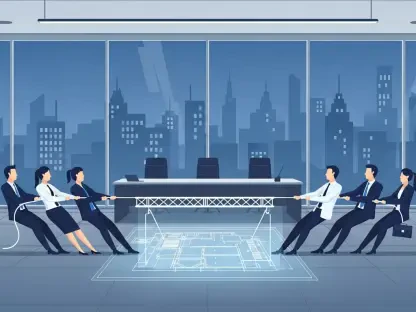

The digital world is witnessing an invisible yet high-stakes conflict, where the very concept of identity is being forged and faked by competing artificial intelligences. On one side, fraudsters are wielding sophisticated tools like deepfakes and generative AI to create convincing fake personas. On the other, businesses are deploying equally advanced AI to defend their systems. This analysis explores the critical trend of AI-powered identity verification, examining the technology, its real-world applications, and its future trajectory in the fight against digital fraud.

The New Battlefield AI Fraud vs AI Defense

The Rising Tide of AI-Generated Fraud

The scale of this emerging threat is staggering. Data from the U.S. Department of Homeland Security projects that AI-enabled fraud losses could skyrocket to $40 billion by 2027, highlighting an urgent and rapidly escalating problem. This surge is fueled by the accessibility of AI tools that can generate synthetic identities and deepfakes with unprecedented realism, rendering traditional identity verification methods almost obsolete.

Consequently, industries built on trust, particularly the insurance sector, are being forced to abandon outdated security measures. Manual reviews and simple data checks are proving insufficient against attacks that are not only sophisticated but also executed at a scale and speed that humans cannot match. This reality is compelling a fundamental shift toward more dynamic and intelligent solutions capable of meeting the challenge head-on.

Real-World Countermeasures The Launch of LexisNexis IDVerse

As a direct response to this evolving threat landscape, LexisNexis Risk Solutions has launched IDVerse for Insurance, a specialized identity verification solution designed explicitly to combat AI-driven fraud. This move signals a significant market trend where generic security tools are being replaced by industry-specific platforms tailored to unique risk environments.

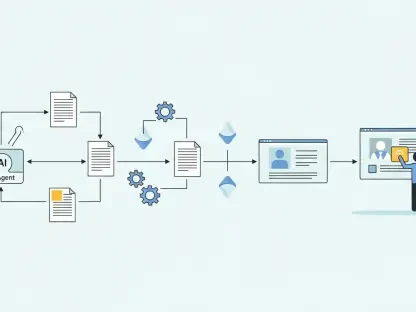

The technology is being integrated across the entire insurance customer lifecycle, from the initial quote and policy issuance to high-risk transactions and claims processing. This application demonstrates a strategic shift toward embedding proactive, AI-powered security directly into core business workflows. Instead of treating verification as a separate checkpoint, this approach neutralizes threats in real time, securing the system from within.

Deconstructing the Technology How AI Fights for Trust

The Engine of Modern Verification

At its core, IDVerse leverages a deep neural network and proprietary AI models trained on vast datasets to distinguish between genuine and fraudulent identities with remarkable accuracy. This system moves beyond simple pattern recognition, learning to identify the subtle imperfections and digital artifacts inherent in AI-generated fakes that are invisible to the human eye.

Key to its effectiveness are advanced biometric verification features, including robust liveness detection and facial matching algorithms. These tools ensure that the person presenting the identity is not only the legitimate owner but is also physically present during the transaction, effectively thwarting attempts to use stolen photos or deepfake videos. The system delivers fully automated, “yes or no” verification decisions, capable of authenticating a global range of identity documents instantly.

Balancing Security with Customer Experience

For insurers, the adoption of such a platform offers a multi-faceted value proposition. It directly reduces fraud risk, enhances operational efficiency by automating previously manual processes, and ultimately protects profitability in an increasingly competitive market. By catching fraudulent claims and applications early, resources can be allocated more effectively.

Simultaneously, the goal is to create a seamless, low-friction digital experience for the customer. Cumbersome manual steps are replaced with a quick and intuitive verification process that builds trust rather than creating frustration. Features like a customizable user interface and contextual AI that adapts to emerging fraud patterns help organizations maintain this crucial balance, ensuring that robust security does not come at the cost of customer satisfaction.

The Future of Identity Evolving Threats and Solutions

The consensus among industry experts is that the cat-and-mouse game between fraudsters and security providers will only intensify. As criminal AI models become more sophisticated and accessible, the defensive AI technologies designed to stop them must evolve at an even faster pace. This continuous innovation cycle will define the future of digital security.

Looking ahead, the evolution of identity verification will likely involve the integration of AI with other data sources for a more holistic risk assessment. This means moving beyond document and biometric checks alone to incorporate behavioral analytics and other contextual data points. However, a primary challenge will be maintaining user privacy and ethical AI standards while deploying increasingly powerful verification technologies. The broader implication is a fundamental redefinition of digital trust, where AI becomes the ultimate arbiter of identity.

Conclusion Adopting AI as a Non-Negotiable Defense

The rapid emergence of AI-driven fraud has rendered traditional security protocols obsolete, creating an urgent and undeniable need for advanced countermeasures. Solutions like LexisNexis IDVerse for Insurance exemplify the industry’s critical pivot toward using intelligent, automated systems to fight back, embedding security directly into the fabric of their operations.

In today’s digital landscape, fighting AI with AI is no longer a choice but a necessity for survival. For organizations to protect their assets, preserve their reputation, and maintain the trust of their customers, embracing sophisticated identity verification technology is the only viable path forward.