For countless homeowners with properties that defy the standard checkboxes—from unique construction materials to a past history of subsidence—the search for insurance has long been a frustrating journey into a digital dead end. In a world where nearly every service is available with a few clicks, the process of securing coverage for these homes often requires a retreat to manual paperwork and lengthy broker phone calls, leaving many to wonder why this corner of the market has remained stubbornly analog. This long-standing disconnect, however, may finally be resolving as new strategic alliances begin to merge modern technology with specialist expertise.

The Digital Hurdle for Atypical Properties

The typical online insurance journey is built for simplicity and speed, relying on automated systems that assess risk based on a narrow set of predictable variables. When a property owner enters details that fall outside these pre-programmed parameters, the result is almost invariably a polite but firm rejection. This automated refusal forces applicants into a slower, more traditional process, often involving specialist brokers who manually navigate the complex underwriting landscape. It is a stark contrast to the seamless digital experiences consumers have come to expect elsewhere.

This technological barrier raises a critical question about inclusivity in the insurance industry. As InsurTech continues to streamline processes for the majority, the gap widens for those with non-standard needs. The reliance on one-size-fits-all algorithms has inadvertently created a class of digitally excluded homeowners, whose properties are perfectly insurable but simply do not fit the rigid mold of mainstream online platforms.

Defining the Insurance Protection Gap

The term “non-standard” encompasses a wide array of circumstances that mainstream insurers often avoid. This includes properties with non-standard construction like timber frames or flat roofs, homes located in areas with a history of flooding, unoccupied properties, or those with a previous claim for subsidence. These factors introduce a level of complexity that automated underwriting systems are not equipped to handle, as they require nuanced assessment rather than a simple algorithmic check.

The industry’s traditional approach to these risks has been to route them away from direct online channels and toward manual underwriting departments or specialized managing general agents (MGAs). While effective, this offline process is often opaque, time-consuming, and can leave homeowners feeling uncertain about their options. This “protection gap” represents a significant vulnerability, where individuals struggle to secure adequate and affordable coverage through conventional digital channels, leaving valuable assets underinsured or uninsured entirely.

A New Alliance to Bridge the Digital Divide

In a direct response to this market need, a strategic partnership has formed between InsurTech provider Urban Jungle and specialist MGA Prestige Underwriting. This collaboration aims to digitize the application process for non-standard home insurance, bringing modern convenience to a historically underserved segment of the market. The alliance leverages the distinct capabilities of each organization to create a solution that is greater than the sum of its parts.

Urban Jungle, founded in 2016, provides the technological foundation. With a customer base exceeding 300,000, its platform is recognized for its user-friendly interface, transparent pricing with no hidden fees, and a seamless digital experience. On the other side of the partnership, Prestige Underwriting contributes over two decades of deep expertise in underwriting complex, difficult-to-place risks. This specialized knowledge is reinforced by sophisticated data enrichment and address-level rating technology, enabling confident and accurate pricing for properties that would otherwise be declined.

Putting the Digital Solution into Practice

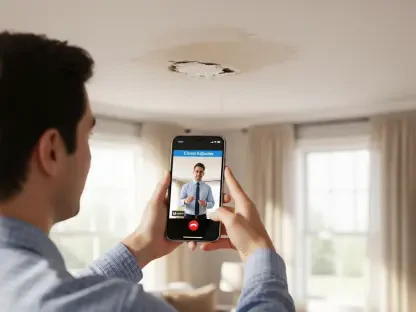

The collaboration materializes as an integrated product offering where Prestige Underwriting’s comprehensive “Coverall” policy is made available online through Urban Jungle’s platform. Marketed under the “Select by Urban Jungle” brand, the solution allows customers to obtain quotes and purchase both buildings and contents coverage in a single, entirely digital transaction. This integration marks a pivotal moment for homeowners who were previously met with instant online rejections.

The customer journey has been fundamentally redesigned. Instead of hitting a dead end, an applicant with a non-standard property is seamlessly guided through a process that can now provide an immediate decision. This is made possible by the fusion of Urban Jungle’s tech-first interface with Prestige Underwriting’s sophisticated back-end underwriting intelligence. The result is a system that can analyze complex variables in real-time, delivering the speed of digital with the precision of specialist underwriting.

The Strategic Impact of a Win-Win-Win Model

This partnership is structured to deliver mutual benefits that extend across the entire value chain. For Urban Jungle, the initiative represents a significant expansion of its home insurance proposition. It is projected to substantially increase its “quotability,” enabling the company to serve a much larger portion of its inbound customer demand and solidify its competitive position in the market.

For Prestige Underwriting, the collaboration opens up a powerful, technology-driven route to a new customer base. By tapping into Urban Jungle’s digital platform, the MGA is expected to see a considerable increase in quote volumes for its non-standard personal lines, thereby broadening its overall market footprint. Ultimately, the most significant winner is the customer. This innovative model delivered a landmark shift toward providing accessible, vital coverage options to homeowners who had been consistently underserved or declined by the standard insurance market, closing a critical gap in protection.