In a world where financial security remains a cornerstone of family stability, a staggering statistic reveals a troubling trend: life insurance ownership among households has plummeted from 63% in 2011 to just 51% in recent data from the 2024 LIMRA Barometer, raising a critical question about why so many are turning away from a product designed to protect loved ones. For countless individuals, the answer lies in the labyrinth of jargon, fine print, and complex policies that make life insurance feel more like a riddle than a safeguard. This pervasive confusion not only deters potential buyers but also leaves families vulnerable to unforeseen risks.

The significance of this issue cannot be overstated. As more households forgo essential coverage, the financial safety net for millions weakens, amplifying the burden on surviving family members during crises. Beyond individual impact, the life insurance industry faces a pressing challenge to rebuild trust and accessibility. Fortunately, a promising solution emerges from an unexpected field—behavioral science. By tapping into how humans think and make decisions, this discipline offers fresh strategies to simplify the daunting world of life insurance, making it more approachable for everyone.

Unraveling the Complexity of Life Insurance

Life insurance, at its core, is a promise of protection, yet for many, it feels like an insurmountable puzzle. The sheer volume of unfamiliar terms—annuities, riders, premiums—combined with dense policy documents, often leaves consumers overwhelmed. This frustration isn’t just anecdotal; it’s a barrier that prevents people from taking a crucial step toward securing their family’s future. The intricate nature of these products can transform a straightforward decision into a source of stress and indecision.

Compounding the problem is the perception that life insurance is a one-size-fits-all solution, when in reality, it demands tailored understanding. Consumers frequently grapple with questions about coverage amounts, policy durations, and hidden costs, often without clear guidance. This lack of clarity breeds hesitation, pushing potential buyers to delay or abandon the process altogether. It’s a vicious cycle where complexity fuels avoidance, leaving gaps in protection that could have devastating consequences.

The Alarming Decline in Coverage

Recent figures paint a grim picture of life insurance adoption, with ownership dropping significantly over the past decade, as noted in the 2024 LIMRA Barometer. This decline, now sitting at just 51% of households, signals a growing disconnect between the product’s purpose and public perception. Families who might benefit most from coverage are often the ones opting out, citing confusion or distrust as primary reasons for their decision.

This gap in coverage has real-world implications, particularly for vulnerable populations. Without a financial buffer, unexpected events like the loss of a primary earner can plunge households into economic hardship. The trend also poses a challenge for the industry, which must confront declining revenues and a shrinking customer base. Addressing this crisis requires more than traditional marketing—it demands a fundamental shift in how life insurance is presented and understood.

Inside the Mind: Behavioral Science Explained

Behavioral science, a field blending psychology and economics, provides a lens to decode how people make choices, offering vital insights for the life insurance sector. It identifies two distinct modes of thinking: System 1, which is quick and emotion-driven, and System 2, which is slow and analytical. For instance, an advertisement featuring a joyful family might instantly evoke a protective instinct through System 1, while a detailed comparison of policy benefits engages the logical scrutiny of System 2.

Consider Jane, a single parent navigating the decision to purchase life insurance. A heartfelt commercial showing a secure family future tugs at her emotions, prompting an immediate desire to act. Yet, when faced with dense contract details, her System 2 thinking takes over, analyzing costs and coverage with careful deliberation. Research from the Society of Actuaries (SOA) Research Institute and Reinsurance Group of America (RGA), involving 2,000 participants, underscores how these cognitive modes shape customer journeys, revealing opportunities for insurers to align messaging with human behavior.

Evidence from the Field: Tested Strategies

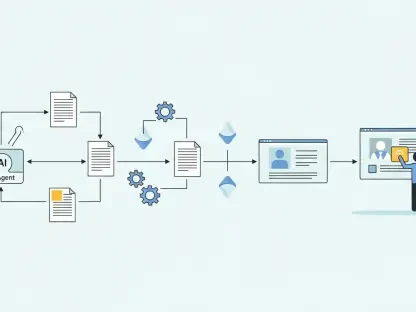

Delving into empirical findings, the collaborative SOA and RGA study offers concrete evidence of behavioral science’s potential to enhance understanding. Conducted with a diverse participant pool, the research compared a control group exposed to jargon-laden content against experimental groups receiving tailored communications. The results highlight specific techniques that nudged comprehension, even if modestly, demonstrating the power of strategic design.

Among the tested methods, the “Make it Easy” approach stood out, using plain language and bullet points to achieve a 3% increase in understanding compared to the control. Meanwhile, the “Make it Timely” tactic, which delivered key information at critical decision points, yielded a smaller 0.2% improvement. Another method, “Make it Salient,” prioritized essential details upfront on digital platforms, though specific outcomes for this were less quantified. These variations in impact suggest that while no single fix exists, combining approaches could amplify effectiveness.

Actionable Solutions for Insurers

Armed with insights from behavioral science, insurers have a roadmap to demystify life insurance for consumers. A primary step involves simplifying communication by adopting clear, relatable language and vivid visuals that resonate with System 1 thinking. For example, replacing technical terms with everyday explanations can transform a policy summary from intimidating to inviting, encouraging initial engagement without overwhelming the reader.

Timing also plays a pivotal role in shaping decisions. Delivering information at key moments—such as during life events like marriage or childbirth—ensures relevance and captures attention when motivation is highest. Additionally, highlighting critical details early in interactions aids System 2 analysis, helping consumers focus on what matters most. Insurers should weave emotional narratives with logical breakdowns to cater to diverse mindsets, ensuring no potential buyer feels alienated.

Finally, the importance of continuous testing cannot be overlooked. Behavioral science is not a static solution; it requires adaptation to evolving consumer patterns. Insurers must experiment with different combinations of ease, timing, and salience, refining their approach based on real-world feedback. Such iterative efforts can gradually rebuild trust, making life insurance not just a product, but a comprehensible pillar of financial planning.

Reflecting on a Path Forward

Looking back, the journey to simplify life insurance through behavioral science revealed a landscape of untapped potential. The stark decline in ownership had exposed deep-rooted challenges, while cognitive insights illuminated why traditional methods fell short. Each tested strategy, from simplifying language to timing information, had offered a piece of the puzzle, contributing to a broader understanding of consumer needs.

The next steps for the industry center on a commitment to innovation. Insurers need to prioritize scalable solutions, blending emotional resonance with analytical clarity to reach wider audiences. Partnerships with behavioral experts could further refine these efforts, ensuring that every policy feels less like a contract and more like a promise. By embracing this human-centered approach, the sector stands poised to restore confidence, turning complexity into connection for generations to come.