In an economy where a single cloud outage or software-as-a-service failure can cost millions in lost revenue and reputational damage, businesses are discovering that traditional cyber insurance often falls short. The lengthy claims processes and complex policy language of indemnity-based coverage

The modern insurance landscape is grappling with an unprecedented scalability crisis, fueled by a surge in claim volumes that consistently outpaces the availability of seasoned claims adjusters and heightened consumer expectations for rapid and accurate service. In response to this pressing

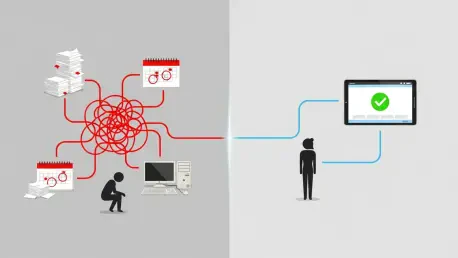

In the hyper-competitive insurance landscape, the ability to launch a new product or adjust a rate in days, not months, is no longer an advantage but a fundamental requirement for survival. Yet for many carriers, the very information technology department tasked with enabling this agility has

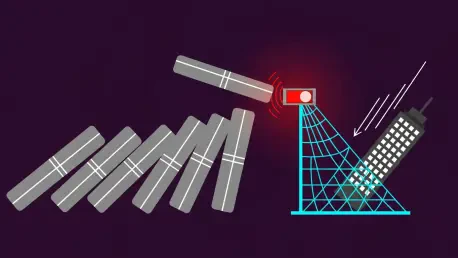

Beyond Business as Usual: Why Outage Coverage Demands a New Approach In an increasingly connected world, a power outage is a catastrophic event that can bring a business to a grinding halt. With grid instability and climate-related disruptions on the rise, the financial toll is staggering, costing

The insurance industry is currently navigating a critical inflection point, where the sheer and ever-increasing volume of high-frequency, low-value claims is fundamentally reshaping operational demands and customer expectations. Automated Claims Processing represents a significant technological

In the relentless pursuit of national expansion, many insurance organizations are unknowingly anchored by an invisible drag on their growth: an outdated and manual approach to producer licensing. This is not merely an administrative inconvenience; it represents a significant operational risk that