The intricate web of global commerce, once a symbol of efficiency, is now revealing itself as a landscape of interconnected vulnerabilities where a single digital disruption can trigger a catastrophic chain reaction. As organizations deepen their reliance on shared cloud infrastructure and complex

The United Kingdom's insurance sector is navigating a complex strategic landscape, with firms simultaneously pursuing the transformative potential of artificial intelligence while also building stronger defenses against escalating third-party risks. A recent industry analysis reveals that a

The modern insurance landscape presents a formidable challenge for independent brokers attempting to navigate a sea of monolithic corporations while retaining their autonomy. In this environment, a hybrid franchise model is emerging as a powerful alternative, blending corporate strength with

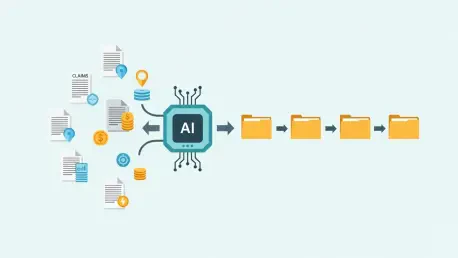

The modern insurance claims process is often hampered by a labyrinth of disconnected data sources, making it exceedingly difficult for insurers to gain a clear and immediate understanding of the risks and relationships involved in any given claim. In response to this industry-wide challenge,

In the intricate and highly regulated annuity market, the greatest danger to an insurer's profitability and stability may not be unpredictable economic shifts, but rather the archaic, fragmented tools they rely on to navigate them. This operational friction creates a critical vulnerability, forcing

Global insurance and investment organization Starr has initiated a significant technological overhaul of its claims processing operations, adopting an advanced AI-native platform to manage its property-and-casualty and specialty insurance lines. This strategic implementation signals a major step in