The days of drawn-out insurance claims, buried under mountains of paperwork and fraught with delays, are rapidly drawing to a close, giving way to a new era of immediacy and precision. From lengthy paperwork to instant payouts, the motor insurance claims process is undergoing a radical transformation. This article explores the rise of autonomous settlement, a trend poised to eliminate friction and redefine customer expectations in the insurance industry.

The Current State of Autonomous Claims

The Market Shift Toward Touchless Processing

The insurtech sector is experiencing a significant surge, with market analysis indicating a robust growth trajectory for AI and automation solutions projected from 2026 through 2028. This momentum is driven by a clear industry imperative to enhance operational efficiency. Major insurance carriers are increasingly adopting automated claims solutions, moving away from manual, high-friction processes toward streamlined, digital-first workflows that promise substantial cost savings and improved accuracy.

This transition is not merely about incremental improvements; it represents a fundamental rethinking of the claims journey. Reports from leading industry analysts consistently highlight the immense potential for efficiency gains. By automating routine tasks like damage assessment and payment processing, insurers can redirect human resources to more complex cases, enhancing both employee and customer satisfaction. The data suggests that touchless processing is quickly becoming a competitive necessity rather than a technological luxury.

A Case Study in Innovation The Click-Ins and Insurtech Fuel Partnership

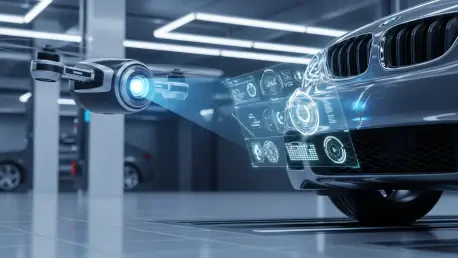

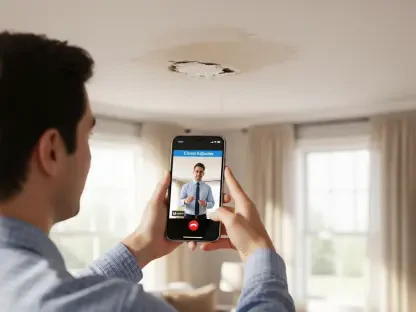

A prime example of this evolution is the strategic collaboration between AI damage-detection specialist Click-Ins and claims technology firm Insurtech Fuel. Together, they have engineered a “one-click” autonomous claims solution designed to handle the entire process seamlessly. This partnership integrates two powerful technologies to create a single, efficient workflow that dramatically reduces human intervention and accelerates settlement times from days to mere seconds.

The process begins with Click-Ins’ sophisticated AI, which uses computer vision and 3D modeling to analyze smartphone images of vehicle damage. Its technology accurately identifies and isolates damage while filtering out environmental “noise” like dirt, shadows, or reflections. This verified data is then transmitted to Insurtech Fuel’s WePayClaims platform. The platform’s rules-driven engine automatically validates the claim against the insurer’s predefined thresholds and processes an instant settlement, entirely removing the need for a physical inspection. A key innovation is the creation of a high-confidence digital baseline for each insured vehicle, which serves as an immutable record to prevent fraud and expedite any future claims.

Industry Insights on the Automated Revolution

Experts across the insurance landscape agree that the shift toward real-time, automated decision-making is one of the most transformative trends in decades. This evolution addresses long-standing pain points for both insurers and policyholders, replacing ambiguity and delay with data-driven clarity and speed. The goal is to create an experience so fluid that the policyholder feels fully supported from the moment of loss to the final payout.

However, the path to full automation is not without its challenges. Insurtech leaders frequently point to the complexities of integrating new, agile platforms with entrenched legacy systems as a significant hurdle. Ensuring robust data security and maintaining compliance with evolving regulations are also top priorities. Furthermore, insurance professionals note that automation redefines the role of the human claims adjuster. Rather than being replaced, adjusters are empowered to manage exceptions, handle complex negotiations, and focus on delivering empathetic customer service, thereby enhancing overall satisfaction.

The Future Trajectory of Claims Automation

The potential for widespread adoption of autonomous claims processing is immense, with many industry observers believing it will soon become the new standard. The key benefits are too compelling to ignore: a dramatic reduction in settlement times, lower operational costs through the elimination of manual tasks, and improved consistency by removing human subjectivity and error from the assessment process.

Despite the clear advantages, several challenges must be addressed for automation to reach its full potential. Navigating regulatory hurdles that were designed for a pre-digital era remains a complex task. Insurers must also work to build customer trust in AI-driven decisions, ensuring transparency and fairness in their algorithms. The risk of algorithmic bias, where automated systems could inadvertently discriminate against certain groups, is a critical concern that requires diligent oversight and continuous model refinement. Looking ahead, these advancements will likely spur the creation of new, more flexible insurance product models and introduce next-generation fraud detection capabilities that are more predictive and proactive.

Conclusion A New Paradigm for Insurance

The movement toward autonomous claims settlement is driven by a convergence of advanced AI, escalating customer expectations for digital convenience, and a clear business case for operational efficiency. This trend is fundamentally reshaping the core function of insurance, shifting it from a reactive, administrative process to a proactive, data-centric service.

Collaborations like the one between Click-Ins and Insurtech Fuel are no longer theoretical concepts; they are making this future a present-day reality. By seamlessly integrating best-in-class technologies, they demonstrate that an instant, accurate, and fraud-resistant claims experience is achievable now. For insurers navigating this new landscape, the message is clear: embracing automation is not just an option for growth but a necessity for survival in an industry being redefined by the demands of the modern policyholder.