growth, fueling a massive market expansion. Citing industry research, the global unit-linked market is projected to skyrocket to $2.3 trillion by 2032, growing at an impressive 10.9% annually from its 2023 valuation of nearly $907 billion. This explosive growth, coupled with increasing regulatory scrutiny across jurisdictions, has exposed the deep-seated vulnerabilities of existing infrastructure, creating an urgent need for a new operational paradigm.

The Great Divide: Bridging the Gap Between Legacy Infrastructure and Market Demands

The Strain of Fragmentation: Why Outdated Systems Can’t Keep Pace

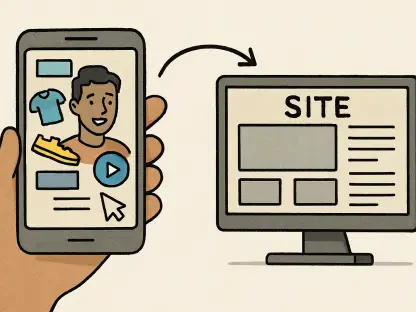

The primary challenge for insurers lies in the operational drag created by disparate, siloed systems. Legacy infrastructure often consists of a patchwork of applications accumulated over years, resulting in inconsistent data, manual reconciliation processes, and an inability to scale efficiently. This fragmentation makes it nearly impossible to gain a unified view of portfolios or manage high transaction volumes without significant manual intervention. For Generali Deutschland, this meant its subsidiaries were operating on different systems, creating inefficiencies that hampered its ability to capitalize on the booming market.

Forging a New Path: How a Unified Platform Creates Competitive Advantage

The partnership between Generali and Clearwater Analytics offers a clear blueprint for overcoming these challenges. By consolidating portfolio management, order execution, and reconciliation onto a single, cloud-native SaaS platform, Generali aims to dismantle its fragmented ecosystem. This strategic move will enable the insurer to seamlessly process significantly higher transaction volumes, manage increased capital inflows, and streamline the administration of its complex underlying funds. The Clearwater platform provides a “single source of truth,” eliminating data discrepancies and automating processes that were previously manual and error-prone.

Unlocking Growth: The Shift from Maintenance to Market Strategy

The benefits of this technological overhaul extend far beyond operational efficiency. By automating routine tasks and streamlining workflows, Generali can redirect its valuable internal resources from system maintenance and manual data entry to strategic, value-driving initiatives. This transition is crucial for long-term competitiveness. Instead of being bogged down by operational constraints, teams can focus on enhancing customer value, developing innovative products, and capitalizing on emerging market opportunities. The ultimate payoff is an agile organization capable of responding swiftly to market dynamics.

The Future of Insurance Operations: What to Expect in a Post-Legacy Era

The Generali-Clearwater deal is a bellwether for the entire insurance industry, signaling the beginning of a broader technological migration. The future of insurance operations will be defined by unified, cloud-based platforms that offer scalability, data transparency, and advanced analytics. We can expect to see a growing trend of insurers partnering with specialized FinTech and WealthTech providers to access cutting-edge solutions. This shift will further accelerate the adoption of AI and machine learning for everything from predictive analytics to enhanced regulatory reporting, creating a more resilient and responsive industry.

Navigating the Transition: A Strategic Roadmap for Insurers

For insurance executives staring down the unit-linked boom, the path forward requires decisive action. The first step is to conduct a thorough audit of existing systems to identify key bottlenecks and measure the true cost of operational inefficiency. Armed with this data, leaders can build a compelling business case for modernization that focuses not only on cost reduction but also on strategic enablement. The next critical step is to partner with a technology provider that offers a proven, scalable, and integrated platform capable of serving as a long-term foundation for growth.

The Inevitable Choice: Adapt or Be Left Behind

The explosive growth of the unit-linked insurance market makes one thing clear: the era of legacy systems is drawing to a close. These outdated platforms, once the bedrock of the industry, have become anchors holding back progress. The collaboration between Generali Deutschland and Clearwater Analytics is more than just a technology upgrade; it is a strategic declaration that the future belongs to those who embrace integration and scalability. For insurers worldwide, the question is no longer if they should modernize, but how quickly they can adapt to avoid being left behind in one of the most significant market shifts of this decade.