The foundational promise of the insurance industry—to provide a financial backstop against disaster—is fracturing under the immense pressure of a rapidly changing climate, leaving entire communities dangerously exposed. For generations, insurers built their models on the bedrock of historical data, a system that functioned reliably in an era of predictable weather patterns. That era is over. Today, the unprecedented frequency and severity of extreme weather events have rendered these legacy systems obsolete, as demonstrated by the first half of 2025 becoming one of the costliest on record due to events like California wildfires and severe convective storms. This systemic failure is forcing a radical reevaluation of risk, pushing the sector away from its reactive posture and toward a future where survival depends on embracing a new arsenal of technological tools, with artificial intelligence leading the charge. The central question is no longer if the industry will change, but if it can change fast enough.

The Technological Revolution in Risk Assessment

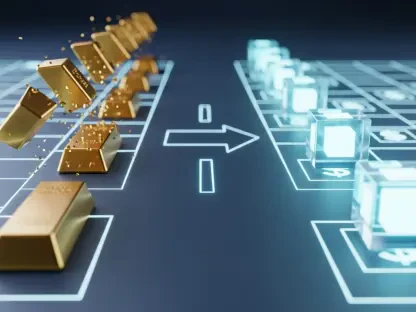

The most profound transformation sweeping the insurance sector is the accelerated pivot from backward-looking historical analysis to sophisticated, real-time intelligence. The inadequacy of using past events to predict future catastrophes has created a vacuum now being filled by AI-powered platforms and advanced geospatial analytics capable of dynamic risk assessment. These technologies are critical for what industry leaders call “precision underwriting,” allowing insurers to process immense and varied datasets—from high-resolution satellite imagery and real-time weather patterns to granular data on infrastructure vulnerabilities. By modeling the complex interplay of these factors, AI can generate forward-looking risk profiles that more accurately reflect the volatile reality of the modern climate, turning what was once a reactive calculation into a proactive science. This is not an optional upgrade; it has become a foundational necessity for any insurer aiming to remain solvent in an increasingly unpredictable world.

This technological evolution is also being defined by a strategic fusion of advanced algorithms with deep domain expertise, often facilitated through partnerships and acquisitions. Major reinsurers are actively integrating specialized climate tech firms into their core operations to gain a competitive edge. For instance, Swiss Re’s acquisition of the UK-based flood modeling firm Fathom did more than just enhance its CatNet platform with a new algorithm; it embedded a team of former hydrologists and climate specialists directly into the risk assessment process. This synthesis of data science and environmental science is creating a new paradigm for underwriting, where human expertise guides and validates machine learning models. As this trend accelerates, the industry is moving toward a future where risk models are not just statistically sound but are also grounded in the fundamental principles of climate science, leading to far more robust and reliable assessments of future threats.

Reshaping Markets and Incentivizing Resilience

Armed with these highly granular, AI-driven insights, insurers and reinsurers are fundamentally reshaping their risk appetite and capital allocation strategies on a global scale. Instead of simply making broad retreats from entire regions deemed too risky, they are now able to make more nuanced decisions. Technology allows them to identify specific pockets of resilience within otherwise high-risk areas, as well as to pinpoint communities that are actively investing in climate adaptation. This creates a powerful market-based incentive structure where proactive risk mitigation is rewarded with continued access to insurance capital. Consequently, state and local governments that invest in hardening infrastructure or implementing stronger building codes are finding themselves in a more favorable position, demonstrating that resilience is becoming a key determinant of insurability and economic stability in the climate era.

This market shift is being amplified by a new era of transparency, driven by groundbreaking public-private partnerships. A pivotal example is the initiative between the First Street Foundation and the Connecticut Insurance Department, which provides every homeowner in the state with free access to property-level climate risk data. This unprecedented level of information serves a dual purpose: it empowers consumers to understand their specific vulnerabilities and take action, while simultaneously providing reinsurers with a comprehensive, state-wide dataset to inform their capital deployment strategies. When coupled with proactive government programs, such as Alabama’s roofing grant program which helps homeowners harden their properties against severe weather, these efforts are directly influencing how reinsurers evaluate long-term exposure. Regions that actively invest in and promote mitigation are becoming more attractive for capital, creating a replicable model for managing systemic climate risk.

Confronting New Frontiers and Systemic Challenges

The industry’s understanding of climate risk is undergoing a crucial expansion, moving beyond the traditional focus on acute, sudden-onset catastrophes. The new frontier of risk assessment now incorporates slower-moving, chronic threats such as persistent sea-level rise, prolonged and intense heatwaves, and the cumulative stress they place on critical infrastructure like power grids and transportation networks. This evolving perspective also includes a growing recognition of the human health dimension, with underwriters beginning to model the impacts of extreme heat on outdoor workers and vulnerable populations as part of the broader value chain. In parallel, nature-based solutions are emerging from the realm of environmentalism into the world of finance. Efforts like coral reef restoration to mitigate storm surge and the use of prescribed burns to manage wildfire fuel are now being quantified and integrated into long-term risk assumptions and pricing models, representing a new category of insurable, resilience-building investments.

However, this promising technological transition is not without its own systemic vulnerabilities, chief among them being the industry’s heavy reliance on foundational data from public institutions. The vast majority of innovative climate models, whether developed by nimble startups or established carriers, are built upon datasets provided by agencies like the National Oceanic and Atmospheric Administration (NOAA). The prospect of the federal government scaling back on providing certain essential climate datasets has raised serious alarms across the sector, as it threatens to erode the very foundation of this new risk-assessment ecosystem. The loss of, or even delays in, access to this public data could severely hinder model calibration, stifle innovation, and weaken the industry’s ability to adapt. This potential data gap is considered such a significant threat that a private sector initiative is reportedly in active development to ensure these vital datasets are preserved.

A New Ecosystem for Climate Adaptation

The culmination of these technological and strategic shifts signaled a historic inflection point for the insurance industry. It moved decisively from a traditionally reactive model of paying for losses after they occurred to a proactive, preventive framework designed to build systemic resilience. This transformation was not achieved in isolation; it was recognized that climate risk represents a multi-sector challenge that no single industry could solve on its own. The future of insurance, therefore, began to materialize within an interconnected “ecosystem of co-beneficiaries,” where technology companies, regulators, insurers, and consumers collaborated. The role of the insurer evolved from a simple financial guarantor to that of an active risk-mitigation partner, using its data and capital to guide and incentivize adaptation at both the individual and community levels, a change underscored by the unprecedented focus on insurance at major global forums like Climate Week New York.

This new model was made tangible through the direct integration of risk assessment into policy eligibility and pricing. Insurers began leveraging granular, property-level data from startups like Fora not just to price policies, but to actively manage risk by mandating specific mitigation actions. For homeowners in high-risk areas, undertaking these prescribed measures—such as installing fire-resistant roofing, clearing brush, or improving property drainage—became a prerequisite for obtaining or maintaining coverage at a reasonable price. This represented the ultimate paradigm shift: insurance transformed into a powerful mechanism to enforce adaptation. By directly tying coverage to resilience, the industry charted a viable path forward, creating a more sustainable system that protected all stakeholders and contributed meaningfully to the broader fight against climate change.