What happens when an industry steeped in tradition faces a tidal wave of complexity and volume that threatens to overwhelm even the most seasoned professionals? In the world of insurance underwriting, where catastrophe-focused portfolios demand precision amid soaring submission numbers, a groundbreaking partnership between Kalepa and AmRisc offers a glimpse of a tech-driven future. This collaboration, blending cutting-edge AI with deep industry expertise, is poised to redefine how underwriters navigate high-stakes decisions, sparking curiosity about the potential for true transformation.

The significance of this alliance cannot be overstated. As the largest catastrophe-focused Managing General Agent (MGA) in the United States, AmRisc handles an immense volume of intricate submissions, often under tight deadlines. Meanwhile, Kalepa brings to the table an AI-powered platform renowned for its accuracy and adaptability. Together, they address a critical pain point in the insurance sector: the urgent need for efficiency without sacrificing quality. This partnership stands as a beacon for an industry at a crossroads, highlighting how technology can bridge operational gaps and set new standards.

Why Underwriting Needs a Tech Overhaul

Underwriting, particularly in the realm of property and catastrophe risk, remains a labor-intensive process mired in manual tasks. With submission volumes climbing and risk profiles becoming ever more intricate, traditional methods often fall short, leading to delays and inconsistencies. The sheer scale of data that underwriters must sift through daily underscores a pressing need for tools that can keep up with demand while maintaining precision.

This challenge is not unique to a single firm but reflects a broader industry struggle. Many companies face bottlenecks in processing documents and assessing risks, especially when dealing with diverse submission types. The stakes are high—errors or inefficiencies can translate into significant financial losses or missed opportunities. It’s clear that a technological shift is not just desirable but essential to sustain growth and competitiveness.

The partnership between Kalepa and AmRisc emerges as a direct response to these systemic issues. By leveraging advanced automation and data-driven insights, this collaboration aims to streamline workflows that have long hindered progress. It serves as a case study for how innovation can address real-world challenges, offering a potential blueprint for others in the sector to follow.

The Critical Need for Innovation in Insurance

As the insurance landscape evolves, the urgency for modernization in underwriting has never been more apparent. Catastrophe-focused portfolios, in particular, are under immense pressure due to increasing natural disaster frequency and the complexity of associated risks. Firms are grappling with how to scale operations without compromising the accuracy that underpins their credibility.

This environment has fueled a surge in InsurTech adoption, where AI and automation are no longer luxuries but necessities. Industry reports indicate that companies integrating such technologies have seen efficiency gains of up to 60% in processing times. The drive toward digital solutions is reshaping decision-making, allowing underwriters to focus on strategic assessments rather than repetitive administrative tasks.

For AmRisc, aligning with Kalepa represents a strategic move to stay ahead of these trends. Their collaboration is part of a larger wave of transformation within the sector, where technology acts as a catalyst for operational resilience. This partnership exemplifies how targeted innovation can tackle specific pain points, paving the way for broader industry advancements.

Unpacking the Kalepa-AmRisc Collaboration

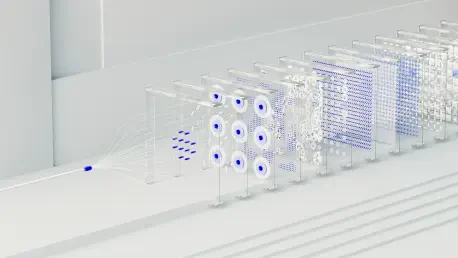

At the heart of this alliance lies a shared vision to revolutionize underwriting through technology. Kalepa’s AI platform, boasting accuracy rates in the mid-to-high 90s, automates document processing and submission analysis for AmRisc, enabling faster and more reliable outcomes. This capability directly addresses the high-volume challenges that often bog down underwriters in catastrophe-focused roles.

The selection of Kalepa as a partner was no arbitrary decision. AmRisc conducted a rigorous evaluation of multiple InsurTech vendors, focusing on metrics like performance, integration speed, and scalability. Kalepa emerged as the standout choice, demonstrating not only technical prowess but also an ability to adapt to the nuanced needs of a leading MGA, ensuring seamless alignment with existing systems.

Early results from this collaboration are promising. Underwriters at AmRisc can now prioritize complex risk evaluations over mundane tasks, thanks to the automation of repetitive processes. For instance, Kalepa’s platform has shown remarkable flexibility in handling diverse submission formats, a critical factor in maintaining workflow efficiency. This immediate impact signals the potential for long-term operational gains.

Hearing from the Pioneers

Insights from key figures in this partnership reveal the depth of commitment to innovation. Paul Monasterio, CEO of Kalepa, highlights the alignment between AmRisc’s progressive stance on property risk and Kalepa’s mission to empower underwriters with state-of-the-art tools. This synergy, according to Monasterio, is the foundation for delivering transformative results.

Laura Beckmann, President of AmRisc, echoes this sentiment by emphasizing the importance of a technology partner that truly understands their operational intricacies. Beckmann notes that Kalepa’s grasp of specific workflows has been instrumental in achieving a smooth integration. This mutual understanding has fostered a collaboration that prioritizes practical impact over mere technological novelty.

Adding a technical perspective, Mark Hall, AmRisc’s Software Engineering Group Lead, praises the speed and effectiveness of Kalepa’s proof of concept. Hall points out that the platform delivered measurable improvements almost immediately, surpassing internal benchmarks. These firsthand accounts collectively paint a picture of a partnership grounded in both visionary goals and tangible outcomes.

AI in Underwriting: Lessons for the Industry

The success of this collaboration offers valuable takeaways for other insurance firms looking to embrace AI. One critical lesson is the importance of selecting technology that integrates effortlessly with existing infrastructure. Kalepa’s tailored implementation at AmRisc demonstrates how seamless adoption can minimize disruption while maximizing benefits.

Another key strategy is to establish clear performance metrics from the outset. Focusing on indicators such as accuracy—where Kalepa achieves rates in the mid-to-high 90s—and processing speed ensures that AI tools deliver quantifiable value. This approach allows firms to assess the true impact of their investments and adjust strategies accordingly.

Finally, balancing automation with human expertise remains essential. AI should handle routine tasks, freeing underwriters to concentrate on nuanced risk assessments that require judgment and experience. This principle, central to the Kalepa-AmRisc alliance, serves as a guiding light for others aiming to enhance efficiency without losing the human touch in underwriting.

Reflecting on a Milestone Partnership

Looking back, the alliance between Kalepa and AmRisc marked a pivotal moment in the evolution of underwriting. Their combined efforts showcased how technology could alleviate longstanding inefficiencies, setting a powerful precedent for the insurance industry. The strides made in streamlining high-volume processing stood as a testament to the potential of strategic collaboration.

For other firms, the path forward became clearer through this example. Exploring AI-driven solutions that prioritize integration, measurable results, and a balance of automation with expertise offered a viable route to transformation. Industry players were encouraged to seek partnerships that aligned with their unique challenges, ensuring relevance and impact.

Beyond immediate gains, this partnership hinted at a broader shift toward data-driven decision-making in insurance. As technology continued to advance, the lessons learned from Kalepa and AmRisc provided a foundation for ongoing innovation. Their journey inspired a collective push toward scalability and precision, shaping the future of underwriting for years to come.