The traditional path to creating a commercial insurance proposal is paved with countless hours of administrative labor, a bottleneck that has long stifled growth and frustrated brokers across the industry. This manual process has historically diverted attention from client engagement and new business development, forcing professionals to spend more time on paperwork than on people. The arrival of new technology, however, signals a potential shift in this long-standing paradigm.

Is Outmarket’s AI the Solution Brokers Have Been Waiting For

This review examines the Outmarket Proposal Builder, an AI-driven tool engineered specifically for commercial insurance brokers. The platform’s core promise is to dismantle the industry-wide challenge of slow, inefficient proposal creation. The following analysis will assess its effectiveness in achieving this goal, determining whether the technology delivers a tangible return on investment by liberating brokers to concentrate on high-value activities like strengthening client relationships and pursuing business growth.

The central question is whether this tool is merely an incremental improvement or a truly transformative solution. For brokerages, the value proposition rests on the platform’s ability to not only accelerate a tedious workflow but also enhance the quality and consistency of their client-facing documents. Ultimately, its success is measured by its capacity to create scalable efficiencies that translate directly into a stronger bottom line and a more competitive market position.

Deconstructing the Proposal Builder Features and Functionality

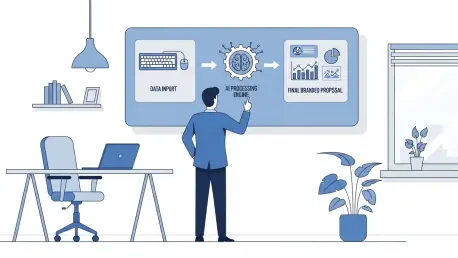

At its core, the Outmarket Proposal Builder is an intelligent workflow that transforms uploaded policy documents into fully branded, client-ready proposals in a matter of minutes. Its primary function is to automate the laborious tasks of transcribing coverages, adjusting limits and deductibles, and meticulously formatting documents. The system is designed to ingest complex carrier quotes and translate them into a polished, easily digestible format without manual data entry.

Beyond automation, the platform offers deep customization to ensure every output reflects an agency’s unique brand identity. Users can modify layouts, edit text, and incorporate visuals to enhance clarity and impact. Crucially, the system allows for the integration of an agency’s existing templates for essential components such as cover pages, team biographies, and legal disclaimers. This feature ensures unwavering brand consistency across all proposals, reinforcing a professional image with every client interaction.

Performance in Practice A Look at Speed Accuracy and Efficiency

An evaluation of the tool’s real-world impact reveals a significant leap forward in operational efficiency. Pilot programs with various organizations have confirmed transformative results, with some firms saving tens of thousands of work-hours annually. This dramatic reduction in administrative burden has a direct and substantial financial benefit, with reported cost savings reaching as high as one million dollars per year for certain organizations.

What distinguishes the Outmarket platform from competing AI solutions is its remarkable accuracy in comprehending the intricate details of complex commercial policies. Where other systems have reportedly struggled, this technology successfully deciphers the nuances embedded in carrier quote documents. It then translates that information into professional proposals with a high degree of fidelity, minimizing the need for extensive revisions and ensuring that the final document is both polished and precise.

The Balance Sheet Key Strengths and Potential Drawbacks

The platform’s most compelling advantages are its revolutionary speed and significant cost-saving potential. By drastically cutting down proposal creation time, it reallocates broker resources toward revenue-generating activities. Moreover, its sophisticated AI demonstrates a superior grasp of complex insurance terminology, which underpins the accuracy of its outputs. Coupled with extensive customization options, these strengths allow agencies to produce highly professional, brand-aligned documents at an unprecedented pace.

However, there are important considerations for prospective users. The quality of the system’s output is inherently tied to the clarity and completeness of the uploaded source documents; ambiguous or poorly structured quotes may require manual clarification. While the tool streamlines the process, brokers must still conduct a final review to verify that all client-specific nuances and strategic recommendations are accurately captured. Furthermore, successful adoption necessitates an initial investment in setup and training to seamlessly integrate an agency’s unique templates and workflows.

The Final Verdict A Game-Changing Advancement for Brokerages

The Outmarket Proposal Builder stands out as a powerful and highly effective solution to a persistent industry bottleneck. It masterfully combines processing speed, AI-driven accuracy, and comprehensive customization to deliver on its core promise of automating proposal generation from start to finish. Based on its demonstrated capacity to save considerable time and money, enhance operational scalability, and produce consistently professional documents, the tool earns a strong recommendation for any modern commercial insurance brokerage aiming to gain a competitive edge.

Concluding Thoughts and Recommendations for Adoption

Ultimately, the Outmarket Proposal Builder was a revolutionary tool that delivered clear and measurable value. It proved best suited for commercial insurance agencies that sought to eliminate administrative inefficiencies and empower their brokers to focus on strategic, revenue-generating activities. Its ability to facilitate effective operational scaling made it an indispensable asset for growth-oriented firms.

Before adopting the platform, it was advisable for firms to have evaluated their existing proposal workflow to identify critical pain points and prepare their standard templates for a smooth integration process. The decision to implement this tool represented a strategic investment in efficiency, one that provided a significant and sustainable competitive advantage in a demanding market.