With a distinguished career in risk management and a sharp focus on AI-driven financial solutions, Simon Glairy has become a leading voice at the intersection of insurance and technology. As traditional institutions begin to embrace the transformative potential of blockchain, we sat down with him to dissect the landmark partnership between Aviva Investors and Ripple. Our conversation explores the practical implications of tokenizing investment products, from streamlining back-office operations and navigating complex regulations to what this shift signals for the future of the entire asset management industry.

This partnership marks Aviva Investors’ initial foray into tokenized fund structures. What specific operational pain points do you expect tokenization on the XRP Ledger to solve, and how will these efficiencies in time and cost translate into tangible benefits for your clients?

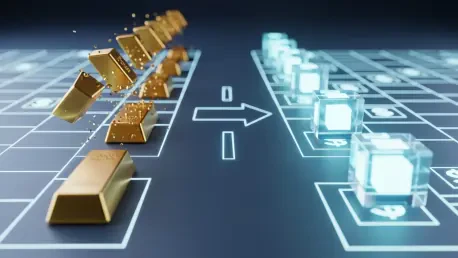

At its core, traditional asset management is burdened by a legacy of intermediaries and manual processes. Think about the layers of reconciliation and the days it takes for settlements to clear; it’s a system that’s ripe for disruption. What we’re seeing with this move is an attempt to directly tackle that administrative friction. By leveraging a blockchain like the XRP Ledger, you can essentially automate reconciliation in real-time and enable direct, peer-to-peer transactions. This eliminates many of the costly and time-consuming steps that currently inflate operational overhead. For the end client, this isn’t just an abstract back-office improvement. It translates directly into a better experience—potentially lower management fees, faster access to their capital, and a level of transparency into their investments that simply wasn’t possible before.

The XRP Ledger is highlighted for its built-in compliance tools and low energy use. How do these specific features address the stringent regulatory and sustainability demands of a major insurance asset manager, and what does the onboarding process look like for an institution like Aviva?

For an institution like Aviva, regulatory compliance and ESG commitments are non-negotiable pillars of their business. The fact that the XRPL was designed with built-in compliance features is a massive draw. It means the infrastructure is pre-tooled for the realities of operating in highly regulated financial markets, which drastically lowers the barrier to entry compared to more open, less structured blockchains. The low energy use is equally critical. The platform avoids the energy-intensive mining processes associated with other networks, which aligns perfectly with the sustainability objectives that are increasingly demanded by both regulators and investors. Onboarding isn’t a simple flip of a switch; it involves integrating this new ledger system with existing portfolios. The key is that the XRPL provides a secure and scalable foundation, allowing a firm like Aviva to begin tokenizing a portion of its funds while maintaining the robust security standards its institutional clients absolutely require.

With tokenization now moving from experimentation to large-scale production, what were the key technological or regulatory hurdles that had to be cleared to make this a reality? Can you describe what the “next generation of institutional assets” will look like in practice for investors?

For years, the industry has been in a sandbox phase, running pilots and proofs-of-concept. The big leap to production required two things: mature, reliable technology and a clearer, if not yet complete, regulatory pathway. Technologically, platforms had to prove they could handle institutional-grade volume and security, which Ripple has demonstrated by processing over four billion transactions. The regulatory side has been a slower burn, but as authorities provide more guidance, large, conservative institutions like Aviva gain the confidence to move forward. For an investor, this “next generation” of assets means their fund shares could exist as digital tokens in a wallet. This opens up possibilities like near-instant settlement instead of waiting days, fractional ownership of previously illiquid assets, and potentially a more dynamic, liquid secondary market for assets that are traditionally locked up.

As a leader in the insurance sector, Aviva is now pioneering this technology. What is the long-term vision for integrating blockchain across your product portfolio, and how will you measure the success of these first tokenized funds against their traditional counterparts?

This initial step is about more than just one or two tokenized funds; it’s about building a new set of rails for the entire investment lifecycle. The long-term vision is to leverage this technology to create more efficient, transparent, and accessible products across the board. Success won’t just be a line on a balance sheet. It will be measured by clear operational metrics: a quantifiable reduction in settlement times, a measurable decrease in administrative costs, and improved liquidity. On the client side, success will be gauged by investor feedback, faster onboarding, and ultimately, whether these new structures deliver better net returns by stripping out a layer of systemic inefficiency. It’s a strategic commitment to innovation that positions them at the forefront of a major technological shift.

What is your forecast for the adoption of tokenized assets within the mainstream insurance and investment sectors over the next five years?

I believe we are at an inflection point. The partnership between a household name like Aviva and a major blockchain player like Ripple sends a powerful signal to the rest of the industry. Over the next five years, I expect we will see a rapid acceleration from cautious exploration to strategic implementation. We’ll see the first wave of large institutions, like Aviva, prove the model and iron out the kinks. This will create a playbook for others to follow. While it may not become the dominant model in five years, it will certainly become a significant and established part of the institutional landscape. The efficiencies are too compelling to ignore, and as one leader demonstrates the benefits, the pressure for others to adopt will become immense. This is no longer a question of ‘if,’ but ‘when’ and ‘how fast.’