The insurance industry today is navigating complex changes, notably rising premiums and AI innovations. Brokers must adapt to this rapidly evolving landscape to effectively serve their clientele. Here, experts from various segments of the industry provide their insights on the challenges and

Artificial intelligence (AI) is transforming the insurance industry, offering a much-needed upgrade to efficiently manage the surge in claims caused by extreme weather events. Insurers face mounting challenges from climate change, including processing a high volume of claims and mitigating

Chainalysis is at the forefront of leveraging artificial intelligence to tackle the growing threats and complexities in the cryptocurrency landscape. The firm is making strategic investments in blockchain technology and enhancing its suite of products to stay ahead of AI-driven scams and

Generative artificial intelligence (GenAI) has profoundly transformed the landscape of risk management and fraud detection across various industries. This technological revolution does not aim to usurp human expertise but rather to augment it, enabling professionals to concentrate on more strategic

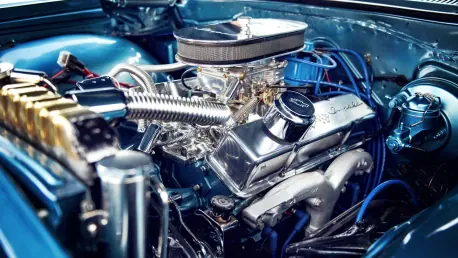

In recent years, technological advancements in motor insurance have revolutionized the claims process, addressing long-standing barriers such as limited access in urban areas and fraudulent claims. With the increased integration of AI and digital platforms, the industry is undergoing a

With an ever-increasing number of fraudulent insurance claims shaking the UK insurance industry, companies like Aviva are stepping up their game. The year 2024 recorded a notable surge in dishonest claims, prompting Aviva to take a closer look at its processes and technology to counteract this