The Dawn of a New Financial Alliance

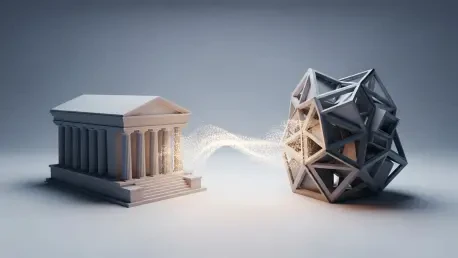

A profound and rapidly accelerating convergence is underway between the worlds of alternative asset management and life insurance. This is not a subtle, incremental change but a seismic shift driven by powerful mutual interests, fundamentally altering how life insurers manage their vast pools of capital. Traditionally bastions of conservative investment, insurers are now strategically pivoting toward the higher-yielding, complex world of private markets. This article explores the mechanics of this powerful symbiosis, examining how the exchange of stable capital for specialized expertise is reshaping product offerings, competitive dynamics, and the very structure of the life insurance industry itself.

From Conservative Bonds to Ambitious Alternatives: Setting the Stage

For decades, the life insurance investment playbook was straightforward and risk-averse, centered on high-grade public bonds that matched their long-term liabilities. This model offered stability and predictability. However, a prolonged period of low interest rates squeezed insurer profitability, making it increasingly difficult to generate the returns needed to meet future policyholder obligations while remaining competitive. This pressure forced the industry to seek out new avenues for yield, creating a crucial opening for alternative asset managers who specialize in less liquid but higher-return asset classes like private debt and real estate. This foundational shift explains why private markets have become the new frontier for an industry built on caution.

The New Symbiosis: Deconstructing the Insurer-Manager Partnership

The Core Exchange: Permanent Capital for Private Market Expertise

At the heart of this transformation lies a synergistic exchange: life insurers provide alternative managers with access to their massive, long-term liabilities and annuity float. This capital is uniquely valuable because it is “semi-permanent,” offering a stable, reliable funding source that insulates managers from the pressures of cyclical fundraising. In return, asset managers bring the specialized expertise needed to navigate and unlock value in private markets. The cost associated with these insurance liabilities is significantly lower than the returns demanded by traditional fund investors, allowing managers to target yield spreads of 100 to 200 basis points over comparable public investments in assets like private debt, real estate, and infrastructure.

From Boardroom Strategy to Consumer Reality: The Annuity Arms Race

This financial re-engineering is not just an abstract concept; it has tangible consequences for consumers. The enhanced returns generated through private market investments enable insurers backed by alternative managers to offer more aggressively priced annuity products. This competitive advantage has fueled a dramatic surge in market share. By 2026, alternative managers’ involvement in U.S. fixed annuity sales accounted for approximately one-third of the market—more than double their share from 2020. This growth is amplified by broader economic tailwinds, including higher interest rates, equity market volatility, and an aging demographic seeking reliable retirement income streams, making these enhanced annuity offerings all the more attractive.

Reshaping the Industry’s Blueprint: Ownership and Capital Flows

The convergence is also triggering a fundamental restructuring of the industry’s architecture. Today, approximately 25% of U.S. insurers are backed by private equity, a testament to the depth of this integration. This shift has also influenced capital strategies on a global scale. To better support these investment-led business models, U.S. life insurers have increasingly turned to offshore reinsurers. By the end of 2026, an estimated 38% of the industry’s $2.4 trillion in reserves had been ceded to Bermuda-based reinsurers, whose regulatory frameworks are often better suited to accommodate portfolios with significant allocations to complex, illiquid assets.

Navigating Uncharted Waters: Opportunities and Headwinds on the Horizon

While the strategic alignment offers clear benefits, it also introduces new layers of risk. Industry analysis offers a note of caution, highlighting that private assets are inherently less liquid, less transparent, and more complex than their public counterparts. Although established managers employ robust risk frameworks to mitigate these challenges, many of these publicly traded alternative firms have not yet been stress-tested through a full, severe credit cycle. Furthermore, operational failures remain a primary cause of distress for asset managers. Despite these risks, the potential for future growth is immense. With U.S. life and annuity assets totaling $6 trillion and alternative managers currently advising on less than 15% of this pool, the runway for continued expansion is substantial.

Strategic Takeaways for Stakeholders

The reshaping of the life insurance industry by private markets demands a nuanced understanding from all participants. For insurers, the key takeaway is the critical need for sophisticated due diligence and robust risk management when partnering with asset managers to ensure that the quest for higher yield does not compromise long-term solvency. For asset managers, the opportunity to access stable capital comes with the immense responsibility of managing liabilities tied to policyholders’ financial security, making operational excellence paramount. For regulators and consumers, the trend promises more competitive products but also necessitates greater scrutiny over transparency, complexity, and the long-term stability of this new, intertwined financial ecosystem.

A Permanent Transformation in a Traditionally Cautious Industry

The convergence of private markets and life insurance was more than a fleeting trend; it represented a permanent and structural evolution of the industry. Driven by a compelling economic logic, this alliance redefined investment strategy, product innovation, and competitive positioning. As alternative managers continued to expand their footprint within the sector, the blend of patient insurance capital with sophisticated private market expertise reshaped the risk and return calculus for insurers and policyholders alike, marking a definitive new chapter for an industry at the heart of long-term financial security.