In an economy where a single cloud outage or software-as-a-service failure can cost millions in lost revenue and reputational damage, businesses are discovering that traditional cyber insurance often falls short. The lengthy claims processes and complex policy language of indemnity-based coverage create a significant gap between when a digital disruption occurs and when financial relief arrives. In response, parametric insurance is emerging as a powerful, trigger-based solution designed for the speed of the digital age. This analysis explores the rapid ascent of this model, with a focus on market leader Parametrix, to understand how it is reshaping cyber resilience.

Market Evolution and Real World Application

Data Driven Growth in a High Stakes Market

The demand for robust business interruption coverage is surging as organizations become increasingly dependent on a complex web of third-party technology providers. The frequent and unpredictable nature of these service failures has created a fertile ground for new insurance models that prioritize speed and certainty over lengthy investigations.

This market shift is validated by significant investment activity. Parametrix recently secured a $27 million Series B funding round, bringing its total funding to an impressive $45 million. The involvement of prominent investors such as Mundi Ventures, FirstMark Capital, and Hannover Digital Investments signals strong institutional confidence in the viability and scalability of the parametric approach to managing digital risk.

Parametrix A Case Study in Parametric Innovation

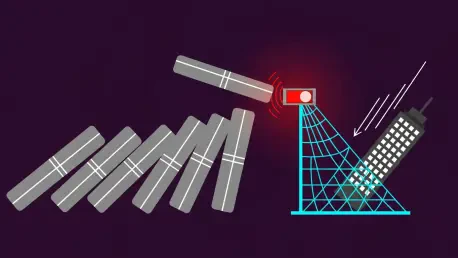

As a Lloyd’s Coverholder, Parametrix has pioneered coverage for downtime events across cloud platforms, SaaS applications, and other critical digital infrastructures. The company’s innovation lies in its proprietary monitoring technology, which continuously tracks the performance of over 7,000 service providers worldwide.

This data-driven system enables the core promise of parametric insurance: when a pre-defined downtime trigger is met and verified, an agreed-upon payment is automatically disbursed. This model eliminates the need for a traditional, often contentious, claims adjustment process. Further innovating, Parametrix launched CyberPMX, a hybrid product that embeds this parametric digital business interruption protection directly into a standard cyber and technology errors-and-omissions policy, offering a more comprehensive safety net.

Insights from Industry Leaders and Investors

A clear consensus has formed among investors that Parametrix is not merely another insurer but a “category-defining” company. Its model is viewed as a foundational component for the modern digital economy, providing the financial stability necessary to underpin the explosive growth of cloud computing and the ongoing AI revolution.

This perspective frames parametric coverage as the critical “financial infrastructure” that allows businesses to innovate and adopt new technologies with greater confidence. The company’s leadership plans to use its new capital to accelerate growth and deepen partnerships, reinforcing its vision of becoming the “protection backbone” for the digital services that power global commerce.

Future Outlook and Broader Implications

Parametric insurance is on a trajectory to evolve from a niche product into a standard component of enterprise risk management. The primary drivers behind this adoption are its defining benefits: speed of payment, objectivity, and transparency. For a business grappling with a sudden service outage, this translates into immediate liquidity to manage the crisis, a stark contrast to the weeks or months it can take to settle a traditional claim.

While challenges such as defining precise triggers and managing basis risk exist, advancing monitoring technologies and data analytics are continually refining the model’s accuracy. Moreover, the broader adoption of this insurance could have a positive ripple effect on the tech industry itself, creating a financial incentive for cloud and SaaS providers to enhance service reliability and uphold their service-level agreements.

Conclusion A New Standard for Cyber Resilience

The fundamental drivers behind the rise of parametric cyber insurance were clear, marking a decisive shift from reactive, indemnity-based models to proactive, event-triggered solutions. Companies like Parametrix successfully addressed a critical and previously unmet business need for rapid, predictable financial recovery from the pervasive threat of digital downtime. Ultimately, this innovative approach became an indispensable tool, establishing a new standard for building financial resilience in an interconnected world.