The insurance sector, long anchored by the weight of paper-based processes and manual data entry, is now confronting an operational revolution driven by autonomous, reasoning-based artificial intelligence. This technological shift is not a distant vision but an unfolding reality, challenging the core of how risk is assessed, clients are onboarded, and policies are managed. As insurers grapple with escalating client expectations and razor-thin margins, the integration of AI agents into daily operations is becoming less of a strategic option and more of a competitive necessity, promising to reshape workflows that have remained largely unchanged for decades.

Beyond the Hype What Happens When AI Agents Join the Insurance Workforce

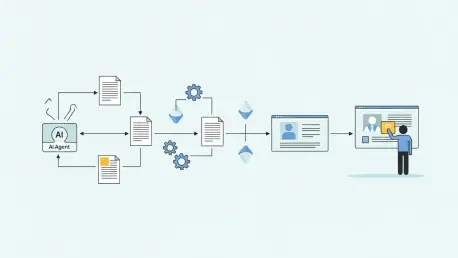

Agentic AI represents a significant leap beyond conventional automation. Unlike simple bots that follow rigid, pre-programmed rules, AI agents are designed to reason, plan, and execute complex, multi-step tasks autonomously. In an insurance context, this means an agent can independently analyze disparate data sources, consolidate policy information, and prepare documents for underwriter review without direct human intervention at every step. This capability moves AI from a passive analytical tool to an active participant in the operational workforce.

The introduction of these digital colleagues fundamentally redefines the role of human professionals within the industry. By offloading repetitive, time-consuming tasks to AI, employees are empowered to shift their focus toward higher-value activities. Instead of spending hours on administrative duties, they can dedicate their expertise to strategic risk assessment, complex client negotiations, and fostering stronger relationships. This transition positions human talent as governors and validators of AI-driven execution, blending machine efficiency with human insight.

The Breaking Point for Traditional Insurance Why Manual Workflows Are No Longer Sustainable

For years, the insurance industry has relied on workflows that are heavily dependent on manual intervention. Processes like new client onboarding, policy renewals, and certificate issuance are often characterized by significant paperwork, redundant data entry, and lengthy review cycles. This operational model is not only inefficient and costly but also prone to human error, which can lead to compliance issues and diminished client satisfaction. The sheer volume of data in highly regulated environments makes these manual processes increasingly untenable.

Moreover, modern client expectations have rendered these traditional workflows obsolete. Customers now demand the same speed, transparency, and seamless digital experience from their insurer that they receive in other sectors. The friction caused by slow onboarding, delayed invoice processing, and opaque servicing procedures creates a significant competitive disadvantage. As the industry moves toward more personalized and dynamic risk products, the inability of manual systems to keep pace with these demands marks a clear breaking point.

A Blueprint for a Hybrid Future The Aon and DataRobot Collaboration

A tangible example of this new operational paradigm is emerging from the strategic collaboration between global professional services firm Aon and enterprise AI platform DataRobot. This partnership is designed to embed agentic AI directly into Aon’s core client-facing processes, creating a blueprint for a hybrid human-AI workforce. The initiative leverages DataRobot’s Agent Workforce Platform to deploy autonomous agents capable of handling resource-intensive tasks, thereby modernizing established insurance workflows.

The collaboration initially targets two critical areas known for operational bottlenecks. For client onboarding, AI agents are tasked with consolidating historical documents, policy records, and binders to accelerate placements and renewals. In ongoing client servicing, the focus is on automating the generation of insurance certificates, processing invoices, and issuing ID cards. This targeted approach allows Aon to demonstrate measurable improvements in efficiency and service delivery while gathering valuable insights from client feedback on these AI-supported features.

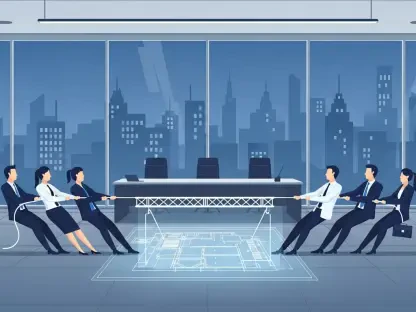

The Human in the Loop Mandate Merging AI Execution with Human Governance

A core principle of this forward-thinking approach is the unwavering commitment to a “human-in-the-loop” model. The goal is not to replace human decision-making but to augment it. In this framework, AI agents execute the procedural aspects of a task, but the final validation, control, and accountability remain firmly in the hands of Aon’s experienced professionals. This ensures that every AI-driven action is subject to human oversight, maintaining the high standards of governance required in the insurance sector.

This hybrid model effectively merges the distinct strengths of both artificial intelligence and human intellect. AI provides unparalleled speed, accuracy, and consistency in processing vast amounts of data, while human experts bring critical thinking, ethical judgment, and deep client relationship management to the forefront. This synergy creates a more resilient and effective operational ecosystem, where technology handles the execution and humans guide the strategy.

Implementing Agentic AI a Practical Framework for Insurers

The partnership between Aon and DataRobot provides a practical framework for other insurers seeking to implement agentic AI responsibly. The strategy begins with identifying value-critical workflows that are encumbered by manual handling and delays. By starting with targeted pilot programs in areas like onboarding or claims processing, organizations can build momentum, refine their approach based on feedback, and demonstrate tangible returns on investment before scaling enterprise-wide.

Ultimately, the successful integration of agentic AI was about more than just technological implementation; it was a strategic initiative aimed at delivering superior client outcomes. The dividends from this approach included faster turnaround times, enhanced operational consistency, and greater transparency for clients. By automating routine execution, insurers freed their most valuable asset—their people—to focus on what they do best: providing expert advice and building lasting partnerships. This human-centric approach to AI adoption set a new standard for innovation and service delivery across the industry.