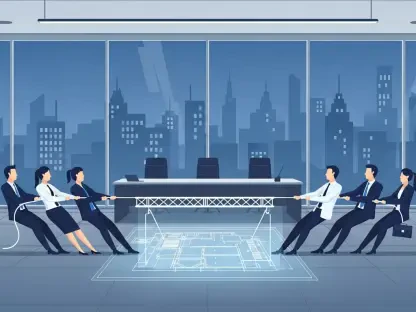

Alabama is confronting a critical economic challenge as soaring liability insurance costs, driven by a surge in litigation, threaten to destabilize businesses and strain household budgets. With liability claims costs jumping an alarming 59% between 2020 and 2024—more than double the rate of consumer price inflation—state lawmakers are now considering significant tort reform. This dramatic escalation, fueled by larger settlements and ballooning legal expenses, has created a high-stakes environment where the balance between fair compensation and economic sustainability is being re-examined. This article will delve into the statistical evidence driving this reform movement, explore the legislative proposals on the table, and analyze the potential ramifications for Alabama’s future.

The National Tide: Understanding the Roots of “Social Inflation”

The pressures felt in Alabama are not occurring in a vacuum; they are a symptom of a broader national trend known as “social inflation.” This phenomenon, which reinsurer Swiss Re estimates has inflated U.S. casualty claims by 57% over the past decade, reflects a fundamental shift in societal attitudes and juror sentiment, often leading to dramatically higher compensation awards against both large corporations and small businesses. This evolving legal climate is characterized by a growing propensity to favor plaintiffs, resulting in a 52% national surge in “nuclear verdicts”—jury awards exceeding $10 million—in 2024 alone. While Alabama has not yet reached the top of the list for these mega-verdicts, the underlying trend represents a significant concern, pushing the state to proactively address the risk before it escalates further.

Examining the Crisis and the Proposed Path Forward

A Data-Driven Diagnosis of Alabama’s Litigation Fever

The push for reform is grounded in stark data from the Alabama Department of Insurance. A detailed analysis reveals that the problem is multifaceted. The percentage of insurance claims escalating to a lawsuit climbed from 10% to 13% over the last four years, indicating a more litigious environment. Simultaneously, the financial mechanics of these claims have shifted, with legal costs consuming a growing portion of payouts, rising from 51% to 54%. This trend is compounded by a sharp increase in the average payment per claim, which leaped from $3,505 to $5,087 during the same period. These figures paint a clear picture of a system where litigation itself, not just the underlying damages, is a primary driver of escalating costs.

Following Florida’s Footsteps: A Legislative Blueprint for Reform

In response to these alarming trends, Alabama lawmakers have introduced a bill aimed directly at the heart of large jury awards: a proposed $1 million cap on non-economic damages. This legislative strategy is not a novel experiment but is closely modeled on reforms successfully implemented in Florida. Once a national epicenter for insurance litigation and nuclear verdicts, Florida enacted comprehensive tort reforms in 2022 and 2023. The results were dramatic. By 2024, the state dropped from being the second-worst in the nation for nuclear verdicts to tenth. For Alabama’s proponents of reform, Florida’s turnaround serves as a compelling case study, offering a potential roadmap to restore predictability and control to its own liability market.

Unpacking the Hidden “Tort Tax” and Legal Complexities

Beyond the headline numbers, reform advocates like the Lawsuit Fairness for Alabama Coalition point to more subtle forces exacerbating the problem. They argue that unchecked litigation abuse is effectively imposing a hidden “tort tax” on the state’s economy. This burden is further inflated by the rise of third-party litigation funding, where outside investors finance lawsuits in exchange for a portion of the settlement, a practice critics claim artificially inflates claims costs and pressures defendants into larger payouts. This situation persists despite Alabama having a “pure contributory negligence” rule—one of the nation’s most defendant-friendly standards, which bars a plaintiff from recovering any damages if they are found even 1% at fault. The fact that costs continue to soar even with this rule in place underscores the belief that more direct legislative action is necessary.

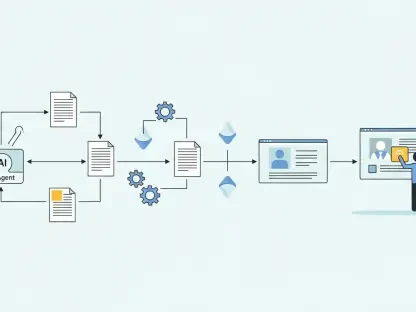

The Future of Liability: Monitoring and Market Evolution

As the tort reform bill moves through the legislature, its fate will undoubtedly shape Alabama’s economic landscape for years to come. The debate highlights a pivotal moment where lawmakers must weigh the interests of plaintiffs against the broader economic impact on consumers and businesses. In a sign of the issue’s growing importance, the Alabama Department of Insurance has committed to conducting its data call annually, ensuring that policymakers will have continuous, up-to-date information to monitor market dynamics and assess the effectiveness of any enacted reforms. This move toward proactive data collection signals a long-term commitment to managing the state’s legal climate and preventing future cost explosions.

Navigating the Headwinds: Key Insights for Stakeholders

The analysis of Alabama’s liability crisis yields several critical takeaways. First, the 59% surge in liability costs is a statistically significant trend that far outpaces normal inflation, driven by both the frequency and severity of litigation. Second, the proposed $1 million cap on non-economic damages is a direct, tested response modeled after Florida’s recent and apparently successful reforms. Finally, the problem is intensified by systemic issues like social inflation and third-party litigation funding, which existing state laws have failed to contain. For Alabama’s business owners, this legislative battle is crucial, as its outcome could determine the future of insurance affordability and availability. For consumers, the debate is equally relevant, as these costs are ultimately passed down through higher prices for goods and services.

A Defining Moment for Alabama’s Economic Future

Alabama stood at a critical juncture, where the path it chose on tort reform was set to have lasting consequences. The core issue was a battle for balance—ensuring injured parties received just compensation without allowing litigation costs to cripple the state’s economy. The data clearly showed an imbalanced system leaning toward unsustainable expenses, and the proposed legislation offered a direct, albeit controversial, solution. As lawmakers, businesses, and citizens weighed the arguments, the ultimate goal remained clear: to foster a fair, predictable, and economically stable legal environment that serves all Alabamians.