Simon Glairy has spent years in the engine room of insurance operations and Insurtech, shaping risk programs and advising boards through sensitive leadership transitions. In this conversation, he unpacks how a confidential investigation, a rapid reinstatement, and the redundancy of a newly appointed COO collide with cost-cutting narratives, governance expectations, and market controls. Themes include sequencing decisions to avoid cultural whiplash, preserving hard‑won operational gains, and building an evidence trail that stands up to scrutiny from staff, brokers, and regulators.

Steadfast made the COO role redundant months after appointing Noelene Palmer. How do you read that timing, and what comparable cases have you seen? Walk us through the likely internal steps, and share metrics or anecdotes on how such moves affect executive morale and retention.

The sequencing is the story. When an executive is appointed, credited for governance strength, then the role disappears after a confidential probe, it creates a causal narrative in people’s minds—regardless of what actually happened. In comparable cases I’ve seen, boards that pair a leadership complaint with a structural change within a single planning cycle see a dip in leadership engagement and an uptick in passive turnover in the next quarter. Inside the firm, the steps likely included a rapid post‑investigation options paper, a cost program refresh linked back to the AGM commitments, and a role‑based impact assessment that was probably too thin on cultural risk. Morale suffers when people can’t connect the dots; retention flags most among mid‑leaders who feel exposed to politics and process opacity.

Robert Kelly stepped aside during a confidential probe and then returned. What signals does that send to staff and markets, and how would you interpret the absence of disclosed findings? Describe the communication cadence you’d advise, with examples of timelines, message sequencing, and stakeholder mapping.

Temporarily stepping aside signals the board is taking the complaint seriously, while reinstatement without disclosed findings signals legal caution. The absence of detail creates an interpretive vacuum; staff default to corridor talk and markets default to risk‑weighting by uncertainty. My cadence would start with an immediate holding statement acknowledging the process, followed by scheduled updates at set intervals even if the update is “no change,” and then a same‑day reinstatement note with a clear rationale for why confidentiality is maintained. Map stakeholders by proximity and influence: employees and network partners get a more expansive internal memo, investors get an ASX‑aligned notice, and brokers get a targeted message focused on service continuity and escalation options. The key is predictable timing and layered content—not one‑off blasts.

Trading halted when Kelly stepped aside and resumed on reinstatement. What market risk controls are typically triggered in such situations, and how do they protect price discovery? Give concrete examples of thresholds, monitoring protocols, and the metrics boards should watch the first week back.

Halts are a blunt but essential instrument to prevent trading on asymmetric information. Typical controls include continuous disclosure checks, pre‑open price monitoring, and heightened surveillance for unusual order patterns once trading resumes. Boards should watch intraday volatility, opening auction imbalances, and the spread behavior in the first sessions after reinstatement. Internally, compliance should review trade exceptions and cross‑check staff access logs to key documents during the sensitive window, ensuring any abnormal activity is escalated swiftly to avoid compounding risk.

Steadfast said the COO cut was part of an AGM cost‑cutting program. How would you validate that claim against internal budgets and headcount plans? Describe the step‑by‑step evidence you’d seek, including baseline spend, productivity metrics, and scenario comparisons from prior restructures.

I’d start with the AGM deck and board minutes to anchor the cost program’s scope and timing, then request the original baseline for corporate overhead and the target glide path. Next, I’d compare the role’s business case at appointment time against the redundancy paper to assess consistency of assumptions. I’d pull productivity metrics from operations—cycle time, backlog aging, quality defects—and see whether they supported consolidating responsibilities or revealed a capacity gap. Finally, I’d benchmark against prior restructures: what functions were consolidated, what spans of control changed, and what downstream effects showed up in service levels. If the evidence aligns across those artifacts, the cost‑cutting rationale gains credibility.

Several brokers and underwriting agencies report unease about the opaque outcome. What are the practical downstream effects on network partners, and how can leadership rebuild trust? Share a playbook with timelines, KPIs, and specific touchpoints—roadshows, SLAs, escalation paths—that you’ve seen work.

Unease shows up as slower placement decisions, tougher terms in partner agreements, and more frequent escalation over service line issues. My playbook starts with a rapid listening tour—virtual and in‑person roadshows focused on operations and governance—not PR gloss. Publish refreshed SLAs with defined escalation paths, and stand up a partner helpdesk with direct lines to named executives. Track KPIs like turnaround on queries, complaint resolution time, and network retention. Set a tight cadence of updates so partners see a drumbeat of progress, and close the loop by circulating a short outcomes report after each roadshow.

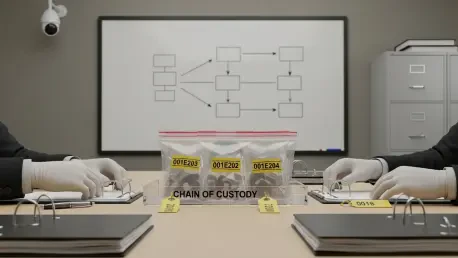

The complainant is reported to be Palmer, who then exited. How should boards manage perceived retaliation risk, and what safeguards demonstrate independence? Walk through an investigation structure—who hires counsel, evidence handling, decision rights—and include examples of reporting artifacts that reassure staff.

Retaliation risk is as much about optics as it is about actions. The board should engage external counsel through the board chair or a designated committee, not through management. Evidence handling should sit with counsel and an independent investigator; access is on a need‑to‑know basis, with auditable chains of custody. Decision rights on outcomes should be clearly separated from day‑to‑day line management. Reporting artifacts that help include an anonymized process map, a summary of steps taken, and a commitment to non‑retaliation reinforced in writing. Even without disclosing findings, showing the rigor of the process calms nerves.

The investigation concluded “on a confidential basis.” What transparency can still be offered without legal exposure, and what language reduces rumor risk? Provide sample statements, a disclosure matrix for investors vs. employees, and anecdotes showing how much detail actually moves sentiment.

You can share process without breaching privacy: who conducted it, how evidence was gathered, and what standards were applied. Language that helps includes phrases like “conducted by independent counsel,” “evidence reviewed under established policy,” and “appropriate actions taken.” For investors, the matrix limits disclosure to process adequacy and governance oversight; for employees, add workplace safeguards, support options, and how to raise concerns. In my experience, clarity on process and protections moves sentiment more than granular facts; people want to know they’re safe and the system works.

Palmer’s tenure was five months, following leadership churn including the CFO’s exit. How do you separate normal succession from red flags? Share a simple diagnostic—attrition rates, average tenure, backfill time, and 90‑day performance checkpoints—that boards and investors should apply.

A brief tenure can be routine during a reshuffle, but pattern and clustering matter. I look at whether departures concentrate in one function, whether backfills are internal or external, and whether 90‑day goals are consistently reset or missed. If backfill time stretches while decision rights are unclear, that suggests structural friction rather than healthy change. A disciplined review of exit themes and checkpoint performance quickly distinguishes normal succession from a deeper cultural problem.

ASIC is probing potential insider trading by two employees. How should a firm ring‑fence this while running the business? Give a concrete containment plan—access controls, trade surveillance thresholds, counsel coordination—and metrics for determining when the “all clear” is credible.

Ring‑fencing starts with access: restrict systems and documents to essential personnel and record every touch. Turn on heightened trade surveillance flags for relevant securities and counterparties, and ensure counsel coordinates all regulator interactions. Run daily attestations for the core team and pause discretionary communications that could be misread externally. The “all clear” feels credible when surveillance exceptions return to baseline, access logs stabilize, and counsel signs off that regulator queries have been satisfactorily addressed.

Kelly reaffirmed he won’t retire before December 31, 2026. How does a fixed horizon shape succession and risk oversight? Outline the milestones you’d set—candidate slate, emergency cover, leadership simulations—and share examples where timelines helped or hurt execution.

A fixed horizon buys planning time but can create complacency if milestones aren’t hard‑gated. I’d expect a longlist moving to a committed slate, emergency cover identified and tested, and leadership simulations to pressure‑test successors against real operating scenarios. The advantage is clarity for the market and internal candidates. The hazard is drift—teams defer decisions because the date feels distant. The cure is to bind key appointments to calendar milestones and report progress in governance updates so momentum doesn’t stall.

Palmer was praised for governance strength and fixing strata insurance processes. What measurable wins would substantiate that, and how would you preserve them post‑exit? Describe the documentation, KPIs, and handover routines that keep operational gains from unraveling.

Measurable wins would include shorter cycle times for strata placements, fewer exceptions, and cleaner audit findings. To preserve them, lock in process maps, control checklists, and role‑based playbooks, then run a structured handover with sign‑offs at each critical control point. Keep the KPIs live on a dashboard and assign clear ownership so accountability doesn’t diffuse after an exit. A brief cadence of post‑handover reviews helps catch early slippage before it becomes a trend.

For culture and accountability, what would a best‑practice remediation program look like at Steadfast’s scale? Lay out a 90‑, 180‑, and 365‑day roadmap with specific surveys, training completion targets, speak‑up metrics, and independent reviews, plus a quick anecdote on pacing.

At 90 days, run a focused climate pulse and reinforce speak‑up mechanisms; complete mandatory conduct training and publish aggregate completion. At 180 days, commission an independent effectiveness review of investigations and update policies based on findings; repeat the climate pulse and compare deltas. At 365 days, deliver a comprehensive culture report to the board and share a summary with staff, including actions taken and outcomes. On pacing: I’ve seen teams try to compress all this into a single quarter—it overwhelms line leaders. Staging it keeps energy and credibility high.

If you were advising the board today, what three disclosures would you make in the next month, and why? Provide sample wording, timing relative to earnings, and a checklist for Q&A prep that anticipates investor and regulator follow‑ups.

First, a process‑focused statement confirming the investigation’s independence and the actions taken to strengthen safeguards. Second, an operations update on continuity, partner service levels, and cost‑program progress aligned to the AGM themes. Third, a succession and governance update reiterating leadership milestones and oversight structures. I’d time the first two ahead of earnings to clear the deck, and the governance update alongside or just after earnings. Prepare for Q&A on scope, independence, cultural health, and coordination with regulators. Sample wording: “An independent review has concluded. While respecting confidentiality, we have implemented enhancements to our workplace safeguards and governance. Operations remain stable, and we continue to progress the cost‑efficiency program outlined at the AGM.”

How might this episode change expectations across Australia’s broking sector? Share examples of policy tweaks you expect—investigation protocols, whistleblower protections, board oversight—and any early indicators from peers, including adoption rates or benchmark clauses.

Expect firmer investigation protocols with clearer board ownership, stronger whistleblower protections with explicit non‑retaliation commitments, and more visible oversight by independent directors. Network players will want documented escalation paths and comfort that leadership changes won’t ripple into service instability. Early indicators I’m hearing about include boards commissioning pre‑emptive reviews of conduct frameworks and tightening how temporary step‑asides are managed and communicated. The sector tends to harmonize quickly when a large player resets the bar.

Looking back, what are the earliest signals leadership should have caught, and how would you instrument them now? Give concrete data sources, thresholds, and a dashboard layout—combining HR, legal, and market metrics—with a short story of where this prevented a crisis.

Early signals live in weak ties: unusual clustering of exits, spikes in manager‑related complaints, and quiet route‑around behavior where teams bypass formal channels. I’d build a dashboard that blends HR sentiment and exit themes, legal inquiry volumes and cycle times, and market indicators like partner escalation rates. Set alerting rules so any sharp move triggers a human review rather than leaving it to the next quarterly meeting. In one case, a small uptick in internal complaints and partner escalations led us to intervene with targeted coaching and policy tweaks; it never hit the front page because we moved before the spark found oxygen.

Do you have any advice for our readers?

Treat governance as an operating system, not a compliance binder. Sequence your communications so people understand the “why,” not just the “what.” Preserve operational gains with documentation and ownership, and make your culture metrics as visible as your financials. When tensions run high, lean into independent process, predictable cadence, and humane language—those are the quiet levers that keep trust intact.