Listen to the Article

What if your insurance policy could prevent a loss instead of just paying for one? That question is no longer hypothetical. It is the driving force behind a revolution that is moving the insurance industry from a reactive past to a proactive future. The traditional promise of risk compensation, paying you back after something goes wrong, is being replaced by a new value proposition: risk prevention. This article explores how technology and real-time data are transforming passive financial products into active, value-added services that mitigate and manage risk, helping to reinvent the insurance business model.

The Shift from Static Risk to Real-Time Intelligence

For decades, insurers ran on a model that sorted people into broad, impersonal categories. Your risk was defined by your age, ZIP code, or job title. The result? Pricing that was often close enough, but rarely precise. That old system is being dismantled, piece by piece, by a wave of Insurtech innovation that replaces averages with personal insights.

Today’s insurance ecosystem is fueled by real-time data, seamlessly flowing from the physical world into predictive systems that learn, adjust, and respond. The three key technologies that are doing the heavy lifting include:

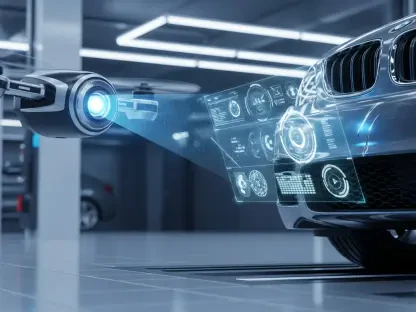

The Internet of Things: Cars, homes, and even people are increasingly connected through smart sensors. Telematics monitors driver behavior. Smart alarms track home safety. Wearables record health and activity data. These devices enable usage-based insurance, a model that converts safer habits into premium savings and aligns incentives between the insurer and the insured.

Artificial Intelligence and Machine Learning: These algorithms analyze immense and varied datasets to build predictive underwriting models that operate on a continuous feedback loop. Unlike static actuarial tables, these models evolve in real time, delivering pricing that more accurately reflects individual risk profiles.

Blockchain and Smart Contracts: Blockchain introduces automation and transparency across insurance transactions. Smart contracts, self-executing digital agreements, automatically trigger claims payouts when predefined conditions are met, such as flight delays or shipment damage. The result: fewer administrative steps, faster resolutions, and a new level of trust built into the process.

Look at commercial fleets, where telematics has become standard. Insurers monitoring factors such as braking patterns and route choices are no longer just assessing risk; they’re helping shape safer behavior. Real-time coaching based on this data has driven claims down by up to 20% in some programs. That’s less risk for underwriters, lower premiums for fleet operators, and a clear win for both.

The Tension Between Innovation and Regulation

Insurtech’s momentum isn’t happening in a vacuum; it’s running headfirst into a wall of regulation and rising consumer scrutiny. This is, after all, one of the most heavily regulated industries in the world, shaped by a century of precedent and fragmented legal frameworks that rarely keep pace with technology. For startups and legacy players alike, navigating that complexity continues to slow the path from pilot to scale.

At the same time, the data-driven backbone of Insurtech presents its own risks; chief among them, privacy. Personalization might make policies smarter and prices fairer, but it also raises uncomfortable questions about surveillance and consent. The global Insurtech market could exceed $150 billion by 2030, but that growth is contingent on one thing: trust. Insurers must be transparent about how data is collected, used, and secured, and just as importantly, how it benefits the individual, not just the algorithm.

In response to these challenges, a new dynamic has emerged. Many traditional insurers are moving from resistance to collaboration, opting to partner with or acquire Insurtech firms rather than compete head-on. It’s a practical calculus: by teaming up with innovators, incumbents can access advanced capabilities without sacrificing their capital base or institutional expertise. A First Connect survey showed that more than 80% of traditional insurers now consider such partnerships essential to their digital transformation efforts. The result? A shifting landscape where collaboration is no longer the exception; it’s the new rule.

How Traditional Insurers Can Catch Up And Lead

Insurtech hasn’t just introduced new tools; it’s rewritten the blueprint. For traditional insurers, adapting means more than upgrading systems or launching an app. It demands a deeper shift: from passive underwriting to proactive protection, from static policies to living, learning products.

In this new landscape, the agents that thrive will be the ones that rethink their approach to insurance. Here’s a quick game plan to help you start moving in that direction:

In the First 30 Days: Audit Your Data Capabilities. Prevention starts with data. Not just collecting it, but connecting, analyzing, and acting on it, across IoT inputs, customer behavior patterns, and legacy systems. Run an honest audit of your current capabilities and governance frameworks. Where are the blind spots? What’s slowing you down?

In the Next 60 Days: Launch a Pilot Focused on Prevention. Avoid the temptation to digitize what’s already obsolete. Instead, choose a high-impact area, such as fleet, commercial property, or cyber, and roll out a focused pilot aimed at preventing loss, not just processing it. Success should be measured in reduced claims, not just cleaner workflows.

In the Final 90 Days: Rethink Your Talent Strategy. A data-driven, prevention-first model needs new muscle. Start assembling cross-functional talent that blends actuarial science with behavioral economics, data engineering, and design thinking. If those skills don’t exist yet internally, build them with intention.

The groundwork is already in place. Insurance is becoming ambient, embedded into platforms, tied to behavior, and powered by real-time feedback loops. The standalone policy itself may soon feel like a relic of the past. What began as a bold experiment in digitization has quietly redefined the very meaning of protection for both the insurer and the clients.

Conclusion

Preventing loss, not just covering it, has become a strategic imperative. Traditional insurers now stand at a crossroads. One road leads to incremental tweaks, digitizing legacy processes, and hoping that’s enough. The other leads to reinvention.

A prevention-first model demands more than tech upgrades; it requires a complete shift in mindset. That means treating data like a strategic asset, investing in next-gen talent, forging alliances with innovators, and rebuilding product strategies around real-time value, not just claims processing.

The winning companies won’t only be the fastest responders, but the ones who invest in insurance tech with real intention. Now is the time to act, before customer expectations outpace your capacity to deliver. Lean into prevention. Lead with transparency. Build for adaptability. The next chapter of insurance is about defining what protection means in a connected world.