A comprehensive analysis of the commercial and specialty insurance sectors reveals a profound transformation in professional mindset, where the once-dominant fear of being replaced by artificial intelligence has given way to a more pressing anxiety about possessing the right skills for a

For the millions of insurance customers who file a claim each year, the promise of a swift, seamless digital resolution often dissolves into a frustrating cycle of repeated questions and channel-hopping. While insurers have invested heavily in digital tools aimed at modernizing the claims process,

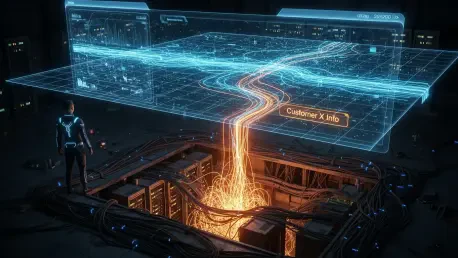

The long-standing insurance model, traditionally built upon generalized risk pools and historical data analysis, is undergoing a profound transformation driven by the immense power of advanced analytics. This shift marks a pivotal evolution from a reactive stance, where insurers primarily respond

The rapid adoption of electric vehicles has introduced a unique set of challenges for owners, particularly when it comes to securing adequate insurance that fully comprehends the specific technology and components powering their machines. In a significant move to address this gap, electric

A comprehensive analysis from Headwaters Economics and the Columbia Climate School has sounded a clear alarm regarding Montana's rapidly intensifying wildfire insurance market, labeling the surge in costs an "urgent challenge" that defies simple solutions. The report, released in the fall of 2025,

The Australian property landscape is increasingly dominated by towering residential and commercial strata developments, creating complex and high-value risks that challenge the traditional insurance market. For property owners and the brokers who serve them, securing adequate coverage for these