The initial silence following a severe winter storm often belies the escalating crisis brewing within homes and properties, a crisis that presents a fundamentally different challenge for the insurance industry compared to more sudden catastrophic events. As severe arctic blasts become more frequent and geographically widespread, insurers are grappling with a surge of complex claims that strain both financial reserves and operational capacity. Unlike the immediate, concentrated damage of a hurricane or tornado, the impact of a deep freeze unfolds over days and weeks, creating a prolonged and evolving claims environment. This slow-motion disaster tests the preparedness of insurance carriers, the guidance of brokers and agents, and the preventative measures taken by homeowners, forcing the entire industry to adapt to a new and challenging reality where the first thaw is often just the beginning of the financial fallout.

The Unfolding Crisis

The claims landscape following a major winter storm is characterized by a “long-tail” effect that complicates every stage of the response. The first wave of reports typically involves obvious and immediate damage, such as claims for burst pipes or property damage from ice-laden tree branches. However, a significant portion of the losses emerges days or even weeks later as temperatures fluctuate. Insidious issues like ice damming on roofs, which allows water to seep into attics and wall cavities, often manifest only after a cycle of thawing and refreezing. This stretched-out timeline creates a continuous influx of new claims from a single event, putting sustained pressure on claims departments and adjuster resources. This volatility makes it incredibly difficult for insurers to accurately assess their total financial exposure and set appropriate reserves, a problem that is compounded when successive storms hit before the previous caseload can be managed effectively.

This challenge is magnified as severe cold snaps increasingly strike regions historically unaccustomed to such weather, particularly across the Southeastern United States. In these non-traditional markets, insurance carriers often lack the necessary local infrastructure, including a sufficient number of on-the-ground field adjusters and established networks of qualified vendors like plumbers and water mitigation specialists who can respond quickly. This gap in preparedness extends beyond the insurance industry. Municipalities in these regions may lack the equipment to treat icy roads, leading to transportation disruptions and a spike in auto claims. Furthermore, homeowners are often less aware of critical preventative maintenance, such as insulating pipes or properly servicing heating systems, resulting in a higher frequency of freeze-related claims that could have been avoided.

From Bad to Worse How Delays Amplify Damage

Following a storm, logistical hurdles directly translate into higher costs for both the policyholder and the insurer. Blocked or impassable roads, ongoing unsafe conditions, and the sheer volume of claims in a concentrated area can significantly slow the deployment of field adjusters. These delays are not merely inconvenient; they are a primary driver of loss severity. Time is a critical factor in mitigating water damage. A burst pipe that is not addressed within hours can lead to extensive interior saturation. If this moisture is not professionally removed, it creates a perfect environment for mold growth. This dynamic can quickly transform a relatively manageable plumbing claim into a major, complex loss involving costly mold remediation, extended displacement for the homeowner, and significantly higher rebuilding costs, underscoring the importance of the policy requirement for insureds to take prompt action.

A substantial portion of these devastating winter storm losses are preventable, often stemming from inadequate property maintenance and common homeowner missteps. A leading contributor to freeze-related claims is the failure to properly insulate plumbing located near exterior walls or to ensure heating systems can withstand prolonged periods of extreme cold. Secondary residences, such as vacation homes and other unoccupied properties, are particularly at risk. When these properties are left vacant during a deep freeze, the risk of a catastrophic event like a pipe burst increases exponentially. This highlights the homeowner’s critical responsibility to ensure such properties are either properly heated, have their water systems shut off and drained, or are regularly checked by a caretaker to prevent a small issue from becoming a major disaster.

The Digital First Responders

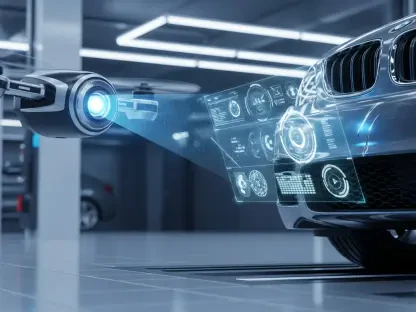

To manage the overwhelming volume of claims during a surge event, the insurance industry is strategically adopting virtual tools and consumer self-service technology. Virtual claims handling, which allows policyholders to submit photos and videos of damage through mobile applications or web portals, has become a crucial “pressure valve” for carriers. This technology enables desk adjusters to rapidly assess damage remotely and, in many cases, initiate the mitigation process—such as dispatching a water extraction crew—or even settle simpler claims without needing to wait for a field adjuster to visit the site. This digital-first approach significantly shortens claim cycle times, reduces the severity of losses by enabling a faster response, and ultimately improves the policyholder’s experience during a highly stressful time.

While virtual tools are highly effective, they are not a universal solution for every claim. The industry has learned that complex, high-value, or structurally significant losses still necessitate the expertise of an in-person field adjuster. Consequently, the prevailing strategy is a hybrid approach that uses virtual handling to efficiently manage the high volume of less complex claims. This frees up experienced field resources to focus their attention on the most challenging cases that require a thorough, on-site inspection. By blending technology with traditional methods, insurers can optimize their resources, triage claims more effectively, and ensure that the right level of expertise is applied to each loss, facilitating a more streamlined and effective recovery process for everyone involved.

A Collaborative Path Forward

Ultimately, the successful navigation of modern winter storm challenges was shown to require a multifaceted and collaborative approach. The outcome for a policyholder after a loss was determined by a combination of factors: the selection of an insurer with robust catastrophe response capabilities, reliance on a knowledgeable agent to provide crucial guidance, and the proactive maintenance of one’s property to prevent losses in the first place. In the aftermath of a catastrophe, the speed at which insurers and policyholders worked together to mitigate further damage proved to be paramount. The effective integration of technology, combined with the irreplaceable expertise of claims professionals and the proactive engagement of homeowners, was the key to managing risk and facilitating recovery in an era of increasingly volatile winter weather.