In a landscape crowded with companies rushing to adopt the latest technological marvels, a specialist workers’ compensation carrier has demonstrated that a disciplined, business-first approach to artificial intelligence can yield more sustainable and impactful results. Employers has deliberately sidestepped the hype cycle, choosing instead to embed AI into its core operations with a clear and unwavering focus on solving concrete problems and empowering its workforce. This methodical strategy, championed by senior vice-president and CIO Kelley Kage, prioritizes strengthening fundamental business decisions in high-stakes areas like underwriting and claims. By focusing on practical application over technological novelty, the insurer has cultivated a powerful model for digital transformation that emphasizes practicality, strategic partnerships, and a deep-seated commitment from leadership to augment, rather than replace, human expertise. This journey showcases how explainable AI can become a potent tool for scaling performance while maintaining operational clarity and control.

A Disciplined and Problem-First Approach

The company’s strategic blueprint was a conscious departure from the broad, often ill-defined digital transformation initiatives that have become commonplace. Management articulated a clear vision that was not centered on a “race to deploy the latest tools,” but rather on a systematic effort to infuse AI across essential operational domains, including underwriting, claims management, finance, IT, and marketing. The core objective driving this initiative was the removal of friction from critical workflows, the enhancement of consistency in decision-making, and the enablement of effective organizational scaling without compromising oversight or strategic direction. This philosophy demanded a highly specific starting point, which involved meticulously identifying and targeting tangible “pain points” that were actively hindering execution or introducing unwanted variability into key processes. This targeted methodology ensured that every technological investment was directly tethered to a clear and measurable business outcome, transforming AI from a speculative pursuit into a precise operational tool.

This problem-centric methodology translated into a series of focused projects designed to deliver immediate and practical value. Instead of launching a monolithic platform, the company directed its resources toward specific challenges, such as reducing the extensive manual labor tied to premium audits. Another key initiative focused on standardizing the risk assessment process, providing underwriters with AI-driven insights to foster greater consistency and accuracy across the board. Furthermore, the strategy addressed internal efficiency by developing tools to accelerate the onboarding and training of new employees, ensuring that institutional knowledge was transferred effectively and that new team members could contribute more rapidly. By breaking down the larger goal of digital transformation into these manageable, high-impact projects, the organization built momentum, demonstrated tangible wins, and fostered a culture where technology was seen as a direct enabler of better business performance rather than an abstract, top-down mandate.

Augmenting Core Insurance Functions

For a specialized insurance carrier, the integrity and accuracy of decisions made within underwriting and claims are of paramount importance, as these functions directly dictate financial stability, customer satisfaction, and the outcomes for injured workers. Recognizing this, Employers designated these departments as the central focus of its AI strategy. The overarching goal was not to automate these roles out of existence but to augment the skilled professionals who perform them. The initiative was designed to equip underwriters and claims adjusters with more powerful tools and deeper insights, allowing them to apply their expertise more effectively to the most complex and nuanced aspects of their work. This strategic concentration ensured that the most sophisticated technologies were applied where they could generate the most significant business impact, reinforcing the company’s core value proposition and strengthening its competitive position in a highly specialized market.

In the claims department, this human-centric philosophy was brought to life through a strategic combination of data analytics, process automation, and artificial intelligence. The new systems were engineered to streamline the initial intake and triage stages of a claim, automatically processing information and surfacing early risk indicators that could signal the potential for higher claim severity. This proactive capability allows for earlier intervention and more effective claims management. Kelley Kage explicitly stated that the objective was “not about replacing adjusters” but about reallocating their time and cognitive energy away from routine, administrative tasks and toward the “judgment-heavy” cases where their experience and critical thinking skills could add the most value. This augmentation approach has yielded significant benefits, including measurably reduced claim cycle times, tighter control over claim severity development, and ultimately, improved outcomes for all stakeholders involved in the workers’ compensation ecosystem.

Forging Strategic and Transparent Partnerships

Understanding that it could not—and should not—build every solution internally, Employers established a deliberately narrow and disciplined framework for selecting external technology partners. The selection process was rooted in practical, business-oriented criteria, moving far beyond typical feature-and-function comparisons. The first and most critical question was whether a potential partner’s solution solved a genuine, pre-identified operational problem within the company. Following this initial hurdle, the insurer meticulously evaluated the solution’s capacity to integrate cleanly into existing workflows and complex data environments. Scalability was another key consideration, ensuring that any new technology could grow with the organization’s needs. Finally, the company prioritized flexibility to avoid becoming locked into rigid, brittle technological dependencies that could stifle future innovation, ensuring that its technology stack remained agile and adaptable.

Beyond technical specifications, a profound understanding of the insurance domain was a non-negotiable prerequisite for any potential collaborator. Employers actively sought partners who could contribute from a risk and operational business perspective, not just a technological one. This often led to a co-design process, marked by rapid piloting and the establishment of clear, quantifiable metrics for success from the outset. The company deliberately avoided partners who offered only “pretty slides and broad recommendations,” instead favoring those willing to engage deeply with the specifics of business decisions and their direct impacts. When AI was a component of the solution, the principles of explainability, transparency, and robust governance were paramount. This led the company to unequivocally reject “big black-box” systems, particularly in the highly sensitive and regulated areas of underwriting and claims, ensuring that every automated recommendation could be understood, scrutinized, and ultimately overseen by a human expert.

A Leadership-Driven Cultural Shift

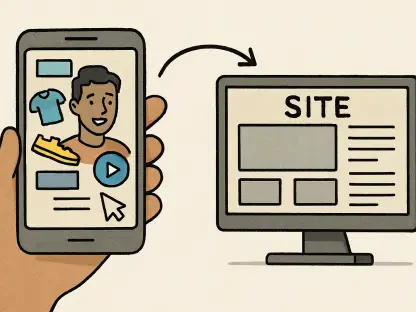

The most profound challenges encountered during the AI integration were not rooted in the technology itself but in the complexities of change management, data quality, and system integration. Insurance professionals, such as underwriters, auditors, and adjusters, operate within a highly regulated environment and face significant time pressures. Consequently, any new technology that introduces additional friction or is perceived as “extra work” is highly likely to meet resistance and fail to gain adoption. To proactively counter this, Employers focused on embedding new capabilities directly into existing systems and designing user-centric interfaces. The objective was to position technology and AI as a “partner and an assistant” that empowers employees to perform their jobs more effectively, with improved quality and increased speed. This focus on a seamless user experience was instrumental in fostering buy-in and turning a technological mandate into a valued workplace tool.

This journey underscored that successful AI integration was fundamentally a leadership and cultural priority that transcended the IT department. The insurer’s forward-looking plan to equip its entire workforce with AI capabilities by 2026 was presented not as an isolated project but as a “genuinely cross-functional leadership effort” with active involvement from the entire executive team. This commitment was reinforced through comprehensive training programs that included both frontline leaders and senior executives, sending a unified message that “we are in this together.” Within this collaborative structure, the CIO’s role was to provide strategic clarity and establish essential guardrails aligned with the company’s risk appetite and operational realities, while simultaneously fostering an environment that encouraged responsible experimentation. The entire initiative was framed through the lens of making better “business decisions with technical dimensions,” proving that sustainable, impactful innovation was achieved by empowering people, not by replacing them.