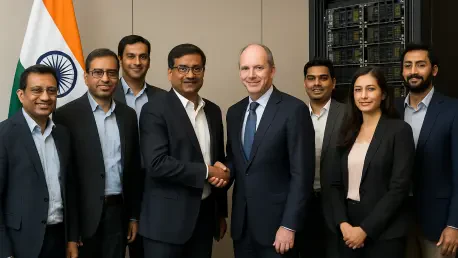

A landmark investment is set to dramatically reshape India’s artificial intelligence landscape, signaling a decisive move toward technological self-reliance in a globally competitive field. The Indian AI infrastructure startup Neysa has secured a staggering commitment of up to $1.2 billion, led by the U.S. private equity giant Blackstone and a consortium of co-investors including Teachers’ Venture Growth, TVS Capital, 360 ONE Asset, and Nexus Venture Partners. This monumental funding package is designed to turbocharge the development of sovereign AI capabilities within the nation, addressing the soaring demand for computational power that underpins modern AI innovation. The deal is structured with $600 million in primary equity, which will grant Blackstone a majority stake in the burgeoning company, complemented by an additional $600 million in planned debt financing. This capital infusion is primarily earmarked for a massive expansion of Neysa’s GPU-based compute capacity, positioning the firm to become a central pillar in India’s strategic push to build a robust, independent AI ecosystem.

The Rise of Specialized AI Neo Clouds

The emergence of companies like Neysa represents a pivotal shift in the cloud computing industry, giving rise to a new category of specialized providers often referred to as “neo-clouds.” These entities are strategically positioned to address the acute global supply constraints for specialized chips and data center capacity that have been created by the explosive growth of artificial intelligence. Unlike traditional hyperscalers, which offer a broad suite of services, neo-clouds focus specifically on providing the dedicated, high-performance GPU capacity essential for training and deploying complex AI models. Their business model is built on agility and customization, offering faster deployment timelines and bespoke solutions tailored to the unique requirements of enterprises, government agencies, and AI developers. This specialized approach is proving critical for clients operating under strict regulatory frameworks, where issues like data sovereignty, security, and low-latency performance are non-negotiable, creating a distinct market niche that legacy providers have struggled to fill effectively.

The core value proposition of these specialized AI infrastructure providers extends beyond mere hardware access to encompass a more holistic and supportive partnership model. For industries such as financial services and healthcare, the mandate to keep sensitive data within national borders for compliance reasons is a powerful driver for adopting local cloud solutions. Neysa capitalizes on this by ensuring its infrastructure meets these stringent data localization requirements. According to co-founder and CEO Sharad Sanghi, a key differentiator for the company is its commitment to providing intensive, round-the-clock customer support—a level of service that larger, more commoditized hyperscalers often do not offer. This high-touch approach addresses a significant pain point for organizations that require deep technical collaboration and rapid problem-solving as they navigate the complexities of AI development and deployment. By combining cutting-edge technology with dedicated support, neo-clouds are carving out a formidable position in the rapidly evolving digital economy.

A Strategic Bet on India’s AI Future

This substantial investment from Blackstone and its partners is anchored in a deeply optimistic and data-driven consensus on the future of India’s AI market. The firm’s analysis projects an unprecedented surge in demand for AI processing power, estimating that India’s current deployment of fewer than 60,000 GPUs will scale nearly thirty-fold to over two million in the coming years. This explosive growth forecast is not based on speculation but is supported by a confluence of powerful domestic trends. A significant catalyst is the proactive push from the Indian government to establish a formidable domestic AI infrastructure, viewing it as a critical component of national security and economic competitiveness. Furthermore, a vibrant and rapidly expanding ecosystem of Indian developers is actively building sophisticated AI models tailored to local languages, cultures, and business challenges, creating a groundswell of demand for accessible, high-performance computing resources that can fuel their innovation.

The momentum behind India’s AI expansion is also being amplified by powerful international forces and the specific needs of regulated sectors. Global AI laboratories and technology companies are increasingly looking to deploy computing capacity closer to their vast Indian user bases. This strategic move is driven by the dual objectives of minimizing latency to enhance user experience and adhering to the country’s evolving data regulations, making local infrastructure providers like Neysa indispensable partners. This deal seamlessly aligns with Blackstone’s broader global investment strategy, which has seen the firm commit billions to digital and AI infrastructure worldwide. Previous landmark investments in large-scale data center platforms such as QTS and AirTrunk, along with backing for specialized AI providers like CoreWeave and Firmus, demonstrate a clear and consistent thesis: the infrastructure powering the AI revolution is one of the most significant investment opportunities of this decade.

Charting the Path Forward

Founded in 2023, the Mumbai-headquartered Neysa’s ambitious growth trajectory was meticulously planned to address the escalating computational demands of the Indian market. The company, which currently operates approximately 1,200 GPUs, set clear intentions to leverage the new capital for the deployment of large-scale GPU clusters. This strategic expansion aimed to scale its capacity to over 20,000 GPUs, a move designed to meet accelerating customer demand and solidify its position as a leading domestic AI infrastructure provider. Neysa’s leadership outlined a clear near-term goal: to more than triple its capacity and revenue within the next year, reflecting the urgent need for its services. While the bulk of the funding was allocated for hardware acquisition and data center build-outs, a smaller yet crucial portion was earmarked for research and development. These R&D efforts focused on enhancing Neysa’s proprietary software platforms for sophisticated orchestration, comprehensive observability, and robust security, ensuring its offerings remained at the cutting edge of technology. The startup, with a lean and expert team of 110, also harbored long-term ambitions to expand its operational footprint beyond India, seeing its success as a potential blueprint for other emerging markets. The investment from Blackstone and its partners provided not just the financial fuel but also the strategic validation needed to pursue this vision, marking a pivotal moment in the company’s journey and for India’s technological future.