Setting the Stage: The Soft Market Challenge in Insurance The insurance industry finds itself grappling with a seismic shift as soft market conditions intensify competition, drive down premiums, and squeeze profit margins across the board. With insurers vying for market share in an environment

What happens when an industry as old as insurance meets the cutting edge of artificial intelligence? A San Francisco-based startup, Liberate, is answering that question with a massive $50 million Series B funding round, shaking up the InsurTech landscape with a bold vision for the future. This

In an era where the insurance industry grapples with increasingly intricate risk landscapes and operational inefficiencies, a groundbreaking solution has emerged to redefine the underwriting process for property and casualty (P&C) insurers. The release of a cutting-edge software platform marks a

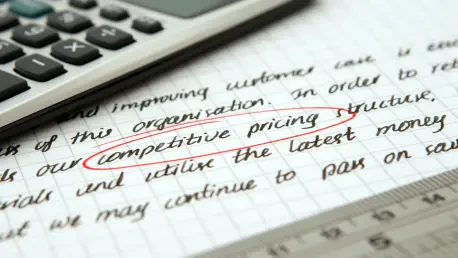

Market Context: The Insurance Pricing Challenge In today's fast-evolving insurance landscape, pricing inefficiencies remain a critical barrier to competitiveness, with studies estimating that manual processes can delay market responsiveness by up to 30%. Insurers grapple with fragmented systems,

Imagine a bustling insurance agency overwhelmed by the sheer volume of financial transactions—premiums, commissions, and reconciliations piling up, with staff buried under manual processes that drain time and resources, leading to inefficiencies that can cripple operations and frustrate clients in

What happens when an industry steeped in tradition faces a tidal wave of complexity and volume that threatens to overwhelm even the most seasoned professionals? In the world of insurance underwriting, where catastrophe-focused portfolios demand precision amid soaring submission numbers, a