Samsung Fire & Marine Insurance's decision to boost its equity share in Canopius Group reveals a strategic ambition to strengthen its global presence. Against the backdrop of expanding insurance markets, Samsung Fire & Marine Insurance is poised to capitalize on emergent opportunities through this

In a significant move that highlights the evolving dynamics of the London insurance market, B.P. Marsh & Partners Plc has strengthened its strategic partnership with Pantheon by bolstering its investment to solidify a commanding presence in this lucrative sector. The recent decision to increase

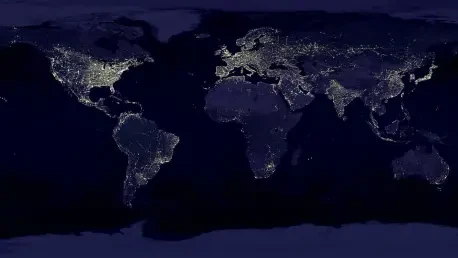

In turbulent geopolitical times, the interplay between global events and the insurance industry comes sharply into focus. Simon Glairy, an authority in insurance and Insurtech, sheds light on how the industry is bracing for potential U.S. military involvement in Iran and its implications across

In an era where economic challenges routinely batter industries, one UK-based personal lines insurer has made headlines with a remarkable financial feat. Policy Expert has not only defied the odds but also set a new benchmark in business growth with an impressive 36% surge in annual revenue. This

In a dynamic financial landscape where risk management stands paramount, acquiring businesses that specialize in sophisticated credit solutions can redefine industry standards. Howden's recent acquisition of Granular Investments serves as a prime example of how strategic expansions can reshape

In a rapidly evolving financial landscape, Hub International has taken significant strides to bolster its wealth management sector. By acquiring Veripax Wealth Management, they aim to enhance their service offerings and cater to a broader clientele. We have Simon Glairy, a distinguished expert in