The rapid and widespread adoption of Artificial Intelligence across every business sector has created an entirely new and complex risk landscape that the global insurance industry is now urgently working to navigate. As companies increasingly delegate critical tasks—from financial analysis and data

A fundamental shift is quietly reshaping the risk management landscape, as long-standing, human-centric models prove increasingly inadequate against the complexities of the modern world. An overwhelming consensus emerging from hundreds of industry interactions—spanning conferences, webinars, and

Despite the escalating frequency and sophistication of digital threats that dominate news cycles, a perplexing and dangerous gap persists within the business world, as Small and Medium-sized Enterprises (SMEs) continue to view cyber insurance as an optional luxury rather than a core operational

A fundamental paradigm shift is underway within the insurance sector, driven by an urgent need to reconcile operational efficiency with the sophisticated demands of the modern consumer. The industry is rapidly transitioning from its legacy as a reactive purveyor of risk transfer products to a

The insurance industry stands at a critical juncture, caught between the immense pressure to innovate and the monumental risk associated with overhauling the legacy core systems that have been the bedrock of their operations for decades. For many carriers, the prospect of a full "rip-and-replace"

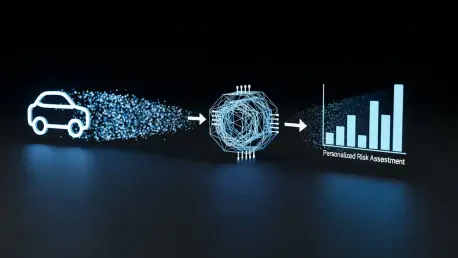

The traditional, often lengthy process of filing a car insurance claim, characterized by extensive paperwork and prolonged waits for adjusters, is rapidly becoming a relic of the past as technology reshapes the industry from the ground up. At the forefront of this revolution is artificial