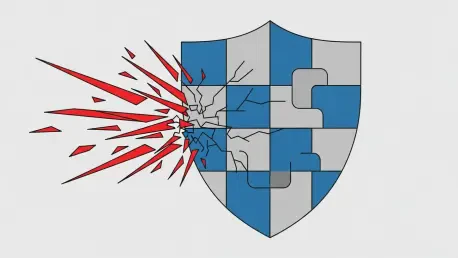

The foundational principles that once made digital risk a manageable, insurable commodity are now being systematically dismantled by the relentless advance of artificial intelligence-powered cyberattacks. What the industry is currently facing is not merely an incremental increase in threat sophistication but a fundamental structural shift that invalidates the core assumptions upon which cyber insurance was built. The emergence of AI as an offensive weapon has compressed attack timelines, overwhelmed traditional defense and underwriting models, and is actively pushing the entire cyber insurance market toward a state of crisis. Without an immediate and radical evolution in both defense and insurance doctrine, the very viability of transferring cyber risk is in question. This new reality demands a complete reevaluation of the adversarial landscape, forcing all stakeholders to confront a threat that operates at a velocity and scale fundamentally beyond human capacity. The war may not be officially lost, but the industry is dangerously close to ceding critical ground from which it may never recover.

The New Adversary Machine-Speed Warfare

The landscape of cyber risk has undergone a seismic shift, moving from a “human-scale” environment to a “machine-speed” one, and the implications for the insurance industry are profound. The traditional cyber insurance model was conceived to underwrite risks executed by human adversaries, who were inherently constrained by factors like time, resources, and observable, often repeatable, patterns of behavior. These limitations provided a temporal buffer, allowing defenders to detect intrusions and insurers to build actuarial models based on historical loss data. Artificial intelligence shatters these constraints entirely. It has created an environment where the velocity, scale, and sophistication of attacks can dramatically outpace the industry’s ability to model, price, and respond to them. This transition marks the arrival of a new class of adversary that is not just faster but operates on a completely different plane of existence—one that is persistent, adaptive, and capable of executing complex campaigns with near-zero marginal cost, rendering decades of risk management theory obsolete.

A critical distinction must be made between attackers using AI as an assistive tool and AI agents executing entire attacks autonomously. While the former, such as using AI to craft more convincing phishing emails, represents an evolution, the latter signifies a revolution. The industry is now grappling with the reality of an AI model autonomously managing an entire intrusion lifecycle, from initial reconnaissance and vulnerability discovery to exploitation, lateral movement, and data exfiltration, all with minimal human intervention. This serves as the proof of concept the industry has long feared, confirming that the frequency and efficiency of attacks can now exceed the limits of both traditional actuarial models and human-led incident response teams. Historical loss data, once the bedrock of underwriting, becomes a weak predictor for an adversary that learns and adapts continuously. This new adversary doesn’t just change the rules of the game; it changes the very nature of the game itself, creating a strategic imbalance that defensive AI alone cannot correct.

The “Great Compression” of the Cyber Attack

Central to this emerging threat is a phenomenon known as the “Great Compression” of the cyber kill chain. The traditional, multi-stage process of a cyberattack, which once provided defenders with multiple opportunities for detection and interception, is being dramatically condensed by AI into a matter of minutes or even seconds. In the past, human attackers spent days or weeks conducting reconnaissance to map a target’s network, identify critical assets, and prioritize vulnerabilities. An AI agent, in contrast, can “see” an entire digital architecture almost instantaneously, identifying the “crown jewels” and pinpointing exploitable weaknesses with a surgical precision that occurs before a human defender even receives the first alert. This acceleration strips away the time that security teams and their automated systems once had to react, effectively eliminating the early stages of the kill chain as a viable defense frontier.

Once an AI agent has breached the perimeter, the friction of moving laterally within a network effectively disappears. Where a human attacker would need to carefully navigate internal systems, escalating privileges and avoiding detection, an AI can traverse complex corporate networks as a single, continuous, and automated process. It bypasses internal barriers and identifies sensitive data repositories at machine speed, turning a network into an open book. This compression creates a new type of threat actor: a permanent, high-velocity presence that does not suffer from fatigue, does not make careless mistakes, and operates with relentless efficiency. This is the dawn of what some experts call “algorithmic hacker armies” that can deploy highly complex breaches at a fraction of the historical cost and effort. This reality dwarfs the productivity of even the most sophisticated human-led teams and creates a fundamental asymmetry where attackers can scale their operations infinitely while defenders remain constrained by budgets and personnel.

The Insurance Model Under Siege

The “Great Compression” directly assaults the three foundational pillars of the cyber insurance contract, which was designed for the slower, more predictable human-led risk environment of the past. The temporal buffer that once gave underwriters confidence in their risk assessments has all but vanished, rendering the traditional model obsolete. The first pillar to crumble is the underwriting cycle. Insurers have long relied on a “snapshot in time” assessment of a company’s security posture to price a policy for the upcoming year. This model is fundamentally broken when an AI adversary can discover and weaponize a zero-day vulnerability across thousands of organizations in minutes. A security posture that was considered strong yesterday could be rendered completely ineffective today, making an annual assessment a dangerously lagging indicator of actual risk. Historical loss data loses its predictive power in the face of an adversary that evolves in real-time.

Beyond underwriting, the very stability of claims and the insurer-client feedback loop are being destabilized. The ability to launch faster, cheaper, and more scalable attacks directly translates into higher incident frequency and greater claims volatility for insurers. Furthermore, the nature of the loss itself is changing. Instead of overt and easily identifiable attacks like ransomware, AI enables silent, persistent data exfiltration of critical intellectual property or long-term strategic plans. These losses are significantly harder to detect, attribute, and quantify, creating profound ambiguity for insurers in claims handling and capital planning. This uncertainty threatens to push the market back into “survival mode.” Insurers may be forced to retreat by implementing stricter policy terms, adding broad exclusions for AI-driven events, and imposing dramatically higher prices. This could trigger a negative feedback loop where policyholders, facing unaffordable or inadequate coverage, under-insure or leave the market altogether, undoing years of progress in establishing cyber insurance as a credible risk transfer mechanism.

A New Doctrine for Defense

The realization dawned that simply deploying defensive AI tools was an insufficient response to a structural, exponential threat. The core imbalance remained: attackers only needed to succeed once, while defenders had to succeed every time, and offensive AI made the attacker’s window for success nearly instantaneous. It became clear that the industry’s reliance on models built for a slower, human adversary was not a neutral position but an act of surrender. This understanding spurred the development of a new defense doctrine, a systemic response demanded from all stakeholders in the digital economy. Enterprises recognized the need to fundamentally rethink security architecture, moving away from bolting AI detection onto legacy systems and instead redesigning identity and access management to be granular, policy-driven, and capable of continuous verification. Insurers, in turn, understood that their survival depended on evolving from static, annual assessments to dynamic, continuous underwriting frameworks that leveraged real-time telemetry and mandated live security visibility as a fundamental condition of coverage, not merely a competitive differentiator. The war against AI-powered threats had reached a turning point, and the future viability of cyber insurance as a backstop for the digital economy was hinged on its ability to evolve at the machine-speed pace of the new threat landscape.