The escalating threat of widespread and systemic cyber incidents is fundamentally challenging traditional insurance models, pushing industry leaders to forge new pathways for managing digital-age catastrophes. In a landmark move demonstrating this shift, specialist insurer Beazley has successfully deepened its insurance-linked securities (ILS) strategy by finalizing a new $300 million cyber catastrophe bond, transferring a significant portion of complex cyber risk from its own balance sheet directly to the capital markets. This transaction not only expands the company’s capacity but also signals a growing maturity in how the financial world quantifies and invests in one of the most pressing risks of the modern era.

A Landmark Transaction in a Favorable Market

The Innovative PoleStar Re Structure

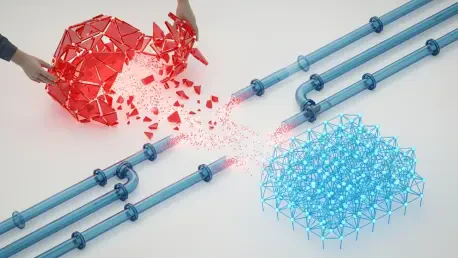

Beazley’s latest issuance, named PoleStar Re Ltd 2026-1, represents a sophisticated evolution in cyber risk transfer designed specifically to provide robust protection against remote probability, catastrophic, and systemic cyber events. This transaction builds upon the company’s pioneering work in this space, following its first cyber cat bond issued in January 2023. A market first, the bond features an innovative structure with three distinct sub-layers over a three-year term that concludes at the end of 2028, allowing for more nuanced risk pricing and investor participation. With this new $300 million bond, Beazley’s total in-force cyber catastrophe bond protection has now reached an impressive $670 million. This contributes to a total cyber excess-of-loss program exceeding $1 billion, which the company asserts is the largest and most comprehensive in the market. The successful placement of this bond was made possible by an exceptionally favorable market environment, where strong investor demand for ILS products is at an all-time high, driven by the attractive returns these instruments offer.

Strategic Expansion into Securitization

This bond is not merely a one-off transaction but a key component of Beazley’s broader, evolving strategy to integrate capital markets more deeply into its cyber risk management framework. The company has laid out ambitious plans to expand its ILS activities far beyond simple bond issuance. Looking ahead, Beazley aims to begin actively securitizing and transforming cyber risks through a dedicated ILS fund, with a target launch in 2026. This initiative signals a strategic pivot from being a consumer of ILS capacity to becoming a creator and manager of cyber risk investment products. To facilitate this, the company will leverage its established Bermuda platform, which provides the ideal regulatory and operational environment for creating novel investment structures. This forward-looking approach is designed to build a sustainable market for cyber risk, creating new avenues for institutional investors to gain exposure to this unique asset class while simultaneously providing the insurance market with a vital source of diverse and substantial reinsurance capital.

A New Blueprint for Cyber Resilience

The successful completion of this sophisticated cyber catastrophe bond, coupled with a clear roadmap for future securitization, marked a significant advancement in the industry. It demonstrated how insurers could proactively partner with capital markets to create substantial capacity for risks that were once considered nearly uninsurable at a systemic level. This strategic financial engineering provided a new blueprint for building a more resilient global infrastructure against the growing threat of large-scale digital disasters, setting a precedent that others in the market are likely to follow.